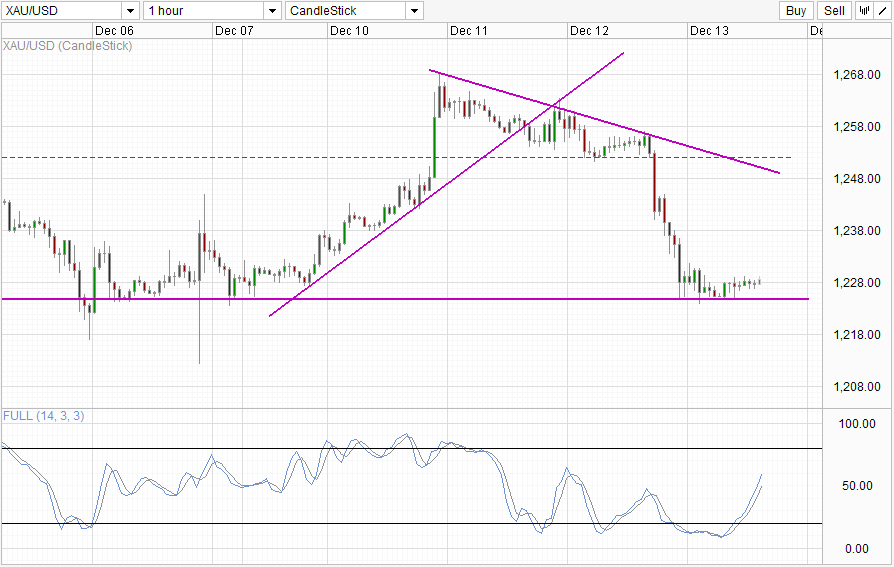

Hourly Chart

Gold prices fell sharply yesterday after we’ve just wrote the analysis which said that prices are “directionless” between 1,251.5 and 1,255. The reason for the sell-off? Break of 1,251.5 support. Decline in risk appetite contributed as well, but it should be noted that the largest 1 hour decline happened during early European hours before US market came into play and was the same hour when the aforementioned support level was broken. This bearishness cannot be regarded as unexpected, as prices were never truly bullish to begin with – recent bullish pushes have gone unexplained other than speculation that there are some big buyers lurking around. This is in no way representative of broad sentiment about Gold and gold prices were running the risk of a strong bearish correction.

Currently prices are staying above 1,225 support, which is also understandable as it is unlikely that bears will have the conviction to sell heavily given the unexpected nature of recent flash rallies. We have no idea when they will suddenly pop up and that will prevent bears from entering large punts especially given FOMC meeting next week. Hence, the likelihood of price breaking the support band from 1,212 – 1,225 today is low and we may actually still find some space for rebound towards 1,235+ levels.

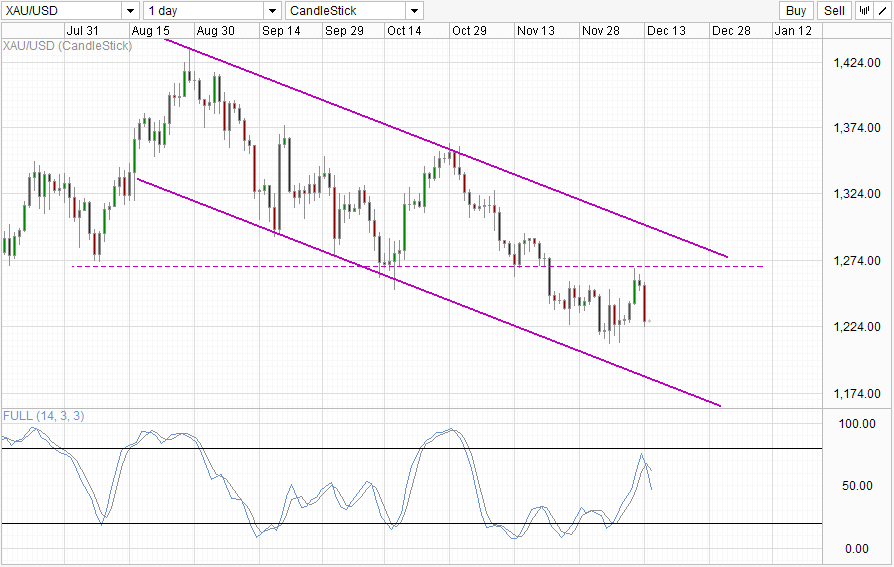

Daily Chart

Daily Chart is undoubtedly bearish though with a new Stoch peak formed. This adds as confirmation for the rejection of 1,270 resistance and opens up Channel Bottom as the bearish target. We can also see the importance of 1,225 which is the swing low back on 26th Nov. Should price break 1,225 we could see bearish acceleration towards 1,212, following which will be the last interim support 1,200 and subsequently the ultimate Channel Bottom target.

More Links:

GBP/USD – Continues to Feel Supply Pressure from Resistance at 1.6450

AUD/USD – Drops Sharply to Three Month Low near 0.89

EUR/USD – Resistance Level at 1.38 Stands Tall

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.