Guidance Key in BoE Minutes on Thursday

Brexit, trade wars, slow economic growth and heightened tensions with Russia, what kind of central bank would consider raising interest rates when the country is facing such challenges? That’s exactly what the Bank of England is doing and on Thursday, they may signal and intention to do so at the next meeting in May.

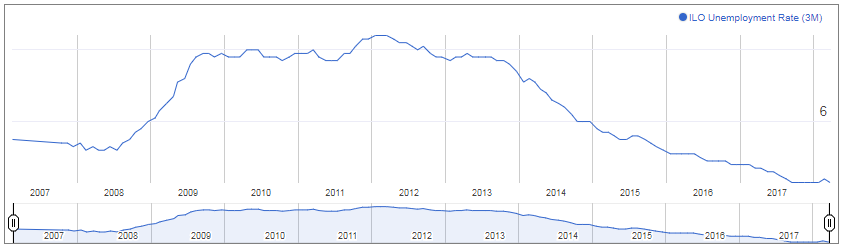

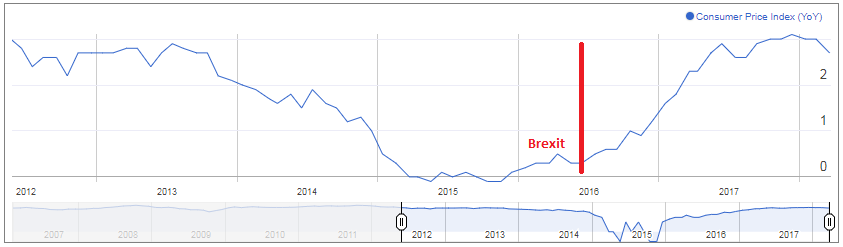

It is worth pointing out firstly that this is only half the story. The country is also experiencing high inflation, a 43-year low in unemployment and rising wages against a backdrop of strong global growth. The Bank of England is not exactly in an enviable position.

UK Unemployment

UK Average Earnings

UK Inflation

To make matters more confusing, inflation has fallen from its highs and was lower than expected in February, with the core number only 0.4% above target. Wage growth is improving but from a low base and remains moderate. And finally Brexit talks are progressing, with the transition deal at the start of the week another major hurdle that’s been overcome. It’s no wonder people can’t agree on the correct course of action.

Markets Flat Ahead of Fed Announcement

Why Are Investors So Confident That Rates Are Rising Then?

The language from policy makers is becoming increasingly hawkish and last month it claimed that tightening (rate hikes) would have to come “somewhat earlier and by a somewhat greater extent” that it expected in November.

It’s because of this that market expectations of a rate hike in May – when the next inflation report is released – are so high. Clearly the central bank is trying to provide clear guidance that interest rates will rise in the near future and May would represent a logical time to do so.

Investors are even looking past small changes in the data that may ordinarily make the BoE question their decision to hike rates – inflation falling more than expected – because the central bank will want to avoid credibility questions arising again if it changes its mind.

Gold Jumps as Investors Waiting for Rate Statement

What Are We Looking For on Thursday and What Impact Will it Have?

Taking all of the above into consideration, it’s logical then that the Monetary Policy Committee will make clear in Thursday’s minutes its intention to raise interest rates in May, which is what traders will be looking for. Any indication that it may be having doubts could hit the pound, given how priced in a May rate hike now is.

