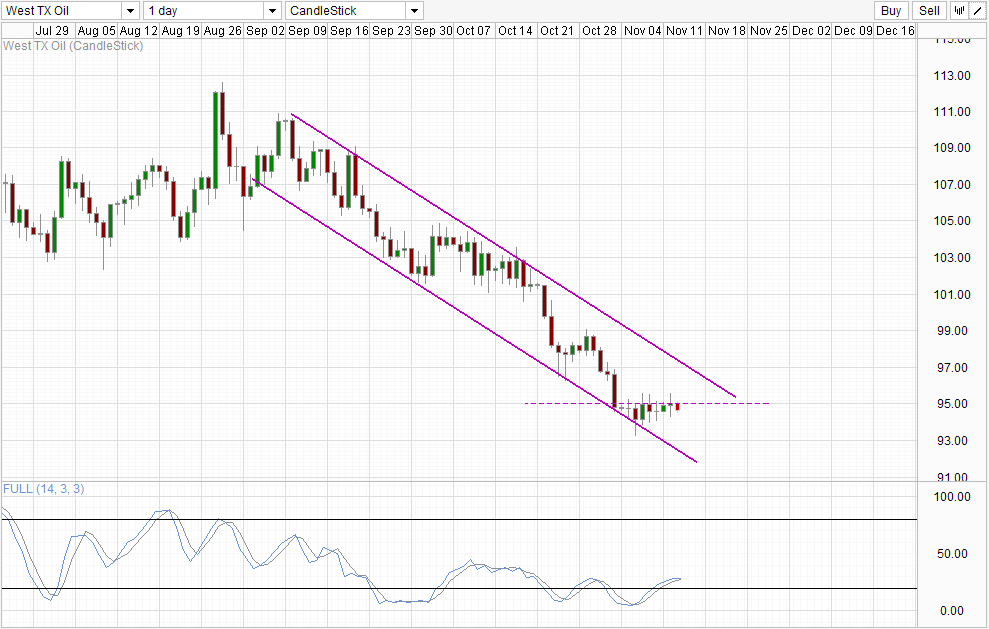

Daily Chart

Bearish pressure continue to pile on WTI Crude, but strangely prices in Crude have been stable, staying between 94.0 – 95.0 since last Wednesday. This is especially interesting considering that market has had 2 major shocker late last week – ECB surprise rate cut and US Non-Farm Payroll which was much stronger than expected. Both events moved commodities and equities strongly, and the relative muteness of Crude Oil during the same period suggest that prices is under a much stronger influence right now.

This stronger influence doesn’t appear to be fundamentals, as global crude supply and demand trend continue to favor lower prices yet crude oil prices have actually traded mildly higher towards the 95.0 resistance. It seems that the influence is just technical based, with prices rebounding after tagging Channel Bottom. The fact that prices wasn’t able to break above 95.0 amidst a bearish bias lends strength to this hypothesis.

This would also imply that a bearish move will be favored in the immediate future, as Stochastic readings have converged with the Signal line, potentially forming a peak similar to the one seen back in late October. The immediate bearish target would be Channel Bottom, with bearish acceleration expected should we trade below the soft support of 94.0.

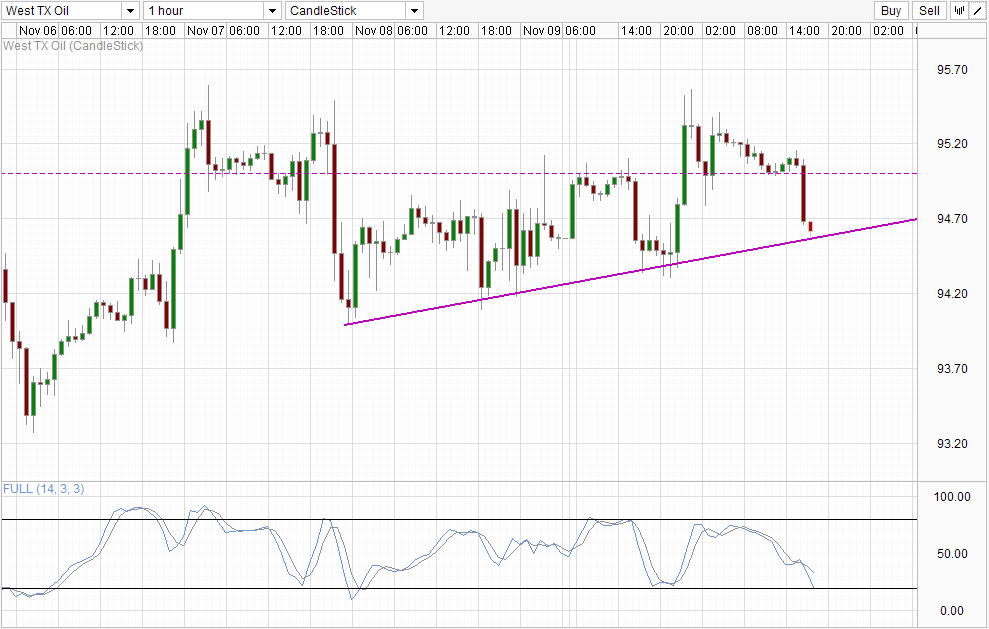

Hourly Chart

Short-term chart does not share with the bearish outlook though, with prices having the potential to rebound off the rising trendline back towards 95.0. This is echoed by Stochastic curve which is close to the Oversold region. Looking at past troughs, stoch curve might not even need to dig further and may reverse from here, increasing the bullish potential towards 95.0. However, as long as price stay below 95.0 or even below 94.7 soft resistance, the likelihood of an eventual bearish drop remains.

More Links:

EUR/USD Technicals – 1.34 Broken With 1.337 In Sight

Gold Technicals – Sliding Lower Gingerly

US10Y Technicals – Finding Support On 126.5

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.