GBP slides as core inflation falls below BoE target

Focus is back on the central banks on Wednesday as we await the second appearance this week of Federal Reserve Chair Jerome Powell and the Bank of England’s interest rate plans are questioned following some softer inflation numbers.

The pound is tumbling again on Wednesday after the latest inflation data for the UK threw a spanner in the works ahead of the BoE meeting in two weeks. There was a growing belief that the central bank will raise interest rates at the August meeting – rightly or wrongly – with the data this week seen providing additional support for such a move but the numbers we’ve seen this morning have done quite the opposite.

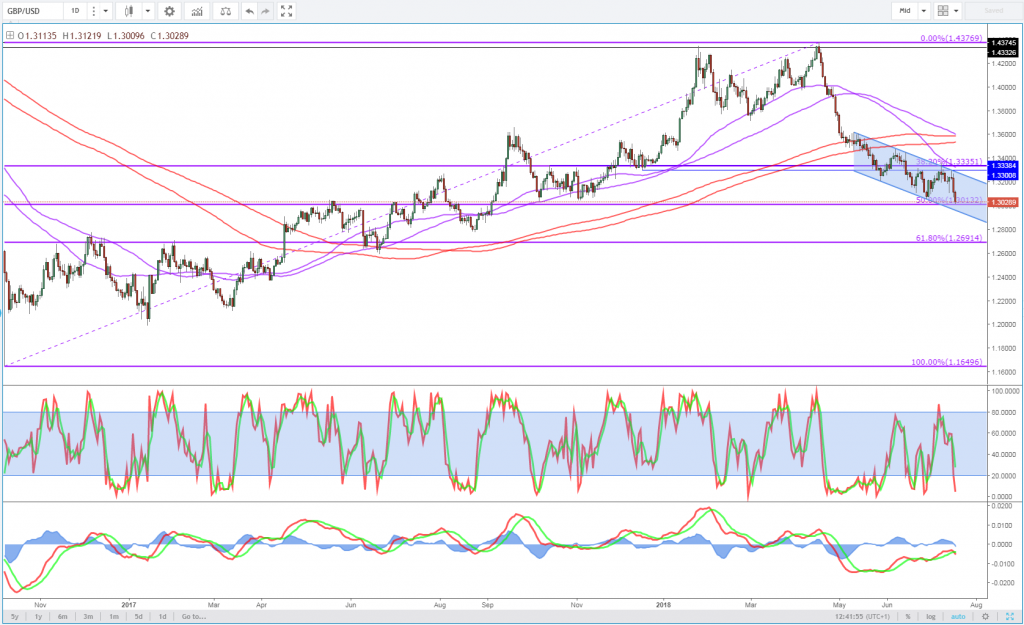

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

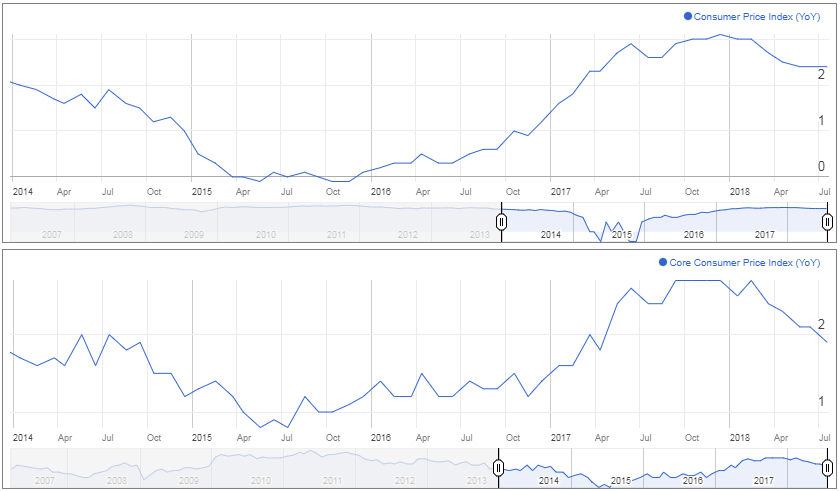

Earlier this year when policy makers were preparing a May hike, inflation was much higher and was seen as being a key reason behind the desire to raise rates. Had that number ticked higher again today, as was expected, it would – along with the other data we’ve seen recently – have provided policy makers an opportunity to follow through on previous plans without coming under too much scrutiny.

Fed Powell advances the dollar

With that not happening and core CPI falling to 1.9%, below the central bank’s 2% target, the decision becomes that much more difficult and uncertain. Moreover, the timing of the meeting is not ideal, with Brexit talks not going smoothly and only a few months in which they need to be concluded. Ordinarily, it would make much more sense for the Monetary Policy Committee to wait until November when much more clarity will exist over the economy and Brexit, but I’m not sure they will and market pricing appears to currently support this view.

UK Inflation

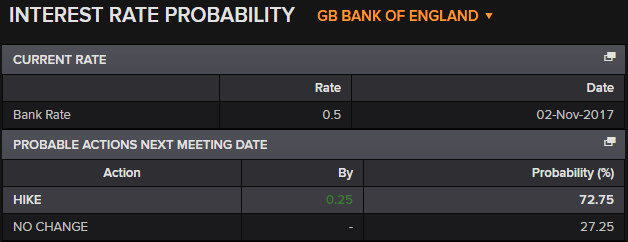

August rate hike still well priced in

An August rate hike is still 72% priced in, down from 77% yesterday, despite this morning’s release, which suggests investors do not believe policy makers will be deterred. The BoE’s credibility has long be brought into question, most recently in May when after months of hinting at a rate hike, it changed its mind due to first quarter weakness which it believed was transitory.

UK Interest Rate Probability

Source – Thomson Reuters Eikon

If it holds off again in two weeks despite the bounce back in the economy, people will seriously question whether any attention at all should be paid to the central banks forward guidance. For this reason, I think they will raise rates and hope they won’t be forced to reverse course in the near future, say if Brexit talks collapse.

Powell speech may offer little new information on interest rates

Attention will now turn to Powell’s testimony on the semi-annual monetary policy report in front of the House Financial Services Committee, where the Fed Chair is once again expected to deliver a very upbeat assessment of the economy and stick to previous views on rate hikes. The Fed has become one of the less interesting central banks due to its reliability and transparency – something that is very much a goal of all central banks – which is likely to make today’s appearance less of a market moving event.

USD/JPY advances to six month high post-testimony

That’s not to say that it doesn’t have the potential to cause market swings, rather that what Powell will say will likely already be priced in and so any movements are less likely to be significant. He may surprise us, should he get into a deeper discussion on trade wars for example and the implications for monetary policy, but as yet this is not something that has had an impact on the outlook.

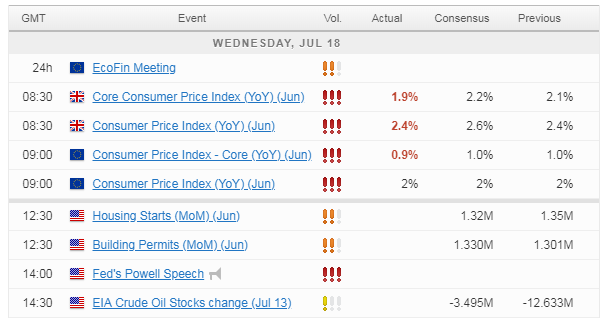

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.