European futures are pointing to a slightly weaker open on Tuesday, the final day of the quarter. Quarter end can bring about some unusual trading activity which should be taken into consideration today as investors look to balance their books. The fact that we’re also approaching the end of the financial year may also feed into this.

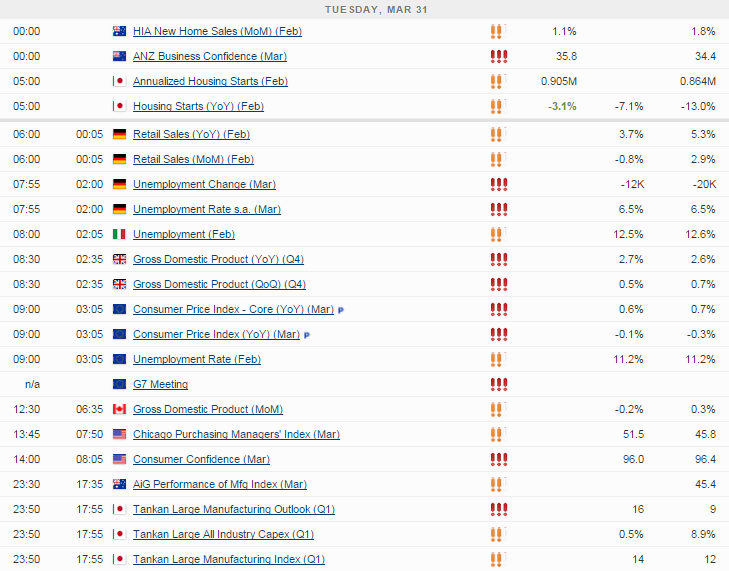

It is also a data heavy trading session, which may bring about increased volatility in the markets. The Eurozone inflation reading particularly stands out as being of interest, as the ECB is very active in the markets right now and any changes in the inflation reading is likely to have a big impact on how long this continues or whether the package will be increased from the current level of €60 billion per month.

The March CPI figure is expected to rise to -0.1% from -0.3% a month earlier, but we shouldn’t get carried away with this as it would largely reflect a temporary bounce in euro denominated oil prices as opposed to a reversal in deflationary pressures in the region. Deflation remains a massive risk to the Eurozone economy and price pressures are likely to remain to the downside this year. Unlike the UK, which is also expected to experience deflation, the eurozone is experiencing bad deflation which is potentially far more damaging. Deflation in the UK is primarily coming from energy and food prices which is instead seen as good deflation and a form of stimulus.

Another important release this morning is the final UK GDP reading, which is seen as confirming growth at 0.5% in the fourth quarter, or 2.7% on an annualised basis. Current account data will also be released alongside the GDP figures, with the deficit seen falling to £21.2 billion.

Negotiations between the P5+1 and Iran will continue today. It’s very difficult to predict whether a deal will be reached by the end of today’s deadline. There is clearly a number of sticking points that are proving difficult to overcome but at the same time, there appears to be a strong willingness from all concerned to be seen to making some progress.

With this in mind, we could see some form of watered down agreement that would see some sanctions lifted while another deadline may be set in order to make further progress in the future. If these sanctions were oil related, I would expect to see a sharp decline in oil prices but once things settle, the net effect may not actually be that great. Two things are acting as a barrier to a significant decline, the already low prices and when Iranian oil would begin to flood the market, with many suggesting it could take up to a year.

Six year lows in Brent crude lie around $10 below current levels and I would be very surprised if any announcement took prices below here. If this level was broken, it may suggest some much sharper declines are in store, with $38.40 and $35.26 coming into focus.

Today also marks the deadline for countries to apply to be founding members of the Asian Infrastructure Investment Bank (AIIB). As it stands, the biggest exemptions from the list of potential founders are the US and Japan, with both having reservations about the standards of governance and transparency. It has been suggested that any objections may have more to do with what it means for China’s role in the world as well as the position of the World Bank and International Monetary Fund, with it being viewed as a direct competitor. It has been suggested that the US in particular currently holds too much influence.

Both the US and Japan have shown a willingness to work with the AIIB and it has even been suggested that Japan would consider joining although this looks very unlikely to come by today’s deadline.

The FTSE is expected to open 10 points lower, the CAC 18 points lower and the DAX 33 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.