Kiwi Dollar has been trading steadily lower after hitting a high of 0.843 on Tuesday. Interestingly, price action of NZD/USD cannot really be explained by way of economic news nor risk on/off sentiment. An extremely bearish Monday did not manage to dent NZD/USD bullish ambitions which continue the ascension post NFP Friday. Early Tuesday which saw stronger than expected NZIER Business Opinion Survey did not manage to pull Kiwi higher, with prices actually trading to a low of 0.836 before overwhelming bullish risk appetite pushed risk currencies higher and allowed Kiwi to reach the previously mentioned high.

However, the subsequent decline on Wednesday does not much up with broad risk sentiment, as S&P 500 managed to reach a new record close once more, but NZD/USD is 1 full percent lower than the 0.843 high by the time US market closed yesterday. Similarly, this morning’s bullish Asian session failed to rejuvenate NZD/USD and prices actually traded lower, hitting the 0.831 soft support just a couple of hours ago.

Hourly Chart

So what’s happening exactly?

Simplest explanation would be to chuck everything under technicals, but even that does not give a satisfying answer – Stochastic readings were actually moving consistently lower while price has been pushing higher between Friday to Tuesday. Only since Wednesday have stochastic reverted back to “normal”; tracking the swings of price movement much better. Things does start to get clearer when we look at the Daily Chart below where prices had to face off 0.84 significant resistance and failed – resulting in the subsequent bearish decline.

However, if 0.84 is such a key level, why didn’t we see bulls overreacting on the stronger than expected Business Survey result on Tuesday? Generally such strong levels have a degree of “magnetism” where traders (in this case bulls) would want to test it as part of their objective. Given that market was actually bullish with 0.84 within reach, it is peculiar to say the least that bulls did not take advantage of this to reach 0.84 during Tuesday Asian hours. That being said, the bearish reaction that followed the test of 0.84 does check out nicely according to the “magnetism” behaviour, which suggest that there is high likelihood of trend reversal as bullish traders would be happy to close their positions/take profit after their objective has been met. If we were to accept this explanation, then perhaps the muted/delayed bullish response can be attributed to bears defending the 0.84 levels.

There are evidences that provide support to this assertion. Historical Open Orders showed concentrated levels of sell orders just under and above 0.84 while buy orders are sparse around the same area. Similarly, Historical Position Ratios showed a sharp increase in bearish positions held by traders as we approach 0.84.

All these show that market sentiment is following 0.84 closely, and technical influence is much higher than fundamentals right now. This would also imply that NZD/USD downtrend would continue for a while, and descending trendline which may be tested soon will have a higher likelihood of holding. Stochastic readings suggest that we should be in a bullish cycle right now, but it is also equally likely that Stoch curve may point lower from here given the “resistance” that is just overhead, and that the push within the Oversold region wasn’t very deep to begin with.

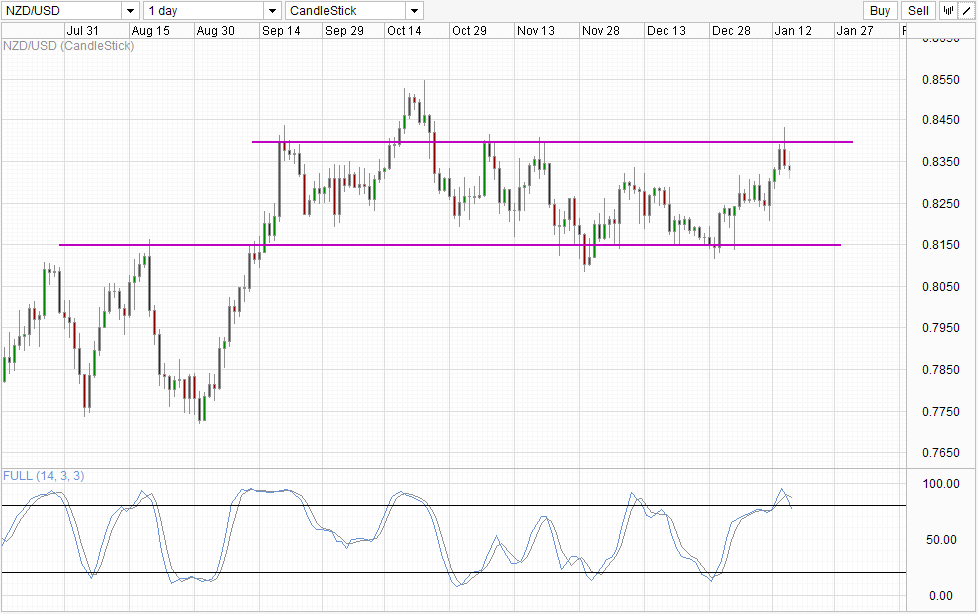

Daily Chart

With 0.84 holding and Stoch curve giving us a bearish cycle signal right now, the likelihood of price moving all the way down to 0.815 is high. However, it should be noted that fundamentals continue to favor a strong NZD given higher interest rate expectations, hence traders need to be aware that 0.815 objective may not be met as RBNZ may hike rates in Q1 if market expectations are right. That being said, USD is also expected to strengthen, giving us a very confusing outlook. Perhaps price action in the past few days is an indication of what is to come for the rest of the year with 2 strong currencies pulling in both directions, resulting in a volatile mess that is hard to interpret. If traders are still interested to participate in NZD’s rising rate expectations, there are other crosses which may provide stronger directional play.

More Links:

GBP/USD – Drops Back to Support Level of 1.6350

AUD/USD – Returns to Familiar Territory Below Resistance Level of 0.90

EUR/USD – Eases Away from Resistance Level at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.