Japanese stocks received a huge boost today. Nikkei 225 gained 3.13% D/D while Topix gains were a bit more modest a 2.68%. The gains came after Bank of Japan released the latest monetary policy statement slightly after Tokyo noon, suggesting that market liked what BOJ has said. However, looking at the actual statements, one wonders if there has been any overreaction to the announcement considering that the central bank has not announced any significant changes to the current stimulus package. Plan for annual rise in monetary base remain at 60 – 70 Trillion Yen each year, while the only changes made was to double the scale of the “Stimulating Bank Lending” and “Growth-Supporting Funding” loan programs. These programs are certainly good, but merely acts as safety nets for banks rather than outright stimulating the economy, and such small changes suggest that BOJ will rather not increase current stimulus package if they can help it, and traders may have to accept that this stimulus package is all we’ve got unless the economic growth narrative of Japan starts to deteriorate more significantly.

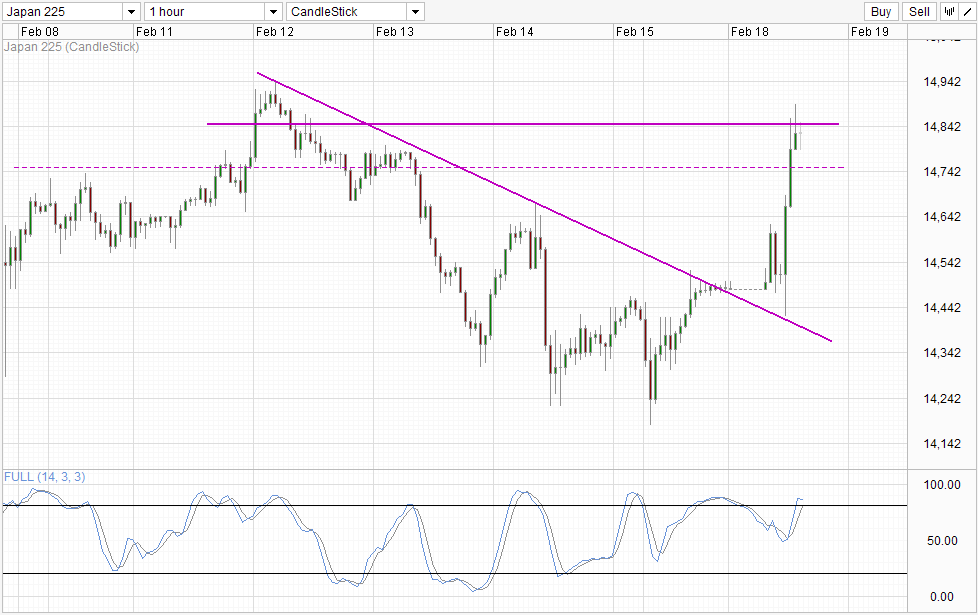

Hourly Chart

If the assertion above is correct, then the likelihood of prices breaching the 14,850 becomes lower, as the fundamental reason for a more than 3% gain is weak. Stochastic readings agree with a pullback scenario as Stoch curve has already started to point lower within the Overbought region.

On a related note, it is clear that bears were actually in control early Asian session. Prices did rally higher during the first 2 hours of trading but prices quickly reversed after bulls failed to breach 14,600, dragging price down to a low of 14,475 – erasing all the gains today and then some. The initial reaction to BOJ announcement was also bearish, pushing prices to a low of 14,425 before the strong bullish momentum took over.

What are we to make out of this? One way to look at it is that the previously bearish sentiment has been banished, but this doesn’t seem to be the case as current swing high is still a fair distance away from the high seen on 12th Feb. Also, there are reports coming out saying that current rally is a product of short-covering, which if true, implies that we shouldn’t the be seeing much more follow-through from here out. Given all these, it will be premature to assume that the previously bearish sentiment has since been banished and traders who want to buy Nikkei 225 from here may want to seek further confirmation to give them stronger conviction about their belief.

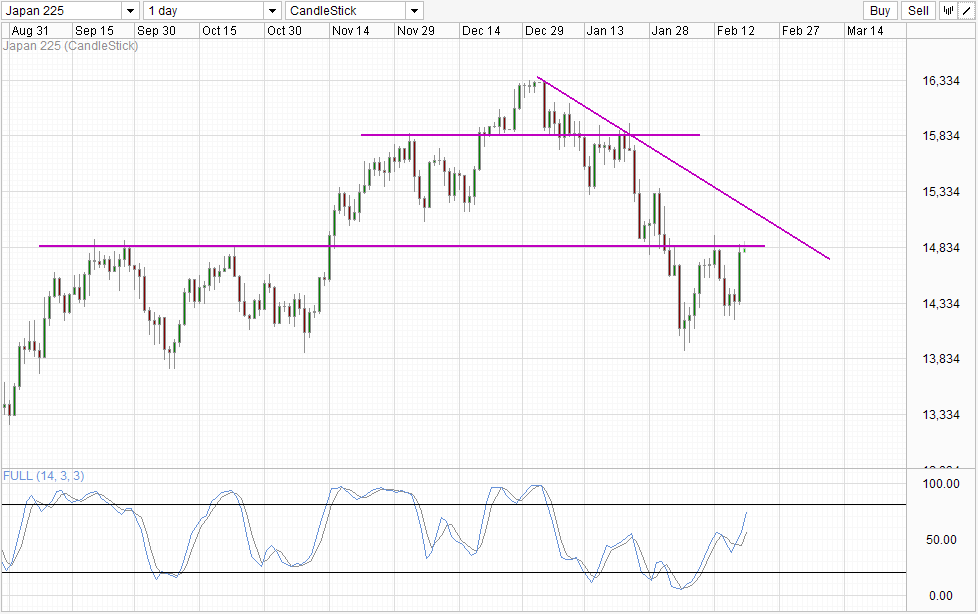

Daily Chart

The confirmation becomes even more important when we realize that 14,850 has even more significance on the Daily Chart stretching back to as early as September 2013. Looking at mid-term trend we can also see that direction is also lower since 2014 started. As such, the rally in Feb can be regarded as a mere correction. Even in the even that price does break 14,850, price could still reverse after tagging the descending trendline. Hence, long-term gains remains in doubt and traders who want to go long right now will need to be aware of the limited reward versus the risks involved.

More Links:

AUD/USD Technicals – No New Revelations From RBA Minutes

EUR/USD Technicals – Staying Above 1.37 Despite Bearish Setback

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.