European equity markets are expected to open a little softer on Friday, weighed down a little by losses in oil which plunged on Thursday after oil producers delivered the bare minimum cut that markets had priced in.

Oil Slides as Producers Extend Cuts By Nine Months

Oil fell more than 5% on Thursday after a meeting of OPEC and non-OPEC producers ended in an agreement to extend the 1.8 million barrels per day of cuts for an additional nine months. It’s believed that this will be more than sufficient to bring the oil market back into balance, by which they mean bring oil stocks back down to their five year average.

While traders weren’t necessarily questioning the suitability of the cut, it was fully priced in in the weeks leading up to the meeting and therefore the path of least resistance was clearly lower. Whether oil prices can remain at these levels or press higher will now depend on compliance with the agreement and the extent to which the US ramps up its productions to take advantage of these prices.

OANDA fxTrade Advanced Charting Platform

GBP Tumbles Again as Labour Cuts Tory Lead to Just 5 Points

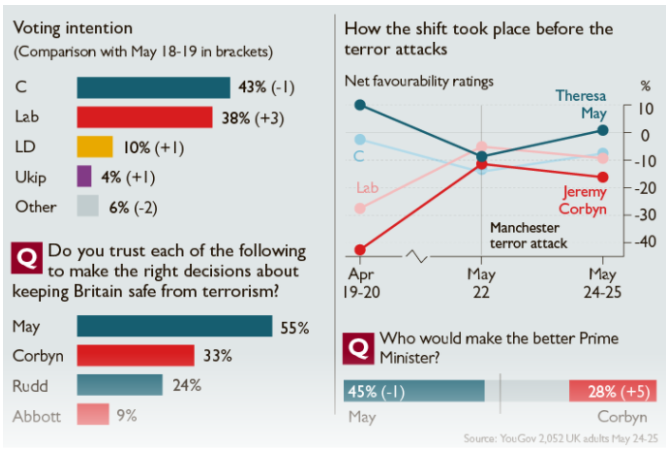

Sterling fell again overnight after a poll showed the gap between Theresa May’s Conservatives and Jeremy Corbyn’s Labour party has narrowed again. The lead – which only a few weeks ago stood at around 20 points – has fallen dramatically to just five according to this YouGov poll.

With this kind of momentum and almost two weeks to go until the vote, not only is this not going to be the breeze that May anticipated when she called the snap election last month, it could yet turn into a humiliating defeat for the Conservative leader and her party.

Coming on the back of losses yesterday, it’s turning into a rotten end to the week for the pound. What’s more, with it having broken below 1.29 against the dollar overnight, it could be facing further misery in the near-term.

The pair had been grinding higher for the last month and while it did manage to briefly penetrate 1.30 on a few occasions, the moves were always lacking conviction which suggested markets weren’t happy at these levels. The break of 1.29 may well be the trigger for a correction in the pair, with 1.28 and 1.2750 being notable levels below.

USD/CAD Canadian Dollar Lower After OPEC Extension Announcement Meets Expectations

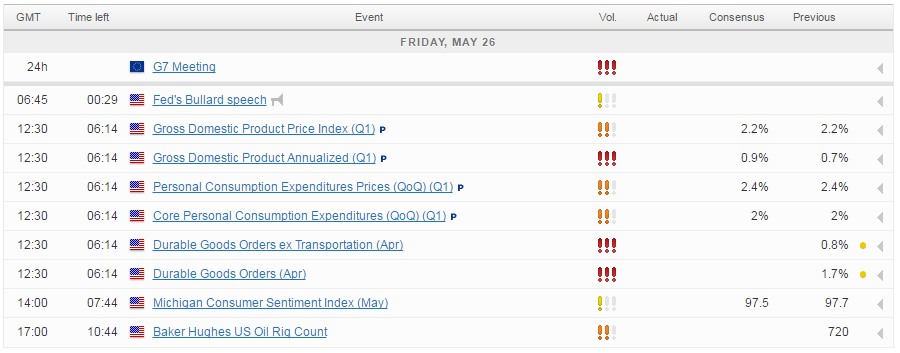

With no data due from Europe today, the focus will be on the US this afternoon as we get the first GDP revision, durable goods orders and the latest consumer data from University of Michigan.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.