Stocks got killed after the Fed disappointed in delivering a clear dovish hike. The Fed raised interest rates and reduced their dot plot forecast, the beginnings of a dovish hike. The stock market however immediately tanked and dollar rallied after the algos and high-frequency trading systems noticed the Fed did not remove “further gradual increases” from the statement. The equity slide accelerated after Fed Chair Powell said, “We thought carefully about how to normalize policy and came to the view that we would effectively have the balance sheet run off on automatic pilot and use monetary policy, rate policy to adjust to incoming data.” He later added, “I think that the runoff of the balance sheet has been smooth and has served its purpose and I don’t see us changing that.”

Powell first killed the stock market rally with his neutral mistake comment. On October 3rd, he said the Fed may go past neutral, but we’re a long way from neutral at this point. The Powell pivot eventually occurred on November 28th at the New York Economic Club. He stated that interest rates are “just below” a range of estimates of the so-called neutral level. The rebound was short-lived.

Now the markets will wait for clarity from the Fed on the balance-sheet reduction. The Fed began shrinking its balance with Janet Yellen back in October of 2017. The current tightening schedule has been removing $50 billion of Treasury and mortgage-backed securities holdings on a monthly basis. The balance sheet reduction is pulling liquidity in the markets and could prevent any major gains in stocks.

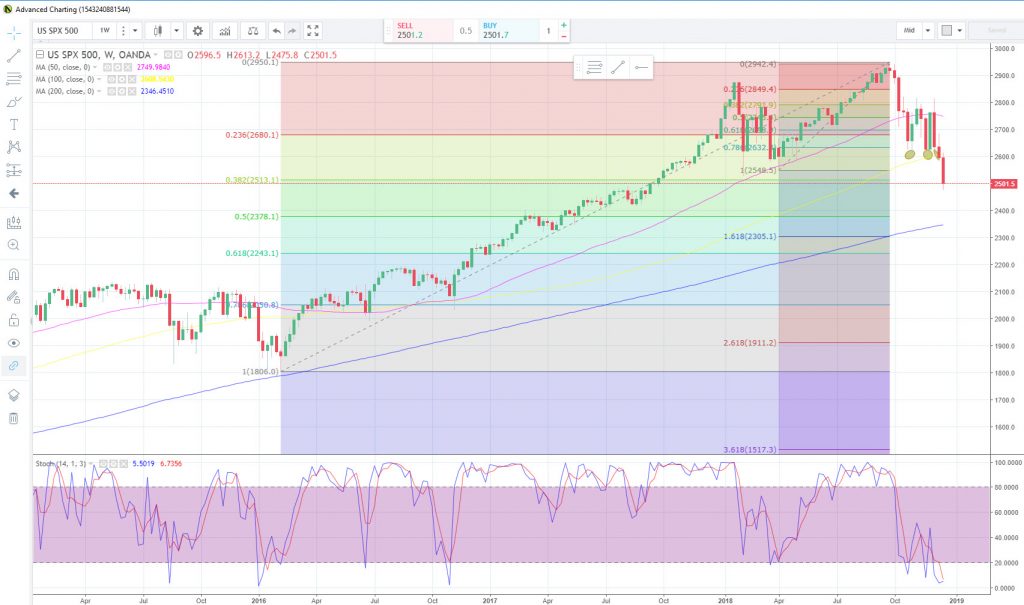

Price action on the S&P 500 weekly chart shows the current slide is testing the 38.2% Fibonacci retracement of the 2016 low to the all-time high move. If bearishness accelerates, major support may come from the 2,375 level. To the upside, 2,675 remains critical resistance.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.