Gold prices took yet another hit yesterday after the impending US Debt Ceiling issue was given a 6 weeks lifeline, postponing disaster day to December. This new development dispersed (at least for now) the clouds of uncertainty and gave rays of hope for investors, causing Gold to shrivel as the Yellow metal practically feeds on fears. Prices broke below the 1,300 level and more importantly the 1,295 support when Boehner formally announced about the plan to temporarily lift debt ceiling for 6 weeks.

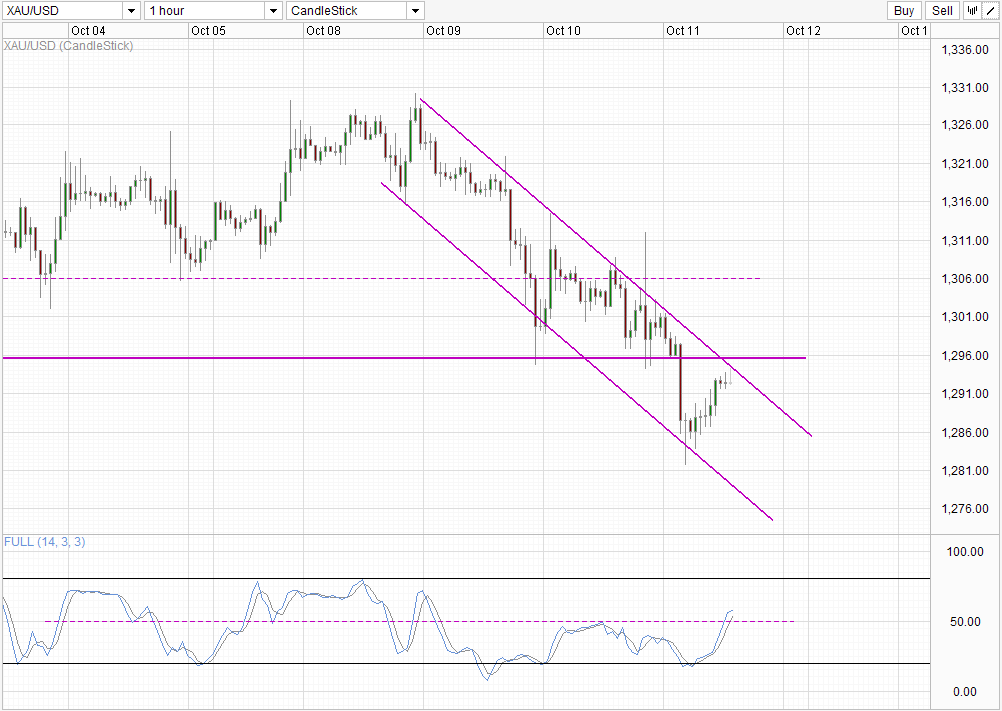

Hourly Chart

Currently, price has pulled back significantly during Asian hours, but overall bias remains bearish. The pullback can be interpreted as a technical pullback as part of the strong bearish momentum that started on 8th/9th October. Furthermore, price have found support from the descending Channel bottom, adding short-term bullish pressure sending price back up to Channel Top.

Considering that fundamental bias is on the downside, the likelihood of price being able to break Channel Top and perhaps even 1,295 becomes slim. Further technical signs from Stochastic also favor a bearish move – Stoch curve is tapering flat and looks likely to U-turn despite just breaking the “resistance’ level of 50.0, which in essence actually affirms the resistance level and will encourage bearish momentum towards Channel Bottom should Stoch curve push below 50.0 once again.

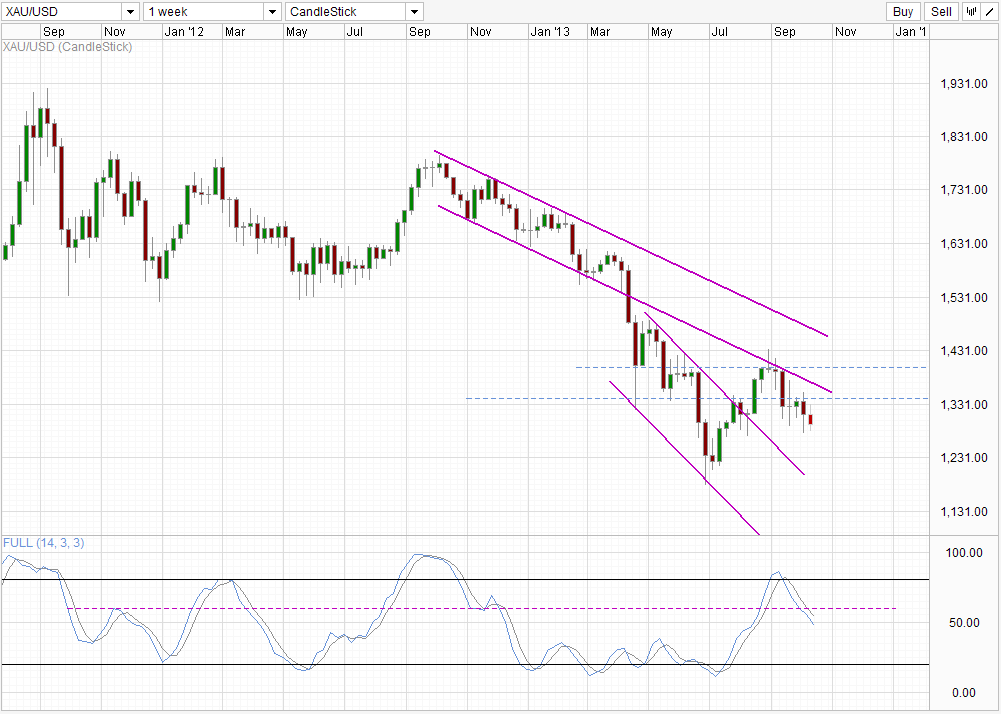

Weekly Chart

Weekly Chart is undoubtedly bearish with prices continuing the bearish rejection that started back in late August/early September. Stochastic agrees with stoch curve pushing below the 60.0 “support” level where points of inflexions have been seen previously. Should price break 1,270 soft support, we could see even stronger bearish acceleration towards the Channel Top below which currently stands beneath 1,200 – the key level where Hedge Funds started buying Gold in huge amounts, and perhaps more importantly the cost price for many global gold miners.

Fundamentally, it should be noted that this extension of 6 weeks does not mean that US has effectively averted a default. In fact, it is likely that default fears will creep in once more within the next couple of weeks if Obama and Boehner continue their failure to meet halfway. However, it is unlikely that gold prices will rally significantly even in such an event. Prices have been consistently trading lower even though we were getting closer to the 17th Oct Debt Ceiling dateline each day. Gold traders seem to be focusing more on the higher deflation risk which is brought about by the potential tapering of QE and the Governmental Shutdown which may spark a recession in US, while assuming that US will never default on its debt obligations. Therefore the only thing that could really jump scare gold higher and result in a sustainable bullish push may be the unthinkable – a US default scenario. Without this, there is a higher likelihood that Gold prices will simply continue its short term and long term bearish trend with small bullish bumps along the way.

More Links:

GBP/USD – Relying on Support at 1.5950 Level

AUD/USD – Remains Subdued with Solid Support at 0.94

EUR/USD – Finds Solid Support at 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.