This has certainly not been a dull week in Capital Markets. The intraday investor has been exposed to just about everything. As of Friday, we have a commodity market that is telling the investor that global growth is slowing. A U.S equity market continuing to signal, financed by cheap money, that the US consumer is somewhat in the driving seat when it comes to stock prices. And finally, a European sovereign market that appears to be convinced that domestic Japan is about to embark on a global shopping spree. All cannot be true; a couple of these markets will eventually have to back down. The only cert that investors should hang to is that any realignment of these asset classes will not be smooth.

Day one of the G20 meeting in Washington DC has given Japan “the thumbs up” and USD/JPY the ‘green light’ to proceed to and beyond the psychological 100 barrier. Japanese Finance Minister Aso has indicated that no one opposed Japan’s aggressive easing policies at the G20-meeting. The new BoJ Governor Kuroda said that fellow members understand the case for his country’s unprecedented monetary stimulus and indicated that he expects no censure for the yen’s slide. Japan is adamant that they are not intentionally weakening their currency, the BOJ easing “is for a domestic policy goal to achieve the +2% inflation target at the earliest possible time.” What have we got? An intellectual currency war!

The extent of global fiscal tightening should again dominate today’s final day talks at the G20. No one expects any agreement on setting numerical targets for debt and fiscal targets of member nations. There is certainly chatter that EU officials are in the mindset of wanting to ease the austerity drive within the Euro-zone – the objective is obviously to “reinvigorate economic growth”. We should expect the Germans to oppose this train of thought, up until now they have been adamant that the Euro- peripheries adhere to strict austerity and reform programs.

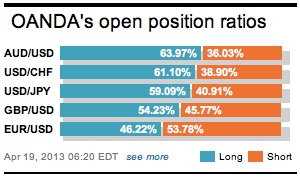

Even the IMF’s Lagarde suggesting that the ECB has room to ease monetary policy could not keep the single currency on the floor for too long yesterday. Nor can uncertainty about the Italian elections. Speculators’ buying the EUR on dips seems to be keeping the currency in a consolidated range for now, however, now we have to follow EUR/JPY. The currency pair’s dominant bid is a clear threat to EUR/USD where most speculators are short. It seems to be a matter of time before the cross should be putting pressure on the EUR’s outright range highs. This week’s theme of sovereign demand provides definite scope for a market move to test this year’s EUR/JPY highs above 131.00. With the start of the IMF/World Bank meeting (ending this Monday) investors should expect “on and off the record comments” to hit the wires and cause some price disruption.

Despite an Italian president not been elected during the first day of voting yesterday, peripheral spreads are tight again this morning, but only slightly so. The market does not seem too worried about the Italian “melodrama” just yet. There are still two rounds of voting for the next president due today and in the second-round it will go to a simple majority vote – this is the round that the market will be concerned with.

This mornings Euro-current account surplus has somewhat managed to distract the market from the Italian political histrionics. The broad measure of the regions economic transactions rose to +EUR16.3-billion in February, up from +EUR13.8-billion the previous month – thanks in part to increased trade. The trade surplus rose to +EUR12.2-billion, certainly a welcome sign for the embattled Euro-zone. Eventually all of this should boost the regions economic output.

Difficult to keep a strong Aussie down

Yen is not the only currency making headlines this morning. The AUD, a Japanese housewife favorite, was sideswiped in early trading after the IMF warned that the currency is about +10% overvalued. Are they talking their book? Perhaps they were already short it. They happened to just thrown another negative comment onto a currency that has been plagued by a weakness in commodity prices and news that its largest trading partner, China, recorded weaker than expected economic growth in Q1 this week. End result? The AUD was able to recover its intraday losses and then some after modest support from cross/JPY buying. Mind you, it also helped that a credit rating agency like Moody’s reiterated that Australia’s triple A-rating is safe…for now.

Other Links:

Investors Seek G20 Signal

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.