AUD/USD was bearish yesterday, continuing the decline seen on Tuesday. However bulls managed to put up a considerable fight, preventing bears easy access below 0.90. Prices did manage to dip below 0.90 briefly but technical bulls pushed prices back up to a high of 0.9044 during late Asian/European session even though there shouldn’t be any economic news/ new development that could have fuelled AUD/USD higher. European bourses were trading deeper into the red zone during the period, and the only major economic number that was released was the worse than expected UK Employment Change which came in at 193K vs a 250K forecast. Unemployment of UK has also risen by 10 basis point to 7.2%, pushing risk appetite understandably lower during the period.

Hourly Chart

Hence, the ability of AUD/USD to hold onto 0.90 despite this bearish pressure highlights that bulls are no pushovers. Hence, it is no surprise that prices continue to remain supported around 0.90 this morning after prices traded lower once more following the bearish rejection of 0.904 resistance and confluence with Channel Top. Bulls were even testing the 0.901 support turned resistance, but fortunately for the bears, the release of a lower than expected HSBC/Markit Chinese Manufacturing PMI put short work of the bullish retest, driving AUD/USD to below 0.895.

However, it should be noted that the strong bulls seen around 0.90 can similarly be lurking around current levels. Furthermore, with prices currently straddling Channel Bottom, a move back towards Channel Top is possible. Stochastic readings agree with Stoch curve crossing the Signal line – suggesting that Stoch curve is bottoming and a bullish cycle signal is possible moving forward.

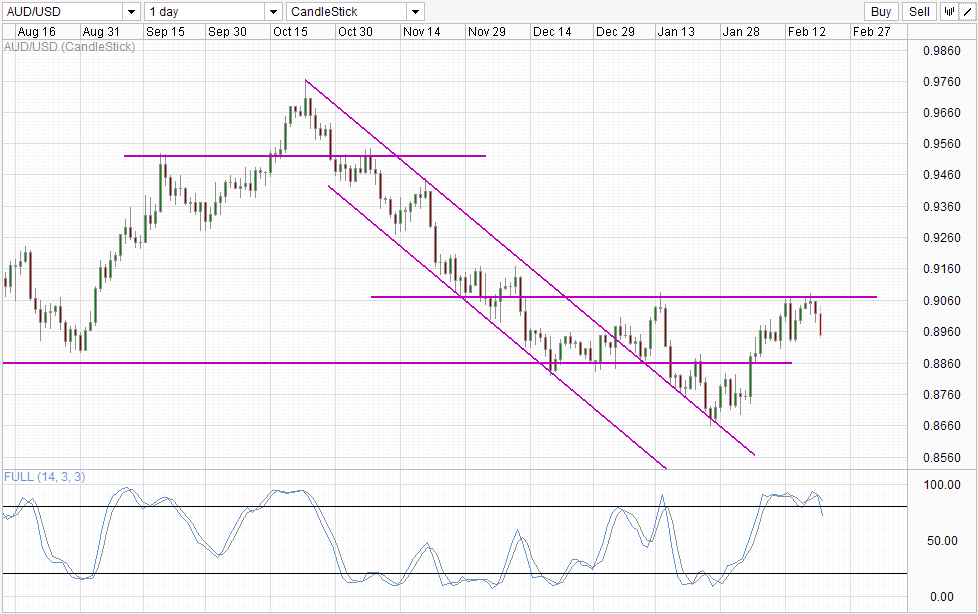

Daily Chart

Daily Chart is bearish with current decline acting as a confirmation for the Evening Star bearish reversal that was formed yesterday. Stochastic curve is also bearish giving an early Bearish Cycle signal right now. However, we are trading directly into the consolidation zone seen between 7th Feb to 11th Feb. As such, do not be surprised if we find some buoyancy in price now, coherent with our Short-Term analysis.

Fundamentally, it should be noted that the global recovery narrative may be a little bit optimistic. We have seen employment number misses for US, UK and Australia recently, all 3 countries whose Central Banks and Government who have been waxing lyrical that 2014 will be a good year. Hence, with more and more data highlighting the weakness in the recovery prospects, we could see risk appetite deteriorating and that will drag risk currency AUD/USD lower in the upcoming months.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.