Nothing seems to be able to stop the slide in Crude Oil. First it was military skirmish in Iraq, with WTI prices continuing to head lower without skipping a beat. Then we have Libya oil crisis rearing its ugly head again 2 days ago. Prices did push up slightly, but it hardly can be classified as a bullish recovery, with prices mostly trading flat. Similarly, yesterday’s bullish report from US Department of Energy failed to revitalize prices. Inventories fell more than 1 million barrels vs expectations, stretching the streak of higher implied demand and decreasing inventory for a total of 6 consecutive weeks – the best combo in the past 3 years. However prices remain bearish, hitting a low of 92.2 yesterday.

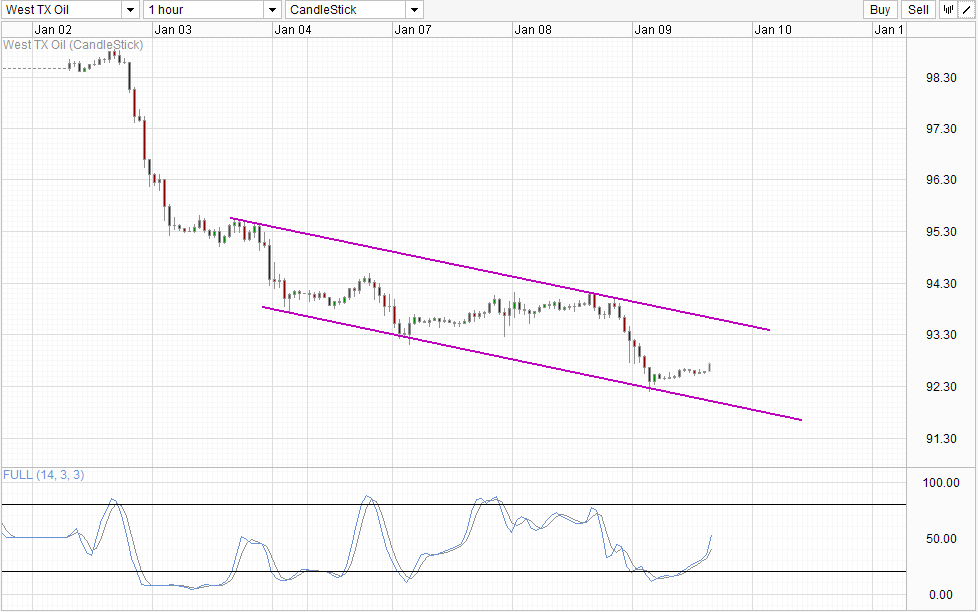

Hourly Chart

To be fair, the DOE weekly report isn’t entirely bullish. Other than Crude Oil Inventories that was better than expected, all other component of the report was bearish – Distillate and Gasoline inventories grew more than twice as expected, suggesting that future demand for Crude may be lower. Perhaps more worryingly, Cushing OK Crude Inventory increased by 1.1 million barrels, reversing’s last week’s decline and than some. Hence, there are good reasons why bullish reaction was muted.

With this in mind, we shouldn’t be too harsh on Crude, and the possibility of a rebound towards Channel Top cannot be discounted. Stochastic agrees with Stoch curve currently in the midst of a bullish cycle. It is likely that price may hit Channel Top and confluence with soft resistance 93.3 based on current pace of increase, and a subsequent bearish response towards Channel Top is favored should that happens.

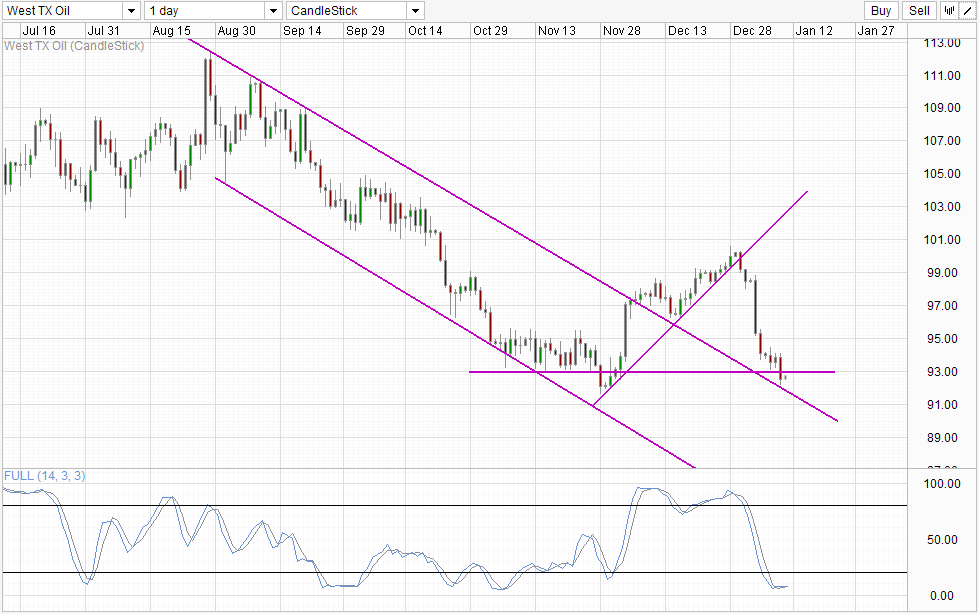

Daily Chart

It is clear that long-term chart is bearish, but currently now is not a great time to enter short from a technical perspective with prices stuck in no-man’s land. We are below 93.0 support but above Channel Top and confluence with the 2H 2013 low of 91.7. Stochastic readings is deeply oversold, but is being less than helpful by currently pointing flat. Traders who have yet participate in WTI weakness may already be too late in the game with 2 missed entry opportunities in 2014 – the break of 99.0 in conjunction with rising trendline, and the break of soft support of 96.0 and intersection level between Channel Top and rising trendline. Long-term bearish pressure remains in play, but traders may need to wait for further confirmation for bearish extension before committing as current bearish momentum may already be overstretched without any significant bullish pullback since the start of decline.

More Links:

EUR/USD Technicals – Heading Lower With 1.358 Broken

AUD/USD Technicals – Riding On SouthBound Train

S&P 500 – Don’t Read Too Much Into “Hawkish” Fed Minutes

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.