Investors await new Chinese tariffs

It’s been a mixed start to the week in financial markets as investors await a possible announcement of new tariffs on China which could come as early as today.

The ongoing conflict between the US and China continues to be a primary driver of market sentiment, with investors concerned about the prospect of a full blown trade war as neither side shows a willingness to blink. It was reported last week that the US invited Chinese officials for further talks, something they were open to but reports over the weekend suggest this wouldn’t go ahead if Donald Trump follows through on threats of tariffs on another $200 billion of goods.

With China threatening to cosy up with Russia and the EU if Trump continues with this hostile trade approach, it will be interesting to see how the White House responds as lawmaker opposition may grow. Trump clearly thought this would be a straightforward monetary fight and may have been caught off guard by the willingness to use alternative tactics to fight back. Investors in the US are continuing to take this in their stride for now but that may not last.

DAX slips on fears of more US tariffs on China

Positive Brexit comments offer hope for deal

The UK will be hoping to use the more hostile and fractured geopolitical environment to its advantage as Brexit negotiations continue. The deadline is fast approaching and we appear to be hearing a more open tone from EU officials who clearly view the risk of no deal Brexit as being very real and damaging and are therefore keen to avoid it. While the EU will still be fully committed to ensuring the UK doesn’t cherry pick post-Brexit and the single market integrity is protected, officials will be keen to minimalize divisions.

IMF pessimistic on UK outlook particularly in no deal scenario

It’s this that I believe will ensure a damaging no deal Brexit is avoided rather than the worry of economic implications for the EU, which of course there also would be. The IMF warned of just that this morning, claiming that even under a broad Brexit agreement the economy will only grow at around 1.5% over the next two year, with a disruptive Brexit being significantly worse.

These pessimistic forecasts for the UK, both in the deal and no deal Brexit scenarios, won’t come as a surprise to anyone and will likely be heavily disputed by those Brexiteers who have constantly attempted to downplay the analysis of supposed experts. While the forecasts are gloomy, the expectations for a deal appear to be improving along with the more conciliatory comments in the media which is providing support to sterling.

No tariffs, now tariffs, what gives?

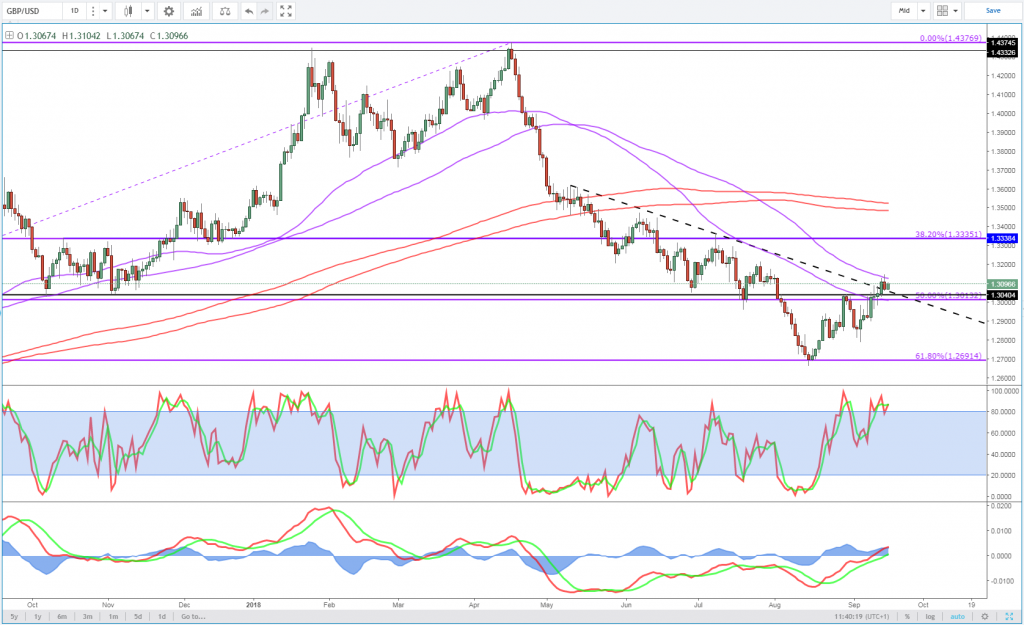

The pound has run into some resistance around 1.3150 but continues to trade above 1.30 this morning after the IMF forecasts. I think this reflects a slightly more optimistic investor and assuming negotiations don’t suddenly turn sour, it could be a sign that the pound sell-off has run out of steam.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

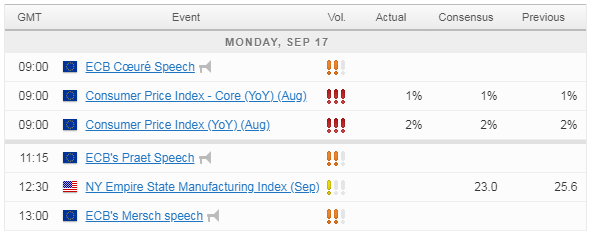

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.