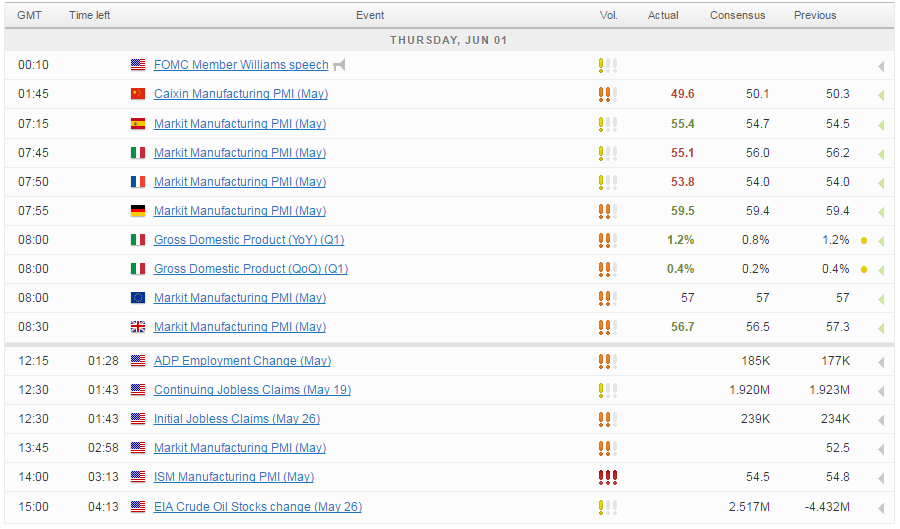

It’s been a busy morning on the economic data side, with manufacturing PMIs being released across Europe and that’s set to continue as we enter into the US session.

ADP, Jobless Claims and Manufacturing PMIs the Key Releases on Thursday

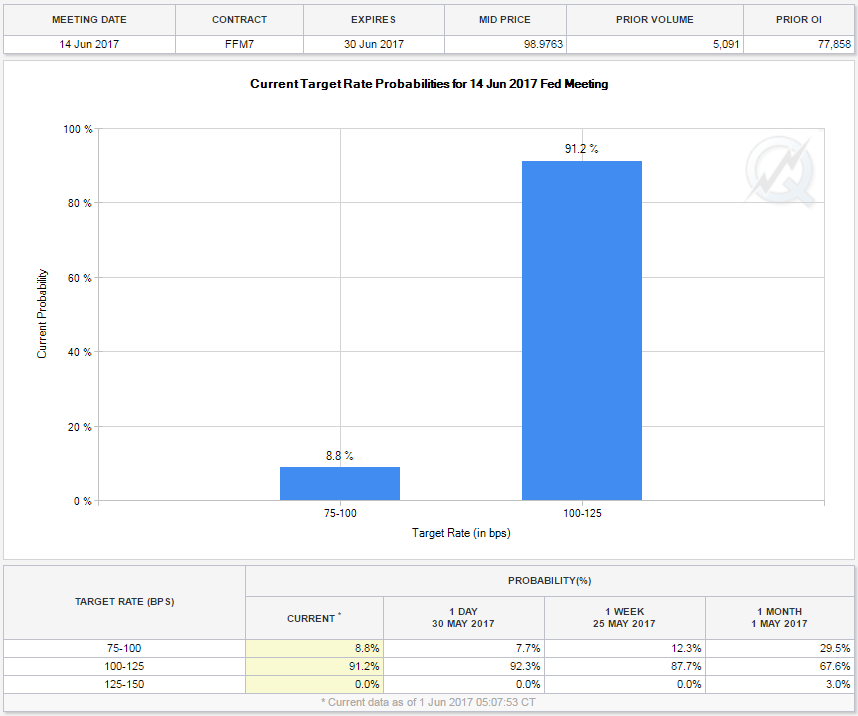

Ahead of tomorrow’s jobs report, the ADP release will be the most closely watched, despite its tendency to not provide an accurate indication of the official NFP release. A number in line with expectations would suggest tomorrow’s number will be good enough to convince the Federal Reserve that a hike at the meeting in two weeks’ time is still a good decision. Given the data we’ve seen since the start of the year though, a bad report tomorrow may worry some officials and it will be interesting to see what that does to market expectations, with a hike currently 91% priced in, according to the CME Group FedWatch Tool. Other data to come from the US today includes jobless claims and manufacturing PMIs from both Markit and ISM.

