The S&P 500 Index rose for the first time in 3 days, gaining 0.28%. However, this gain wasn’t without its share of bearish scares, as the index fell to a low of 1,832 during the first few hours of trading after US session opened. This decline was surprisingly aggressive considering that Asian markets and European bourses were trading higher as risk appetite across board was bullish. Furthermore, IMF made an announcement saying that they’ve raised their estimate for world economic growth to 3.7% in 2014. Hence, the decline is a strong testament to the strength of bears as stock traders basically ignored the bullish news and continued trading lower.

Suggestions that the decline was led by lacklustre earning reports do not fly as the bearish damage wasn’t limited to US stocks alone. European stock indexes such as DAX and FTSE 100 traded lower sharply as well, with FTSE closing marginally lower at -0.04% (-2.47) despite gaining more than 0.40% before US session opened. Similarly, DAX was 0.81% higher before the sudden bearish slide and ended up closing a mere 0.15% higher. The implication is clear – this is a broad risk related move and unlikely to have been triggered by individual stock earnings disappointment.

If we were to be pedantic about it, we can also take a look at the individual companies that announced their earnings yesterday, and there doesn’t seem to be any major disappointments, with biggest losers yesterday such as Travelers and Verizon Communications actually posting better than expected Earnings Per Share. When we look at the totality of all the S&P 500 companies that have reported results so far, 67% have beaten earnings estimates. The number of companies exceeding projected revenue stands at 67% as well, which is actually slightly better than the historical performance of past earning seasons.

Perhaps, the reason for the unknown sell-off yesterday is similar to why prices fell on 13th – e.g. a slight sell-off that got out of control which highlights the inherent unease of the market. Right now there are talks on the street that the decline was simply due to New York traders wanting to leave early due to the cold weather and hence started clearing their positions when market was trading close to the recent swing high and this simply snowballed into a mild “panic”.

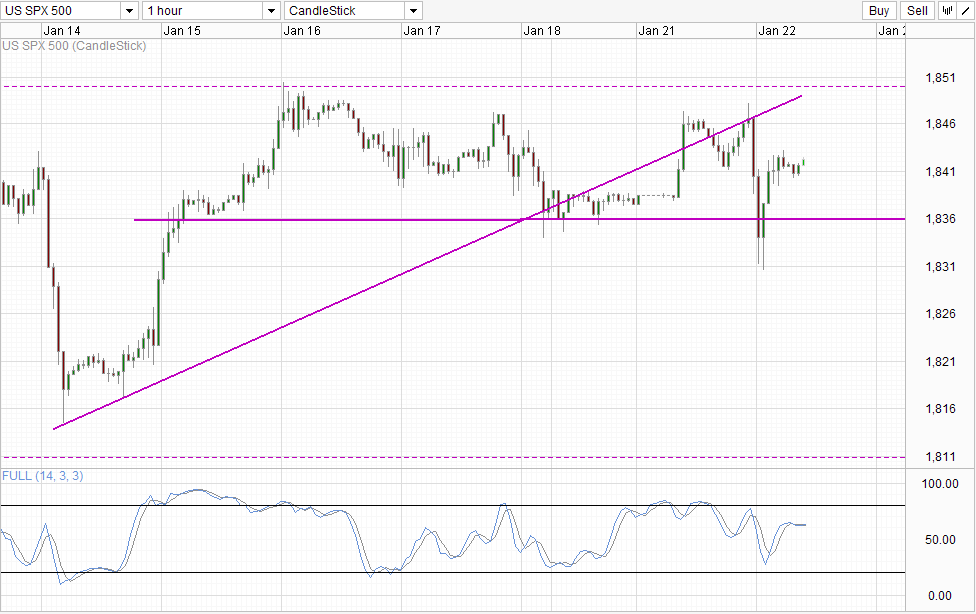

Hourly Chart

If that is the reason for the sell-off, it is no wonder that we were not able to break the 1,836 soft support level as there is really nothing fundamental that could have driven price lower further. Also it should be noted that stock prices recovered quite significantly on 14th Jan after the same inexplicable decline, suggesting that the same may be seen once again today.

There is technical pressure as well as the prices during US opening session coincided with the test of the upward trendline. The failure to overcome the trendline affirmed that the bearish break of the trendline remains in play, and could have exacerbated the initial bearish sell-off during early US session. Right now, prices is sitting above 1,840 support after rebounding off the 1,836 support. This opens up the possibility of a move towards 1,850.

More Links:

GBP/USD – Breaks Through Resistance at 1.6450

AUD/USD – Surges to One Week High near 0.8870

EUR/USD – Crawls back above Key 1.3550 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.