Some slight pullback seen in Gold after price failed to clear 1,330 resistance yesterday. We are currently trading around the 1,315 – 1,320 consolidation zone seen late Friday, with prices breaking away from the Channel Bottom that has been in play since 10th Feb.

To be honest, this decline is not surprising as there wasn’t any solid reason for prices to be trading so high to begin with. Global risk appetite has recovered while major Central Banks in the world are appearing more hawkish than before. The Fed as said that they will continue the current pace of QE tapers, while Bank of England is expected to start raising interest rates in 2014. Reserve Banks of Australia has vowed to keep rates stable for now and the risk of any rate cuts in the near future has been lowered tremendously, while perennial dove Bank of Japan is definitely reluctant to introduce even more stimulus, choosing to expand wider safety nets for banks instead of injecting further liquidity outright. With these central banks not expected to loosen monetary policy, inflation risk will be lower and hence demand for inflation protection will be lower.

Hence, continued rally for Gold was always going to be highly doubtful even though current rally is adequately supported by volume with most of the volume coming from institutional speculators (read: Hedge Funds). Once these Hedge Funds run out of purchasing power, or have loaded up too much Gold, this rally will start to unravel.

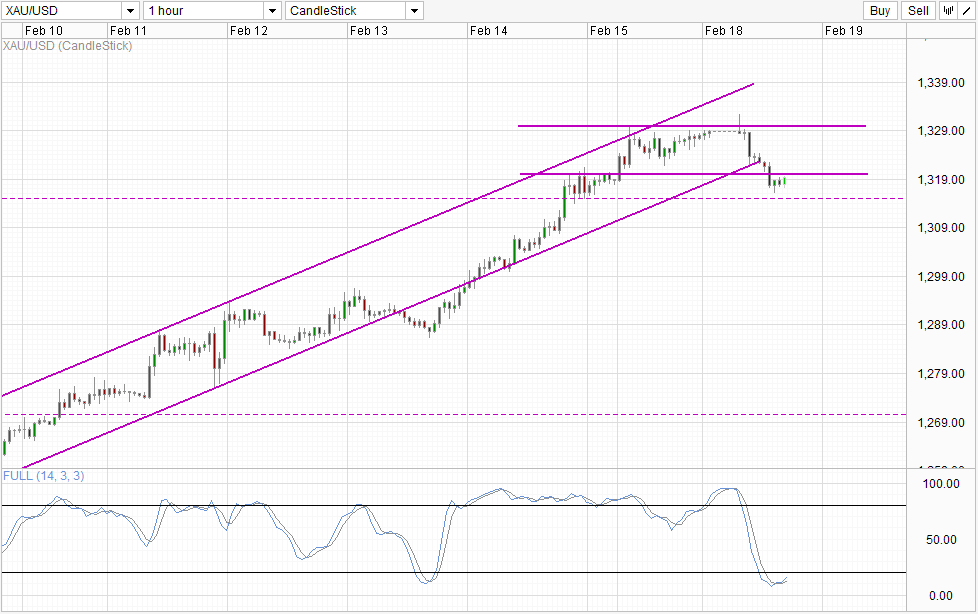

Hourly Chart

The only problem is that it is hard to determine when these institutional funds will stop buying Gold. Today’s dip may be a sign of a bearish reversal, but it could also be an attractive price for these speculators to load up even more Gold at “bargain prices”. From a technical perspective, it should be noted that S/T uptrend momentum remains in play above 1,315. Also, prices have exited the rising Channel before and recovered back up rather quickly. As such, we cannot automatically assume that current Channel break is a strong bearish signal and there is a likelihood that prices may be able to climb back within the Channel once more. This notion is supported by Stochastic indicator that shows both Stoch and Signal curves pointing higher – suggesting that a bullish cycle is imminent.

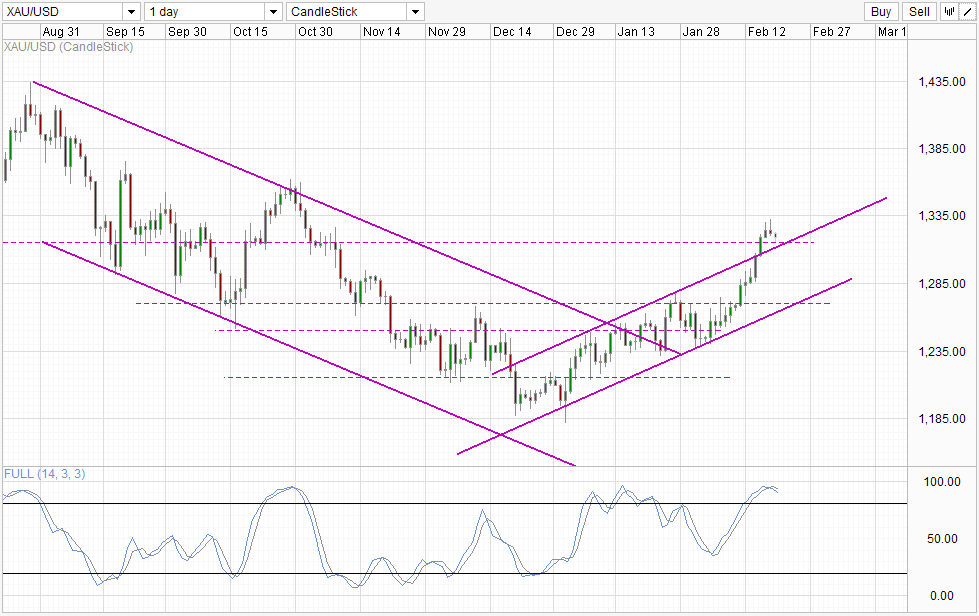

Daily Chart

Daily Chart is more optimistic for the bulls. Prices have since broken away from Channel Top, and even though we have tapered lower from recent swing high, prices remain above Channel Top. If Channel Top does hold, we could see even stronger bullish pressure as this would validate institutional speculators bet and encourage even more buying activity.

Nonetheless, long-term uptrend potential is still highly suspect. If we were to accept that the reason prices have rallied from sub 1,200 to current super-1,300 levels is due to the speculators alone, then it stands to reason that these speculators would already have loaded up a significant amount of Gold, and one wonders how much more Gold can these speculators buy even on generous leverage. Hence, if the fundamental climate explained above does not change, any attempt to push Gold prices higher will be relatively laborious and the risk of sharp bearish moves will keep increasing.

More Links:

EUR/USD Technicals – Staying Above 1.37 Despite Bearish Setback

AUD/USD Technicals – No New Revelations From RBA Minutes

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.