It is difficult to explain why stock prices have been so bullish in recent days, but whether you like it or not, the bullish sentiment is strong. Traders bought more stocks and pushed prices higher despite a flurry of bearish economic data yesterday – Advance Retail Sales came in at -0.4% vs -0.1% expected while previous month’s data was reversed lower. Initial Jobless Claims have also jumped from 331K previous to current 339K amidst an expectations for a slight drop to 330K.

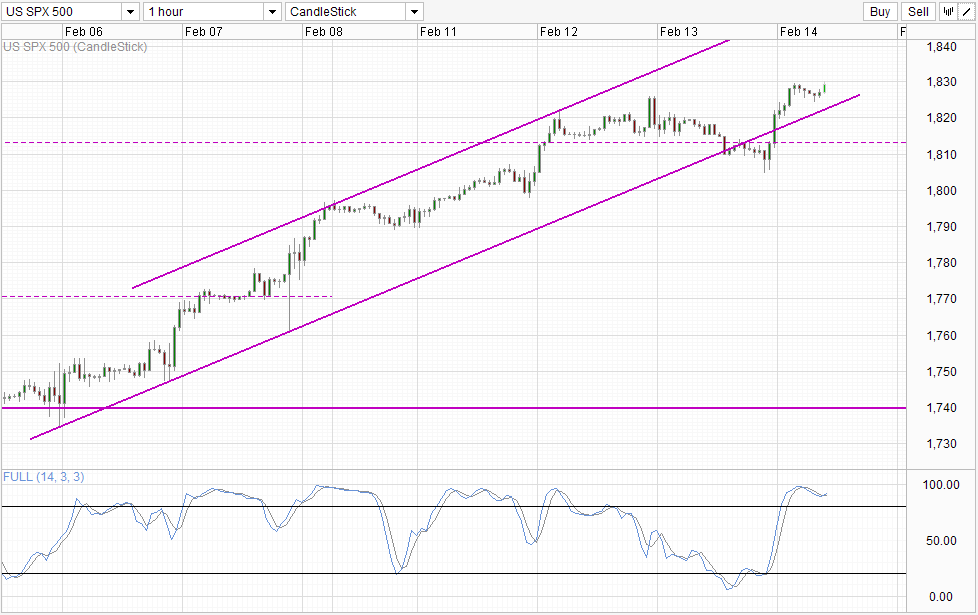

Hourly Chart

The ability of traders to basically ignore bad news would have been a strong bullish statement in itself, but it should also be noted that current bull trend has managed to ignore technical pressures as well. Prices were trending lower before US session started, pushing below both 1,812.5 support level and rising Channel Bottom. The bearish break was also “confirmed” in the sense that a bearish rejection was seen at the confluence between the 2 aforementioned support lines, increasing bearish pressure and opening up a move towards 1,800 round figure. Hence, yesterday’s rally managed to invalidated not only fundamental pressure but technical pressures as well.

Does this mean that the bullish sentiment is twice as strong? Perhaps, anything running on pure sentiment alone is considered risky as you are not able to gauge when the sentiment will fall apart. Some technical traders would use Fibonacci Retracements/Extension levels as a guide for such purposes as they argue that these Fib levels tend to coincide with when huge institutional traders hit their trading limits. Whether that is indeed true or not we will likely never be able to find out as the verification data is hard to gather. Nonetheless, considering that we are trading at record leveraged levels for stocks, it is clear that trading limits are actually higher than before. This doesn’t mean that using Fib levels is definitely out, but certainly the previously described justification for using the indicator will be diminished.

The good thing for pure technical traders is that they may not even need to use Fib for their trading decision. Fact of the matter is an uptrend has proven to be to be intact and strong, and currently Asian traders are sending S&P 500 futures to a new weekly high once more, and should that happen, a move towards Channel Top will be even more likely.

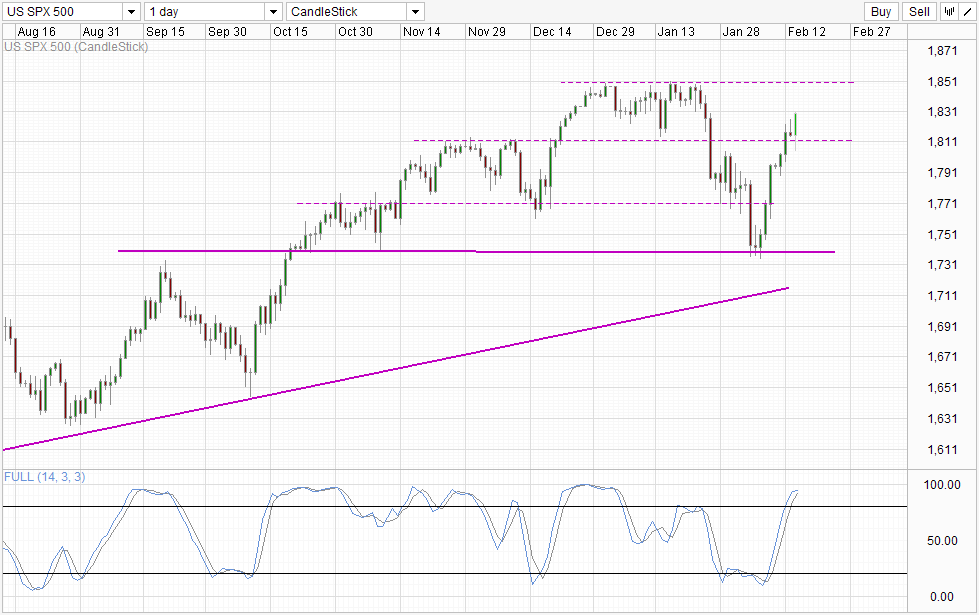

Daily Chart

Daily Chart echoes the same strong bullish pressure from a technical perspective. With 1,812.5 broken, the next significant resistance would be 1,850. Should 1,850 gets broken, the bullish train that has been moving since late 2012/early 2013 will be back on track and we may see yet more further gains in the short-term.

However, from a long-term perspective, the potential downside risks still remain. This latest bearish pullback in Jan 2014 has managed to breach 2 significant support levels but has failed to spark a fresh longer-term correction. As such, the call for a future bearish correction continues, and with stock positions remaining at highest leveraged levels with US economic recovery narrative continue to look weak, we may have simply delay the inevitable long-term bearish correction that most traders are expected.

More Links:

AUD/USD – Despite Excursion, 0.90 Level Remains Key

EUR/USD – Looking to Challenge Resistance at 1.37 Again

GBP/USD – Moves to New Multi-Year High Above 1.6670

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.