Yen has been strengthening on safe haven flows as equities across the globe trade lower. USD/JPY hit a recent low of 101.76, a long fall from the 2014 high of 105.44 which is even more impressive when you consider that price has shed more than 300 pips from peak to trough since last Thursday.

However, this is not the real issue – Yen strengthening on safe haven flows is something that traders already know. What we need to know is whether Bank of Japan will be worried that a strengthening Yen will derail current recovery track?

Judging by what various policy makers have said in the past, it seems that BOJ’s comfort level for USD/JPY would be around 100 – 105, with some analysts suggesting that the sweet spot for BOJ to stretch all the way to 110.0. Hence, it is unlikely that BOJ will be panicking over this slide in USD/JPY. Furthermore, latest minutes from December 19-20 meeting showed that members are getting worried about the inflation, with one member on record expressing concerns that wages growth will not be able to make up for the combined impact of higher inflation and the sales tax hike. Some members also mused that the widening trade deficit is a reflection that Japanese firms are inefficient, or they are transferring their business operations elsewhere – either which are bad for the economy and will be made worst by rising inflation/weaker Yen. The revelation of these concerns was juxtaposed by the record trade deficit numbers which was released during the same time as the minutes – highlighting the problems brought by Abenomics and the Yen. Hence, having a slightly stronger Yen right now will actually allay the concerns, and it is highly unlikely that BOJ will artificially push USD/JPY higher in the near term.

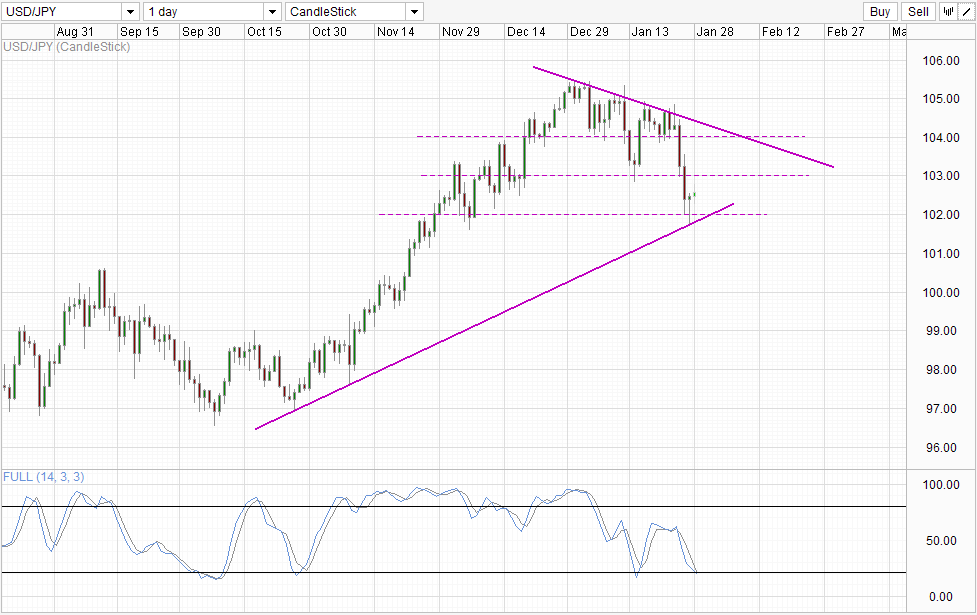

Daily Chart

It is also likely that BOJ will not need help. Technicals still favor bullish momentum with prices rebounding off the lower rising trendline. 102.0 round figure support provided further bullish pressure which opens up a move towards 103.0. Even stochastic readings points to an eventual bullish cycle signal as Stoch curve/Signal line distance has narrowed significantly, suggesting that a bullish Stoch/Signal cross is imminent just as both lines dip into the Oversold region.

Fundamentals also support a weaker Yen as well. Beyond BOJ stimulus, the fact that Japan’s trade balance is widening shows that money is actually leaking out of the economy – a depreciative effect on the currency. Furthermore, if inflation in Japan continue to rise without an equal match in production levels, the status of “safe haven” for Yen will be taken away as the currency continue to weaken due to higher inflation. On the other hand, USD which is strengthening will likely become the next go to point for safe haven flows, leading to a bizarro world where USD/JPY will rally should global risk trends continue to deteriorate.

If Kuroda and Shinzo Abe wants to prevent this from happening, perhaps a change of mandate needs to be in order. Having a 2% inflation seems simple enough, but it is not the headline inflation that we want, but rather higher inflation which encourage higher wages and consumption and hence production is the end goal. However, addressing underlying issue is definitely much more difficult that simply aiming for a headline inflation rate – but as what wise men will tell you, the good are never easy, and the easy never good. If Abenomics/Kuroda think their job is done, they definitely need to think again.

More Links:

Week In FX Americas – The Loonies’ Week from Hell

Week in FX Europe – Contagion, contagion, contagion!

Week in FX Asia – China Manufacturing Disappoints as Emerging Markets Drop

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.