Sudden spike in EUR/USD seen yesterday during New York afternoon – a very strange hour as trading volume tend to decrease after the first few hours of trading during US session. Furthermore, there wasn’t any news releases or announcements during the period that could have triggered such a response. Also, we did not see other assets moving in similar fashion during the same period – Stocks were heading lower but the momentum of which is consistent to early US session, while commodities were mostly trading within earlier range. Some small spikes were seen on major USD pairs such as AUD/USD and GBP/USD, but the magnitude was much smaller compared to the more than 80 pips jump of EUR/USD. This suggest that the small spikes are simply spillover from the EUR/USD rally rather than USD suddenly weakening out of nowhere and pushing “risk currencies” higher.

12 hours since the event has occurred we are still none the wiser why the sharp rally happened, and the likelihood of a large trade distorting prices during an illiquid hour cannot be ignored. Whether this large trade was due to fat fingers or a genuine long order does not matter – as market is still clearly bearish based on what we’ve seen subsequent to the rally.

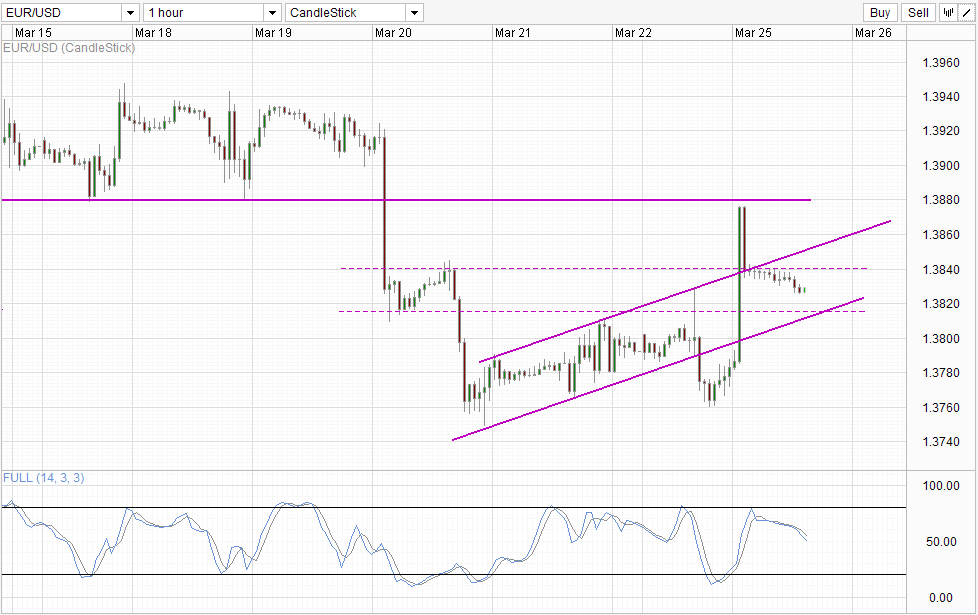

Hourly Chart

Firstly, prices traded back below 1.3840 resistance turned support quickly, and pushed back below the rising Channel Top, opening a move back towards Channel Bottom and potentially the intersection with 1.3815 support based on current pace of decline. Stochastic indicator is also currently bearish, lending strength to the bearish scenario.

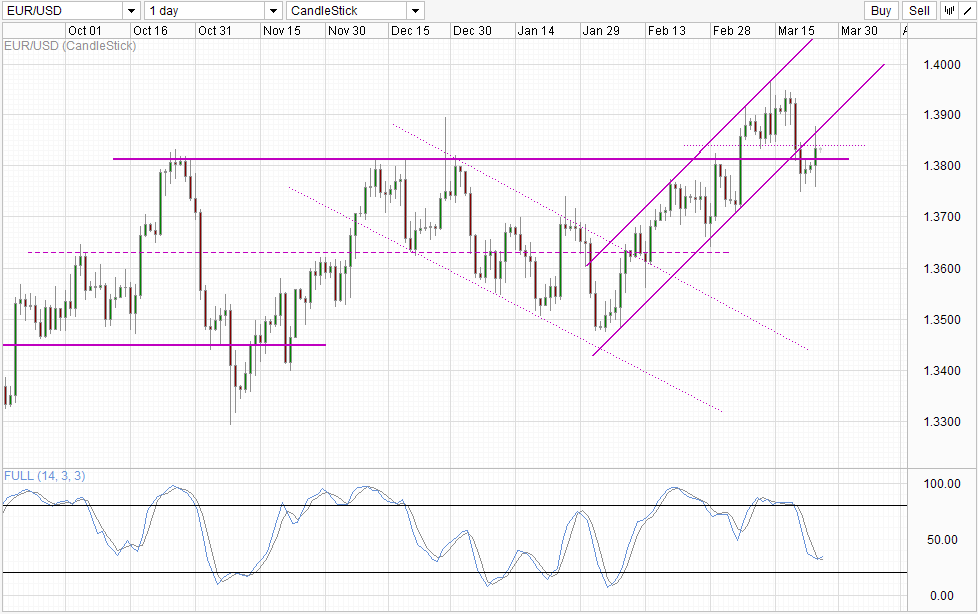

Daily Chart

Daily Chart is also bearish as yesterday’s rally can be construed as a re-test of Channel Bottom that has failed. Hence, the breakout of the Channel is confirmed and we could see further bearish extension that can bring us lower beyond recent swing low of 1.375 towards 1.370. Stochastic curve has crossed the signal line higher, but stoch curve has “resistance” around 40.0 and 50.0 to break and hence it will not be surprising to see Stoch curve reversing back lower from here to enter into the Oversold region to bring the bearish cycle to a proper conclusion.

The only concern is whether yesterday’s spike will repeat again. As FX is an extremely liquid and large market, price manipulation by way of large orders is unlikely, and even Central Banks will find it hard to keep buying/selling to move a major currency pair around 100 pips day after day. Hence, we should not be seeing similar spikes today, and instead the likelihood of market clawing back the “ill gotten gains” yesterday is higher.

More Links:

Gold Technicals – Bearish Below 1,315

S&P 500 – US Traders Seen More Bearish Than Others

GBP/USD – Little Activity Ahead of UK Inflation Numbers

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.