The still heavy long positioning in the U.S. precious metals futures are about to have their metals tested if the charts are anything to go by.

Gold

Long-suffering bullish gold traders had more reason to worry overnight, as they looked up into the sky and saw the vultures circling over their positioning. Despite a flattening of the U.S. yield curve, gold could not make any gains; instead, it fell 15 dollars to a low of 1261.00 before rising slightly to 1266.00 to gasp for air.

To say that the technical picture for gold this morning is ominous would be an understatement. Gold fell through trendline support at 1272.00, and then the 200-day moving average at 1267.25, both of which form resistance today. Gold stopped just shy of the long-term support at 1260.00 before its unconvincing recovery. A break of this level may be the straw that breaks the camel’s back for structural long positioning and in turn could trigger a rush for the exit door.

Traders will be eyeing potential dollar strength nervously as we head into Friday’s payrolls data followed by next week’s FOMC. If this pushes gold over the 1260.00 cliffs, the technical picture suggests gold may not find many friends until the 1200.00 regions.

Silver

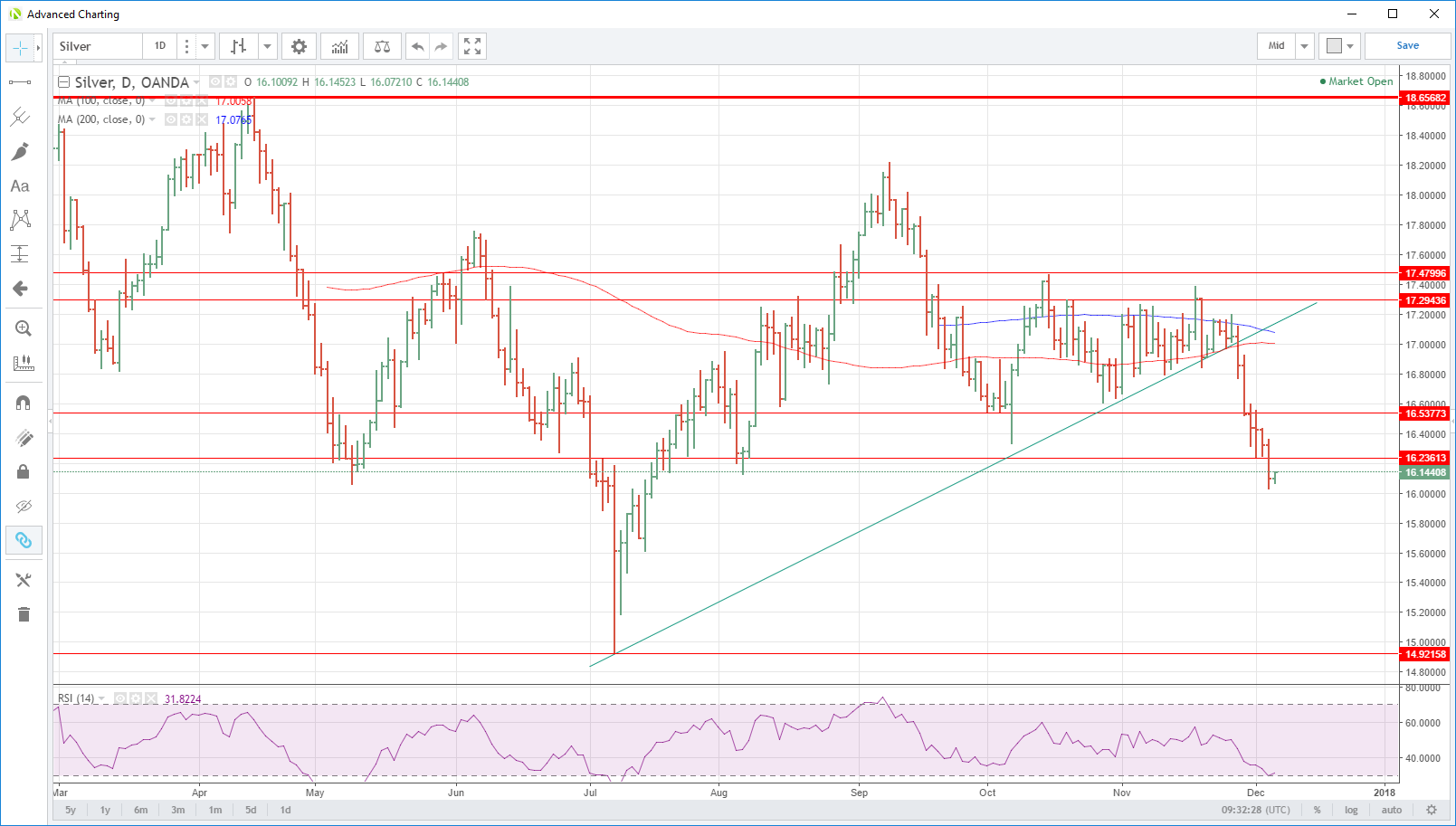

If the vultures are circling gold, then with silver, they are already feasting on the carcass. Silver broke its long-term support line at 17.0000 last week and has continued its downward spiral unabated ever since. In the process leaving it’s 100 and 200-day moving averages above as a distant memory.

Silver has managed the barest of dead cat bounces today in Asia, trading slightly of the overnight lows at 16.1450. Resistance resides at 16.2360 initially followed by 16.5380.

The technical picture looks grim below. Silver will have support at 16.0000 initially, thereafter there is nothing but clear air until the 14.9200 area to arrest its decline.

The only glimmer of hope on silver’s technical picture is that its Relative Strength Index (RSI) is pushing into very oversold territory. Unless the tone of the markets changes though, this may mean only temporary salvation but does imply that the 16.0000 support should be tough to break in the short-term.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.