Prices of the yellow metal climbed higher on Friday, closing above the 1,265 resistance after a weak NFP print resulted in renewed speculation that the Fed will refrain from further taper cuts in order not to jeopardize current fragile recovery further. The bullish momentum continued today after shrugging off an initial bearish setback which tested 1,265 support level. Currently, we are trading above the 1,270 resistance after pushing above the recent swing high of 5th Feb, highlighting the strong bullish momentum we are currently under right now.

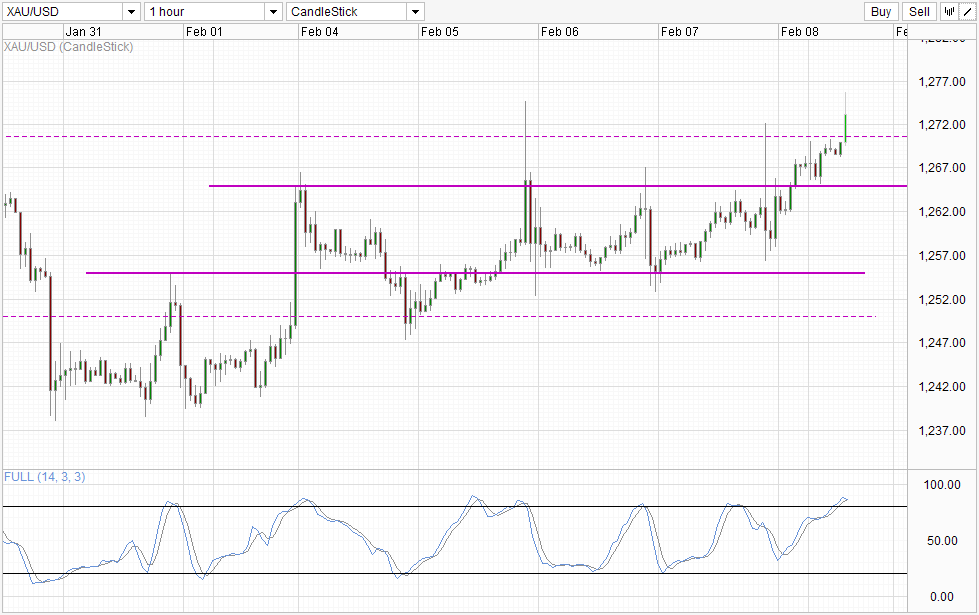

Hourly Chart

Perhaps even more importantly, prices is trading above Friday’s high which was immediately after NFP numbers were released. Gold was always a candidate for strong bullish rallies on a weak NFP print, as risk appetite is expected to decrease and hence a safe haven asset like Gold will be pushed up higher. Even in the event that risk appetite actually gained (which is actually what happened) because of stimulus bets, Gold will stand to gain as inflation risk becomes higher. Stocks on the other hand does not have the same clarity, and as such it is strange to see that Gold did not manage to sustain the initial rally despite this clarity and ended up trading lower by the end of the hour after NFP was released. This is a huge testament that there are a huge numbers of bearish traders lying in wait, trying to keep price within the 1,255 – 1,265 consolidation zone. Hence, by successfully moving above 1,265, Friday’s High and now 1,270, it can be ascertained that bears which have managed to foil a total of 4 attempts above 1,265 is categorically banished, and the likelihood of a swift return back towards the consolidation channel becomes lower.

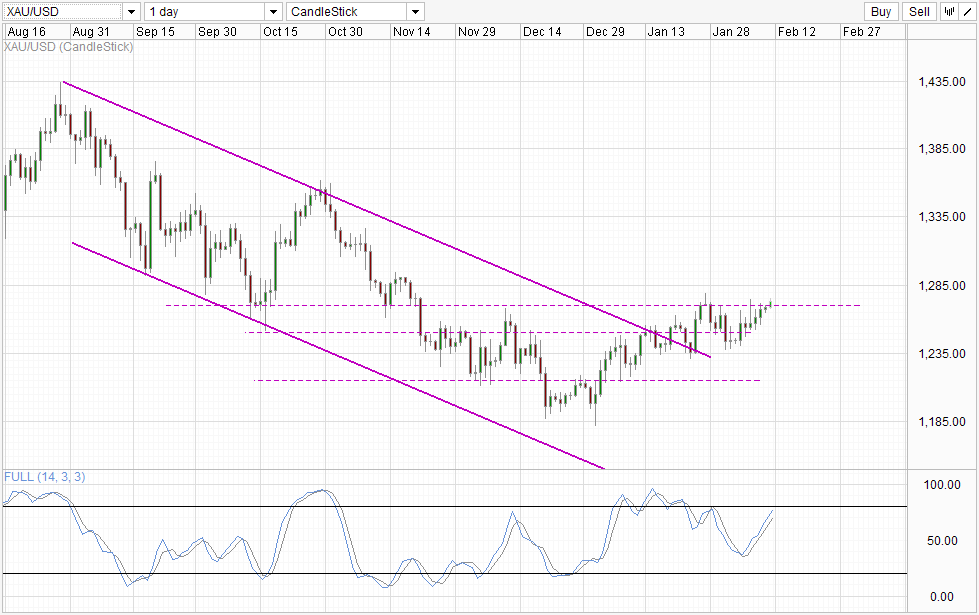

Daily Chart

However, the job for bulls is not finished on the daily chart. Price would need to clear the previous swing high of 1,279.29 in order to demonstrate strong bullish conviction that will invalidate the decline since late August 2013. However, even in the event that this happened, Stochastic readings suggest that momentum may be overbought and it becomes difficult to imagine Gold being able to climb higher with resistance levels 1,290, 1,300 and 1,310 coming in quick succession.

As such, we will need to see a strong fundamental shift in current economic climate for a sustained bullish push in the long-term. This may come in the form of a surprising dovish delivery by new Fed Chairman Yellen who is scheduled to speak to the House on Tuesday. This is going to be a make or break situation for current Gold rally, as prices are only so elevated because of stimulus speculation. Hence, if Yellen suggest that there will be more taper cuts coming in 2014, we could easily see Gold giving up all the gains made on Friday. On the other hand, if there is a surprising dovish stance by Yellen and she goes as far as saying that QE taper is on hold, this may be the shift in economic climate that is needed to send Gold higher on a longer term basis.

More Links:

Nikkei 225 – Improvement In Risk Appetite Alone Not Enough For Long-Term Gains

WTI Crude – Risk of Pullback High As Fundamental Reason For Gains Weak

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.