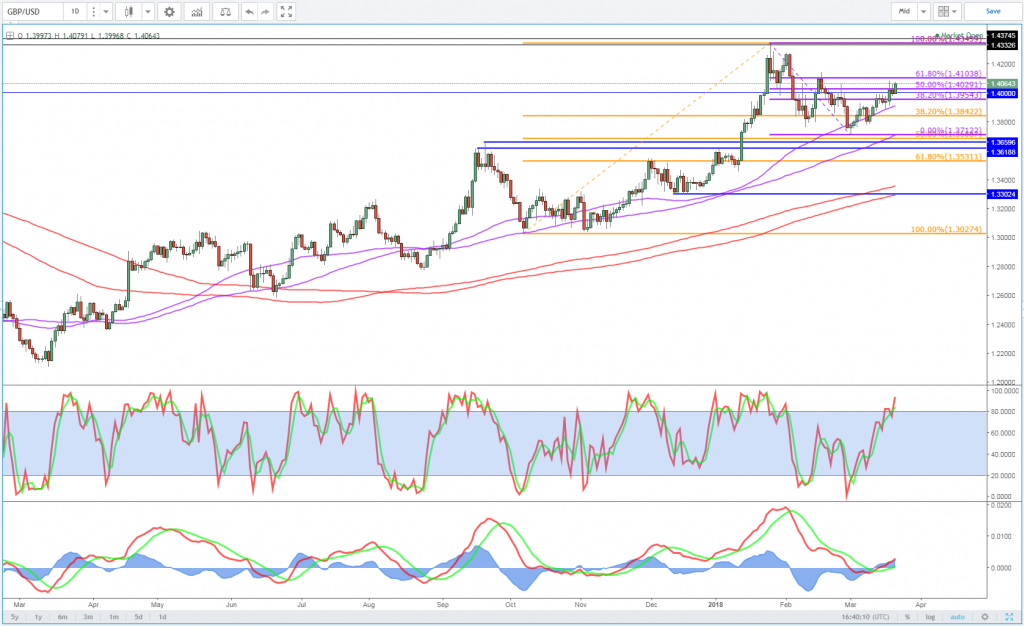

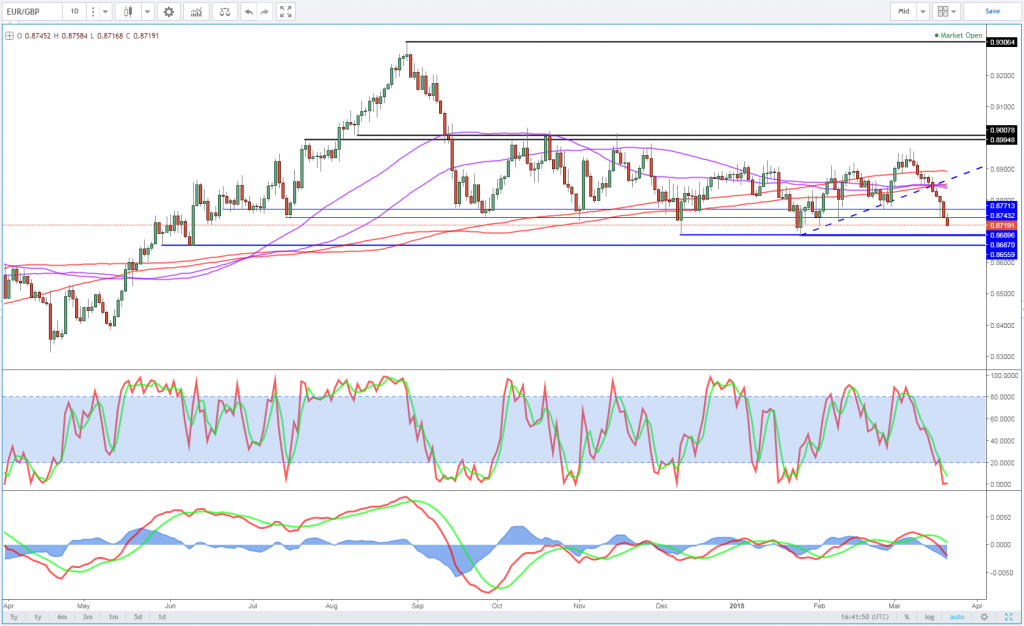

The interesting thing with the charts is that, with all the good Brexit transition news now priced in – subject to sign off by EU leaders later in the week – and a rate hike also priced in, I wonder how much more upside the pound will see and whether we may instead see profit taking shortly after the release. The pound has certainly rallied strongly recently in anticipation of it all, particularly against the euro but I wonder what it has left in the tank.

GBPUSD Daily Chart

GBPJPY Daily Chart

EURGBP Daily Chart

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.