Optimism Returns After Brief Consolidation

US indices are on course to open around half a percentage point higher on Wednesday, as we enter the business end of what promised to be a very busy and important week for markets.

There’s been no shortage of optimism in the equity market rally in recent weeks but as we entered month end it did appear to lose some of its spark, triggering some consolidation at record highs. With futures pointing to a higher open on Wednesday, it seems that spark may be returning, with optimism over tax reform and another solid earnings season providing the catalyst for the rally. The week has not been short of major economic events but the bulk of these, and arguably the most important ones, are still to come.

Fed Statement Eyed But Focus on Yellen Replacement

The Fed’s monetary policy decision would typically be one of, if not the most important event of the week but that may not be the case today. For one, it’s extremely unlikely that any change in interest rates will be announced, with December remaining far more likely for the final hike of the year. With Chair Janet Yellen not making an appearance after the announcement, we instead have to rely on the accompanying statement for clues as to whether another hike in December is still planned.

Moreover, with Donald Trump poised to announce who will succeed Yellen from February on Thursday, investors may take the statement with a pinch of salt when considering interest rates beyond the end of the year. All things considered, not only is today’s announcement not the biggest market event this week, it’s unlikely to even be the most important Fed event.

Another Taxing Day for Dollar Bulls

When it comes to the statement, I don’t expect the central bank to deviate much, if at all, from previous rhetoric as the data has been broadly consistent with expectations, barring the understandable weak jobs report last month. This Friday’s report is expected to be much better than normal which should mostly offset the weakness in job creation in September, something the Fed may allude to.

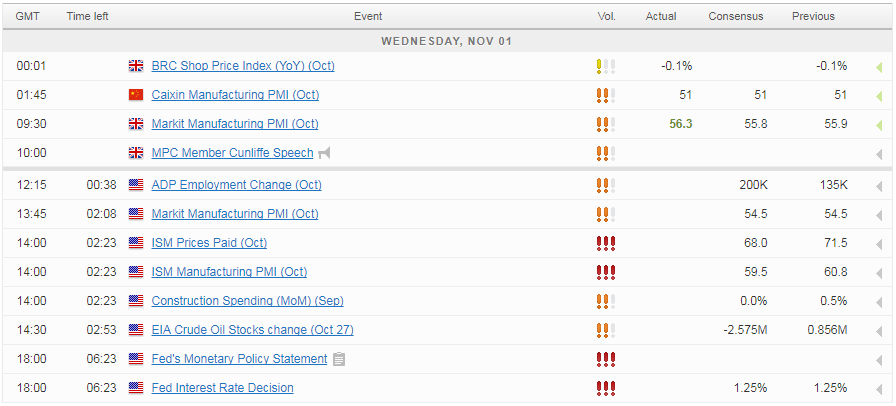

US Data Could Provide Pre-Fed Volatility

While Friday’s jobs report will undoubtedly be the highlight of the economic data this week, there are a number of other releases today that will be of interest. The ADP number is typically eyed for insight into the direction that Friday’s NFP number will take but with the September’s release having been so far from the official number, expectations for the two are very different (200,000 for ADP, 312,000 for NFP). Still, it may provide some insight from a directional perspective, i.e. will the NFP bounce back and bring the average more in line with what we would expect.

The two manufacturing PMI surveys will also be tracked closely on Wednesday, as will the oil inventory data from EIA after API reported another sizable draw-down on Tuesday, almost double the number expected today. Oil has been well bid in recent months as the re-balancing efforts of oil producers brings inventories back in line with the five-year average.

OANDA fxTrade Advanced Charting Platform

With major producers discussing another extension to the output cut, it would appear that higher prices are not destabilizing efforts to bring the market back into balance. Higher global demand has been another supporting factor in the recent rally which has seen Brent hit its highest level in almost two and a half years.

API Inventories Throw Fuel on Oil’s Fire

Sterling Rallies Ahead of Potential BoE Rate Hike

The pound is rising ahead of Thursday’s Bank of England meeting, at which the central bank is expected to announce its first rate hike in more than a decade. This morning’s manufacturing PMI is largely behind the latest rally in the pound, with the survey having highlighted robust domestic demand as well as rising inflation pressures, something policy makers have become increasingly concerned about due to the already elevated price growth.

While above-target inflation is being almost entirely driven by the pound’s post-Brexit drop, a growing number of policy makers now appear to be of the belief that last year’s rate cut is no longer necessary and a return to the previous lower bound is warranted. Markets are heavily pricing in a rate hike tomorrow which may limit any upside in the pound in relation to this, with the accompanying commentary probably more important. With a split among policy makers being clear from recent commentary, a failure to hike tomorrow could trigger a sharp decline in the pound.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.