Thursday may not be dominated by appearances from prominent central bankers like the previous two were but we’re continuing to see markets focus on what’s been said, with the euro and sterling both pushing higher again.

An apparent acceptance by the heads of the UK and European central banks that tighter monetary policy may be appropriate in the not too distant future is once again supporting the currencies this morning, with the euro having hit fresh 13-month highs against the dollar and the pound rising above 1.30 briefly, also against the greenback.

OANDA fxTrade Advanced Charting Platform

It’s clear that both Mario Draghi and Mark Carney aren’t entirely behind the idea that monetary policy should be tightened any time soon but comments in recent days appear to suggest they’re reluctantly accepting the growing consensus within their central banks and preparing markets for a potential move. I still believe that a further reduction in bond buying from the ECB is much more likely than a rate hike from the Bank of England this year but given how markets were positioned on the latter only a couple of weeks ago, the market response is probably appropriate.

DAX Edges Lower, German CPI Looms

While the euro now looks likely to add to its gains in the coming weeks – with 1.16 being the next key technical level once 1.1425-1.1450 is overcome – the new found bullishness in the pound will be tested, with 1.30 against the dollar representing a big psychological test. We did briefly breach this level in the middle of May but the move failed to generate any real momentum and fell back towards 1.26 in the following weeks. There does appear to be more momentum with the move on this occasion which could aid the push but the pair did fail at the first time of asking this morning.

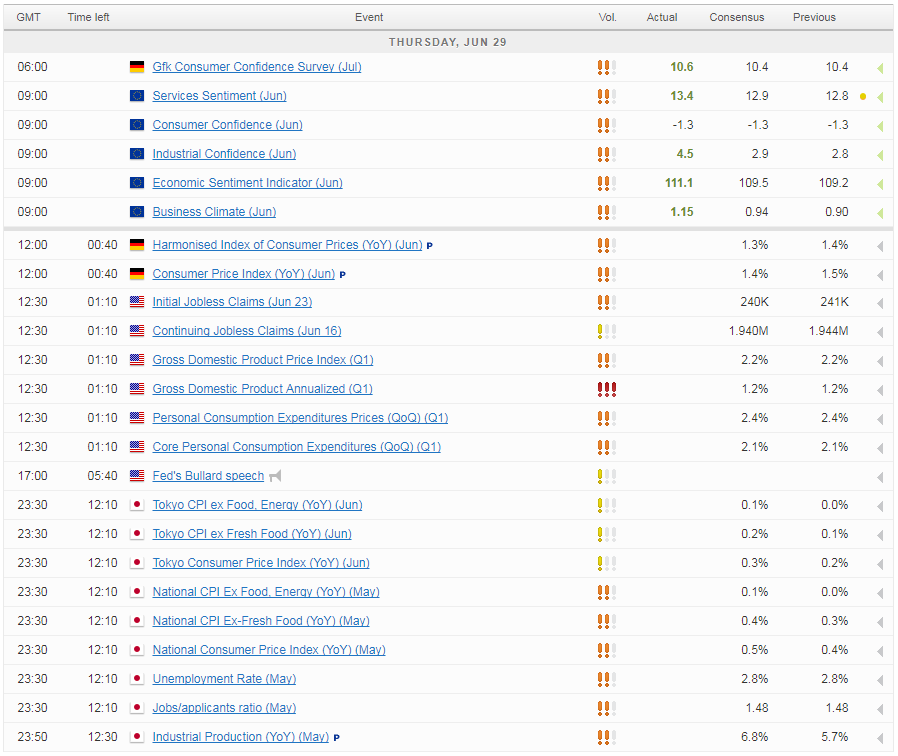

The absence of central bankers today will put more focus back on the data today, with the final revision of US first quarter GDP being released, alongside jobless claims. With investors already doubting whether the Fed will raise rates again this year, it will be interesting to see how they respond should we get a downward revision in the first quarter figure.

Central Banks take Center Stage

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.