European equity markets are expected to open slightly higher on Tuesday following mixed trade in Asia overnight, as Chinese manufacturing data disappointed but the Reserve Bank of Australia cut interest rates to record lows of 1.75%.

The decline further into contraction territory in the Caixin manufacturing PMI came as a surprise this morning, especially considering the improvements we’ve seen in the rest of the data over the last month. Given the differences in the official manufacturing reading, which just remained in growth territory for a second month, the numbers would suggest that perhaps the larger state owned firms are benefiting from recent stimulus efforts more so than the small to medium sized private firms.

The benefits could flow through to them in the coming months but I think today’s data is a reminder of the challenging times ahead for the world’s second largest economy. The positive data over the last month has helped alleviate some of these concerns but as we’ve seen in the past, it doesn’t always take much to reignite them. China has passed the first test but I’m not convinced it will be afforded the luxury of many more.

The Australian dollar tanked overnight after the RBA responded to the unexpected sharp decline in inflation in March by cutting interest rates. The move by the RBA wasn’t exactly unexpected following last week’s inflation release but at the same time, it was not a guarantee either, with the Australian economy showing signs of improvement as highlighted repeatedly by the central bank itself.

That said, the decline in prices did afford the RBA the opportunity to ease monetary policy further and at the same time, ease the upward pressure on the currency which it warned could complicate the economic adjustment. The aussie is currently hovering around 0.7550 against the greenback, having found support here also when the CPI data was released last week. A move below here could see it test 0.7475, which has proven to be a key level of support since the middle of March.

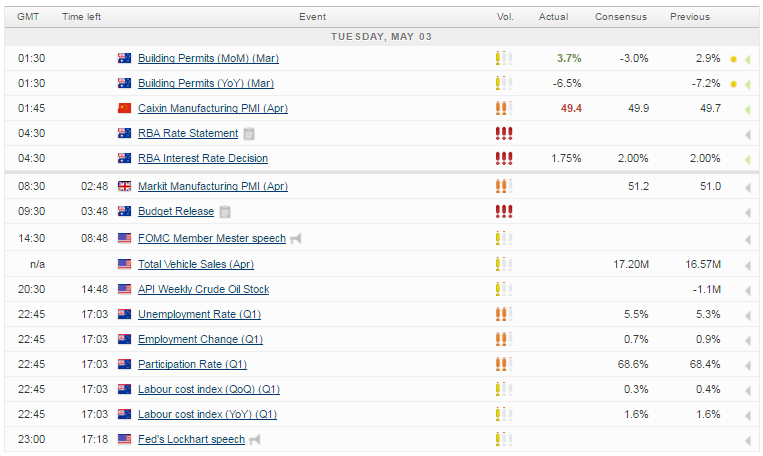

Still to come today we have the latest manufacturing PMI from the U.K. which is expected to remain in growth territory for now at 51.3. The “Brexit” vote in June may keep it under pressure over the next couple of months and I wouldn’t be entirely surprised if it falls into contraction territory in that period. We’ll also hear from Fed members Dennis Lockhart and Loretta Mester today and get the latest API weekly crude oil stocks data, which could keep oil under pressure after yesterday’s reports that OPEC increased production to near-record levels.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.