GBP Remains Under Pressure as Election Uncertainties Weigh

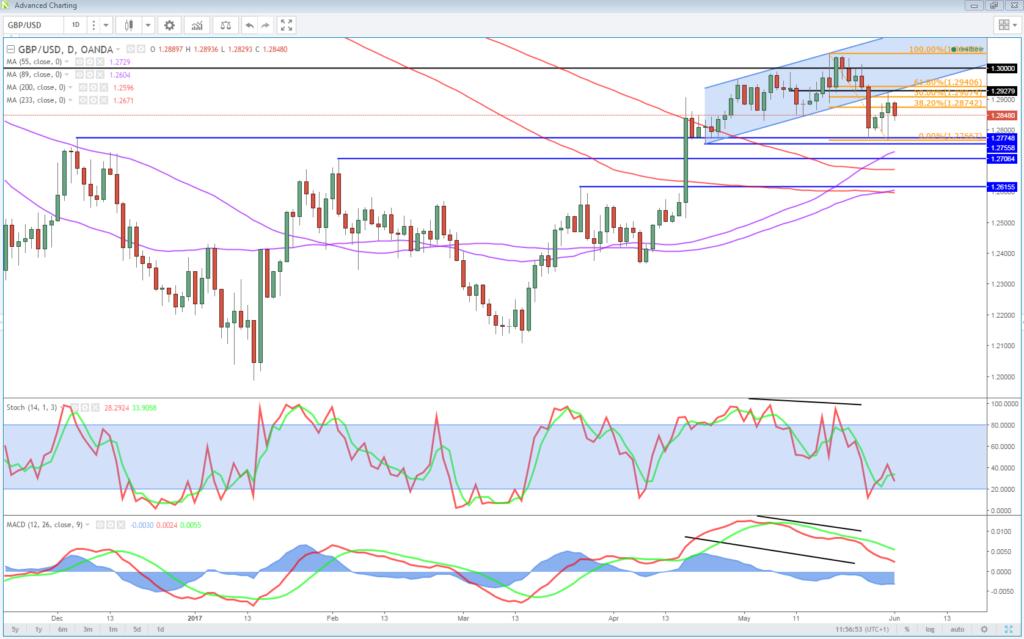

Sterling is coming under some pressure once again on Thursday as the election continues to weigh on the currency.

OANDA fxTrade Advanced Charting Platform

Despite staging a recovery on Wednesday when a poll from Panelbase called into doubt one earlier released by YouGov, the pound has once again fallen victim to the uncertainty surrounding the election outcome next week. What once looked like being an easy campaign for Theresa May and a question of just how large the majority could get has been clouded by problems, which doesn’t bode well for the Brexit negotiations.

EUR/USD – Euro Ticks Lower as German, Eurozone Mfg. PMIs Meet Expectations

Whether May can stage a recovery over the next week and settle traders nerves is yet to be seen but in the absence of this – and momentum is very much against her – sterling continues to look vulnerable. On the bright side, this is good news for the FTSE which has tended to benefit from the weaker currency due to the global nature of the companies that make it up.

Oil Stages Minor Recovery After API Report, EIA Confirmation Could Boost it Further

Oil is staging a modest recovery on Thursday after enjoying a small bounce late in yesterday’s session. Brent crude has stabilised around $51 today after finding support yesterday around $50, an important psychological level. The bounce was aided by the API report on Wednesday evening which suggested inventories had fallen by 8.67 million last week which was far more than what was expected.

Commodities Diverge Ahead Of Trump’s Climate Accord Decision

Should EIA confirm this number today – or a number close to it – it would be the largest drawdown since September and could offer further reprieve for oil, which has been sold heavily over the last week since the output cut was extended by another nine months. It would appear the markets were both expecting and demanding more in terms of the size of the cut and were disappointed that participating members took a more cautious approach. It will be interesting to see whether today’s inventory number extends the number of weekly drawdowns to eight and perhaps convinces people that the cut is working more than markets would suggest.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.