It’s been quite a mixed start to the week for the markets, with Asia offering little direction overnight having recovered late on following a tough start, Europe coming under pressure early in the session and U.S. futures pointing slightly higher.

Today’s moves actually reflect quite well the lack of direction we have in the markets at the moment. Most equity indices have been range-bound for much of this month, potentially due to a lack of major catalysts to provide the spark for the next move. While today is looking a little light on that front, there are a number of possible catalysts to come this week which could provide the spark, none more so than the FOMC minutes on Wednesday.

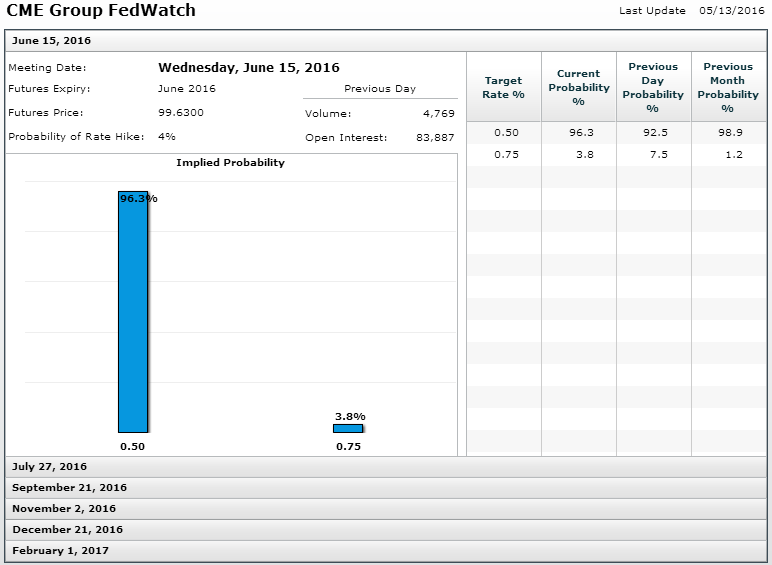

The rhetoric from a number of Federal Reserve officials recently has been that June is a “live” meeting and so another rate hike is possible and yet the markets simply aren’t buying it. It will be interesting to see whether the minutes from the last meeting support this idea or put the final nail in the coffin. With the implied probability of a hike in June now down to 4%, it would appear investors are anticipating the latter.

Source – CME Group FedWatch Tool

The Brexit debate will also continue in the background which could impact sentiment in Europe. Boris Johnson, arguably the most important member of the “Leave” camp, stepped up his criticism of the E.U. over the weekend following a very quiet start to the campaign. I imagine we’re going to hear a lot more from both camps on this issue in the coming weeks and with the polls so close, it could get very interesting.

One area we are finding support today is in oil, with both Brent and WTI crude higher by around 2%. Oil has also been range-bound for a while now but it seems that a suggestion by Goldman Sachs that the oil market is no longer oversupplied due to a number of supply disruptions and bankruptcies in the U.S., has propelled prices to a six month high. The next key level for Brent will be around $51-51.50, while $48.50 in WTI may offer some resistance.

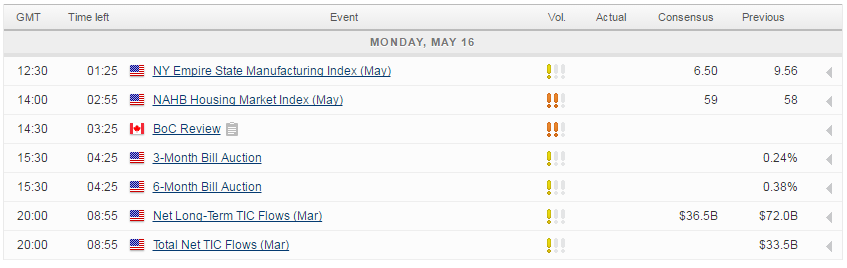

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.