Draghi’s lower rates for longer and even possibly below the current levels has given the EUR bears renewed confidence, euro-bonds a leg up and equity markets a green light. With fixed income dealers pricing in a more aggressive Fed tapering currently has the “mighty” dollar in demand ahead of this mornings headline event – non-farm payrolls. However, buyers beware as the outcome of this jobs report always has the potential to undo all of the good with one ‘soft’ stroke.

Obviously today’s key event, US non-farm payrolls, will determine the direction of the dollar and all the other asset classes. The stronger than expected US data that’s been released over the past week has definitely raised market expectation to new heights for this morning’s labor release. The Fed has loudly acknowledged that they are heavily leaning on the labor market for guidance and each NFP release from here until the end of the year will be a contentious event.

Speculators, investors and dealers alike will be looking at this morning print to be broadly supportive of a potential September taper in a matter of weeks. The fixed income asset class will be the most active of classes if the market is surprised greatly in either direction by the employment headline.

The market is expecting net new US payroll jobs to come in somewhere just above their earlier expected consensus print of +180k and probably just shy of the psychological +200k number. On the face of it, despite US gross hiring remaining tame, the drop in initial claims over the past four-weeks would certainly suggest that US layoffs are falling further. Many are taking the better readings on claims as reason enough to edge the unemployment rate down to +7.3% from +7.4%. Although the rates market will be highly keyed in on payrolls and its implications for Fed tapering at the mid-month FOMC meeting, many analysts now believe that it would take an extraordinarily “weak” reading for the Fed to refrain from reducing purchases – to many individuals, a token taper starts in two-weeks.

The fixed income dealers favor-selling product on rallies as they expect the yield range to continue to gradually push higher. US 10-years currently trade at +2.92% with short-term aspirations of punching through the highly influential +3% level. The biggest obstacle for a higher rate environment remains the markets uncertainty over the Syrian situation and the potential for another fiscal showdown on the horizon. These are reasons to make it hard for US and global yields to break substantially higher. Bonds remain the investor’s primary safer-haven asset class.

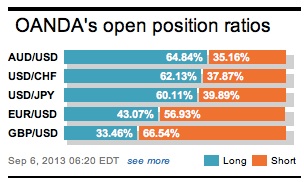

An NFP print coming in close to consensus would remain dollar supportive. It could be the beginning of the next dollar bid higher against EM and G10 alike. From what we have seen from the emerging markets space over the past number of weeks, investors should be expecting further weakness from TRY, INR, and MXN outright on a consensus or stronger headline from the labor report. As for G10, the game plan for many remains the same. Current market consensus continues to favor long USD/JPY and short EUR/USD positioning – interest differential trading.

The US is not the only one reporting on their domestic job situation this morning. Its strongest trading ally Canada, just north of the US, is expecting a solid rebound from July’s negative employment headline print (-39k). The market consensus expects a +20k rebound in jobs and an unemployment rate to remain unchanged at +7.2%. With the new governor Poloz delivering an extended neutral monetary policy stance at this week’s BoC rate meeting, together with a potential tapering Fed does not support the CAD from an interest differential perspective. Currently the market should be favoring selling the loonie on USD pullbacks. The CAD remains contained within its four-cent range of 1.03-1.07. It’s monotonous range trading with little vulnerability for now.

Other Links:

Rate Differentials Favour Dollar, But Then There’s Tomorrow?

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.