Election uncertainty leaves investors on the fence

It’s been a mixed start to trading at the start of the week, with stocks in Europe looking a little flat and US futures slightly in the red as traders await the results of the midterm elections.

I think we’ve entered wait and see mode which, given the volatility of recent weeks, isn’t the worst thing. I think a couple of steady days will be welcomed by investors after what was a largely positive week just gone. The midterms may generate more volatility in the middle of the week as we see the knee-jerk reactions to the result but at this stage it’s tough to judge how markets would respond.

Much of Trump’s pro-growth, pro-markets agenda has arguably been enacted in the first two years of his Presidency while he’s had the backing of both the House and Senate. If the Democrats take control of the House, for example, it may inhibit his final two years which investors may not be particularly upset about given his determination to engage in a trade war with China and the EU.

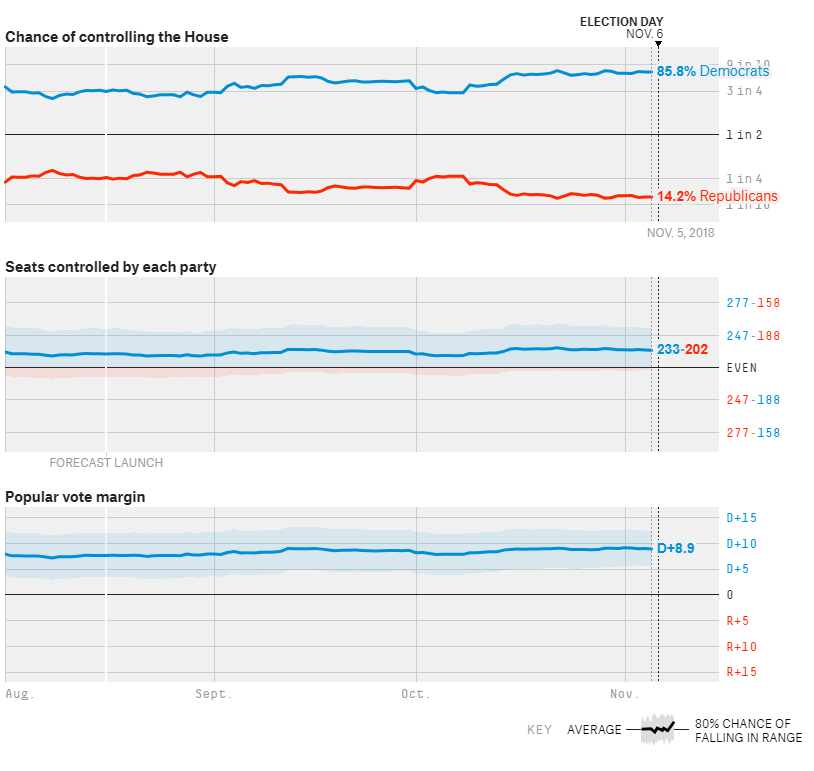

US Midterms Forecast

Source – FiveThirtyEight

Will Fed signal slower interest rate hikes on Thursday?

The other event of note this week will be the Fed decision on Thursday. While I don’t buy into Trump’s claims that the Fed is to blame for the market sell-off, it is clear that the trigger was Powell’s comments a month ago when he stated that we’re not close to the neutral rate yet and could go beyond. Given how markets have responded since then, I do wonder whether they will signal a slight softening on the outlook for interest rates on Thursday.

I doubt this will get in the way of a rate hike next month but they may be encouraged to take a slightly more cautious approach next year and even a nod to this on Thursday could put investors’ fears at ease. Today, it’s the ISM non-manufacturing PMI that traders will be focused on and its expected to drop back below 60 following last month’s huge and unexpected jump.

Oil lower as Iranian sanctions come into force

Oil prices are continuing to slip at the start of the week as the US sanctions against Iran come into force. WTI and Brent have fallen almost 20% since peaking a month ago when sanctions and the prospect of a tight oil market had traders talking about $100 a barrel oil again. Sentiment has very quickly shifted and inventory builds over the last couple of weeks along with global growth fears have sparked a dramatic change in sentiment towards oil which is now trading back at the levels it stabilised around earlier in the summer.

Oil (WTI and Brent) Daily Chart

Is there a bullish case for Gold into year end?

Gold is also relatively stable at the start of the week having roughly settled in a range between $1,220 and $1,240 over the last few weeks. While any improvement in risk appetite could be seen as being negative for Gold prices, I wonder whether if this is accompanied by a softer dollar if the opposite will be true. Positive progress on Brexit and Italy are two scenarios that could trigger this and both could feasibly happen in the coming weeks.

Gold Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.