Asset class prices continue to fluctuate, mostly on the market’s expectation of Fed tapering through QE easing later this year. The degree of ‘swaying volatility’ has already tapered somewhat, on the back of last week’s major positioning. Mind you, there are always a few last minute requirements that unnerve the weaker of market positions. This week’s highlights are primarily Fed related, including the FOMC statement, FOMC forecasts, and the chairman’s press conference.

The Fed’s communication skills had better be sharp, any miscommunication and the bleeding starts again. Investors will be looking for any changes in the regular statement and forecasts from ‘helicopter’ Ben and his fellow cohorts. Despite having already done some significant pre-meeting asset price damage and rebalancing last week, the market hemorrhaging only stopped after a few Fed watch reports. They suggested that any bond tapering would be gradual in nature, and that rates would remain “low” for a considerable period of time. It was more about who delivered the message rather than the message itself – Hilsenrath’s piece (the Fed’s friend) at the WSJ.

A communication challenge remains for the Fed’s team. Future Fed policy should undertake three distinct phases: tapering, pause and tightening. For many individuals the unknown variable is the length of time between each of the above phases. The market is expecting Bernanke to press home the point mid-week that there will be a considerable amount of time between ‘ending’ (note, not tapering) QE and raising rates. Ben needs to be very transparent when highlighting the point between “taking the foot off the gas and applying the brakes.”

“Tapering is not tightening”- Getting its message across in a clear and precise manner, with the least amount of market destruction, is not an easy task for central bankers. Separating the above three phases, especially as unemployment eases, is a trick not yet learned by any of them. However, it’s the Fed’s job to make the transition from each phase as smooth as possible, and investors will get to see how successful they have been doing this by mid-week. Leading into the Fed’s policy decision on Wednesday, the US CPI report and housing starts report could affect the “tenor of the hawks within the FOMC.”

Some early Euro data this morning continues to show signs of mild improvement within the region. Wage growth in Q1 picked up (+1.6%), as did April import numbers (€146.4b vs. €143b, m/m), which suggests that maybe Euro consumer demand is not yet dead. However, exports data for the region was down for the same time period (April exports €161.3b vs. €165.6b), making a “sustainable and even economic recovery that more elusive.” This was obviously something that the ECB was well aware of beforehand, otherwise they would not have cut their growth forecasts a few weeks ago.

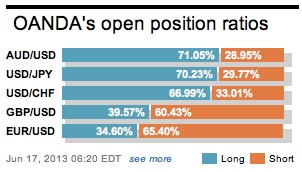

After having stayed short of the 17-member single currency for most of Q2, many speculators have been squeezed to square ahead of the Fed announcement. Despite the EUR managing to hold just above the accelerated trend support of 1.3300, weak Eurozone fundamentals and an improving US economy has bears thinking about reestablishing some of their ‘short’ positions again. Even with the technicals indicating that Euro longs should be favored, diverging data and rate differentials are supporting owning the USD. This market is anticipating a Fed to “talk a dovish book,” to ease some of the moves that have been supported by tapering expectations – creating a false EUR bid into FOMC?

According to technical analysts it’s hoping to stage a clear break above resistance at 1.3342 – the 61.8% retracement and late February high. If achieved, this would leave the immediate risks marginally higher and possible push through the optioned protected next big figure – 1.3400. Any momentum forcing the EUR below 1.3310, for a period of time, will open the door for the currency to test last weeks low at 1.3279. All jargon aside; many investors will prefer to wade to the sidelines until after the Fed. Some prior price action will make no sense and could be costly. Investors need clear and concise direction – let’s hope Ben and company is transparent enough.

Other Links:

EUR Bulls and Bears End Week Licking Wounds

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.