Will UK Inflation Data Alleviate Policy Makers Concerns?

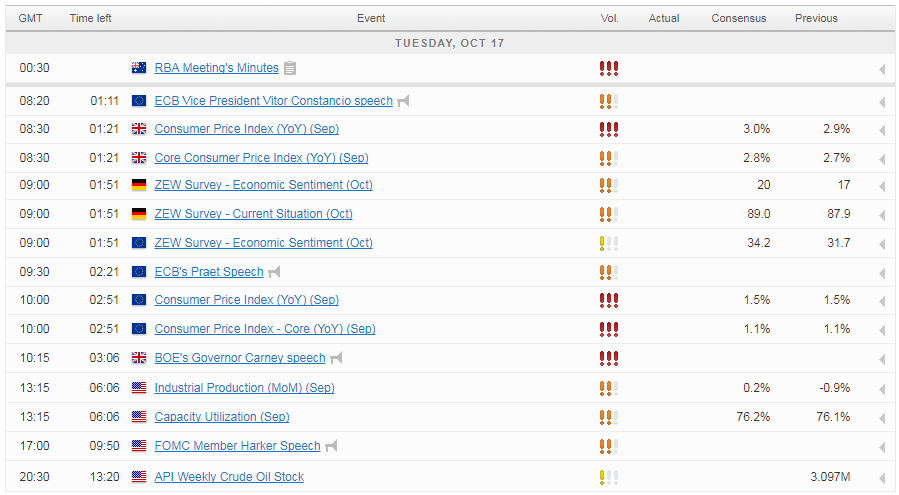

European equity markets are expected to open relatively flat on Tuesday, as we await some important inflation data from the UK and the eurozone, as well as appearances from Bank of England policy makers.

It could be an important week for the UK as we get three economic reports that could strongly influence whether or not the BoE follows through with plans to raise interest rates for the first time since the global financial crisis. Policy makers have shown a desire to do so in recent months despite the outlook for the economy being far from encouraging.

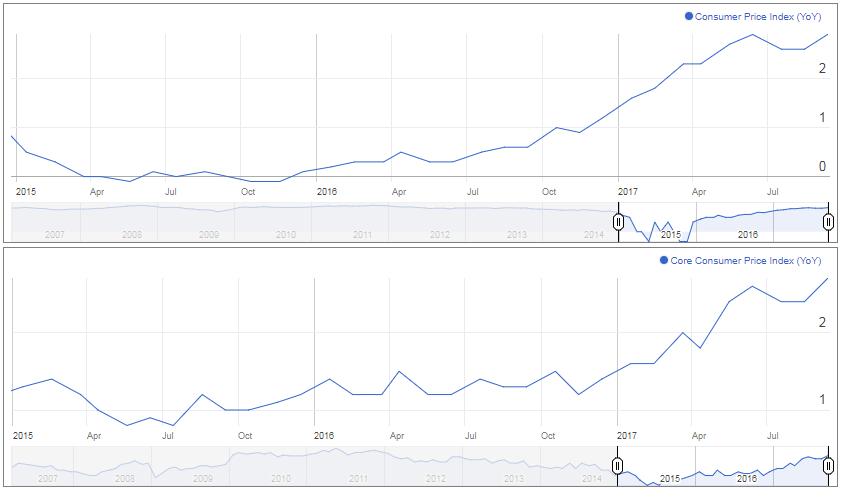

The MPC is apparently growing increasingly concerned about persistent above target inflation, despite the fact that the one-off post-referendum currency devaluation has likely played a considerable role in this. If this is the case then we would expect annual measures of inflation to naturally correct themselves, which suggests policy makers are of the belief that the numbers go beyond these transitory factors.

Three BoE Policy Makers Appear Before Treasury Select Committee

Should the September CPI data remain elevated – as is expected – it’s unlikely to ease policy makers concerns, making a rate hike this year all the more likely. If the data falls short of expectations then those policy makers that remain on the fence – which appears to include Governor Mark Carney – may be inclined to await more data before committing to a rate hike, which could weigh on sterling and boost the FTSE.

Carney is due to appear before the Treasury Select Committee this morning so we could get his view on interest rates then. His new colleagues Sir David Ramsden and Silvana Tenreyro will also make an appearance earlier in the morning, which could provide important insight as none of the three have so far voted in favour of raising interest rates.

Eurozone Inflation Data Eyed as ECB Prepares QE Reduction

The BoE is not the only central bank looking to tighten monetary policy before the year is out. The ECB is believed to be preparing plans to end its quantitative easing program, possibly starting with a 50% reduction and nine month extension from January, bringing purchases down to €30 billion until September next year.

The improved economic outlook has coincided with improvements in inflation in the eurozone and as long as this continues to point in the right direction, policy makers are likely to continue towards policy normalisation. We’re expecting no revisions to the September CPI data today, with overall inflation seen remaining at 1.5% and core at 1.1%.

USD/CAD Canadian Dollar Lower as Growth Expectations Drop

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.