US stocks enjoyed yet another day of rally, clocking in the biggest 4-day rally seen in more than year. S&P 500 gained 1.11% while Dow Jones Industrial Average which has been observed to be the less bullish of the 2 finally did one better at 1.22%. Strangely, the more risk sensitive Nasdaq 100 was the most “modest” at 1.11% (1.1058% actually vs S&P 500’s 1.1062%) despite outperforming the other 2 major indexes for the previous 3 days. Nonetheless, it is still a good day for Nasdaq 100 as the tech heavy index managed to erase the loss of 2014 and is currently closing in on the previous 2014 high made on 22nd Jan.

It is also interesting to note that Yellen’s hawkish comments and confirmation that QE Tapers will live on did little to damage market sentiment. Stocks did trade lower when the prepared comments were released at 9.30 pm SGT (8.30am EST), revealing that Yellen is committed to stick to Bernanke’s plan of tightening towards the end of his reign, but prices recovered quickly. Certainly, the strong underlying bullish sentiment spotted on Monday played a big part in buffering any potential bearishness/disappointment that tapers will continue, but it is likely that 1,800 round figure support helped to rebuff any significant bearish selling attempt as well.

Some may argue that market is actually placing a higher weight on the recovery prospect of US, and Yellen’s commitment to further tapers is evidence that the recovery narrative is playing strongly. However, if we listen to Yellen’s actual comments, we would realize that she and the Fed does not really think that US economy is on a firm footing yet. The new Fed Chairman (Yellen doesn’t want to be called Chairwoman or Chairperson), mentioned that the recovery in labor market is “far from complete”, and refuses to commit to a “pre-set course” – which can be interpreted as providing leeway for halting of tapering action if things go south. This suggest that perhaps Yellen herself is not the most confident about the US economy, and as such it is interesting to see that market paying higher premiums on stock prices as though that the recovery scenario is a surety (hint: it’s not if last Friday’s NFP numbers is anything to go by).

Nonetheless, there are good news yesterday – US House of Representatives have voted to suspend the debt limit until March 2015. Even though the vote was marginally approved by a 221 – 201 minor tilt, President Obama will certainly be glad to see House Speaker Boehner and House Majority Leader Eric Cantor both supporting this ‘clean’ bill. This bill is now passed to the Democrat majority Senate, and is expected to pass without any issues as Majority Leader Harry Reid has vowed to “act as soon as possible”. With the can kicked down far down the road, markets should be able to enjoy political fuss free trading for the next 12 months – good for risk appetite.

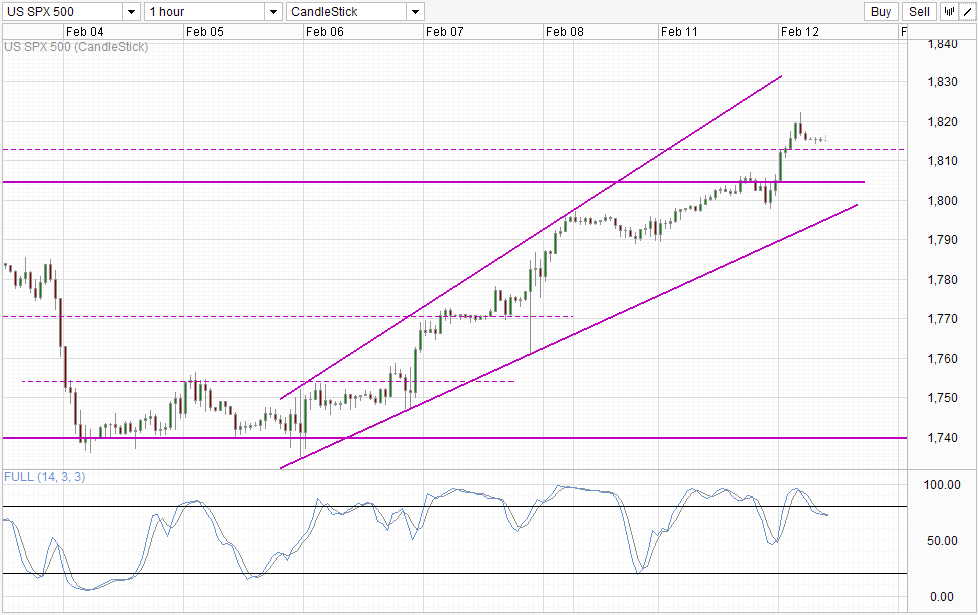

Hourly Chart

From a technical perspective, price has cleared the 1,812.5 resistance, and there isn’t anything in the interim that could thwart a move towards upper Wedge. Stochastic readings which were bearish just a few hours before has since mellowed significantly, with Stoch/Signal curves converging and the likelihood of reversing is high.

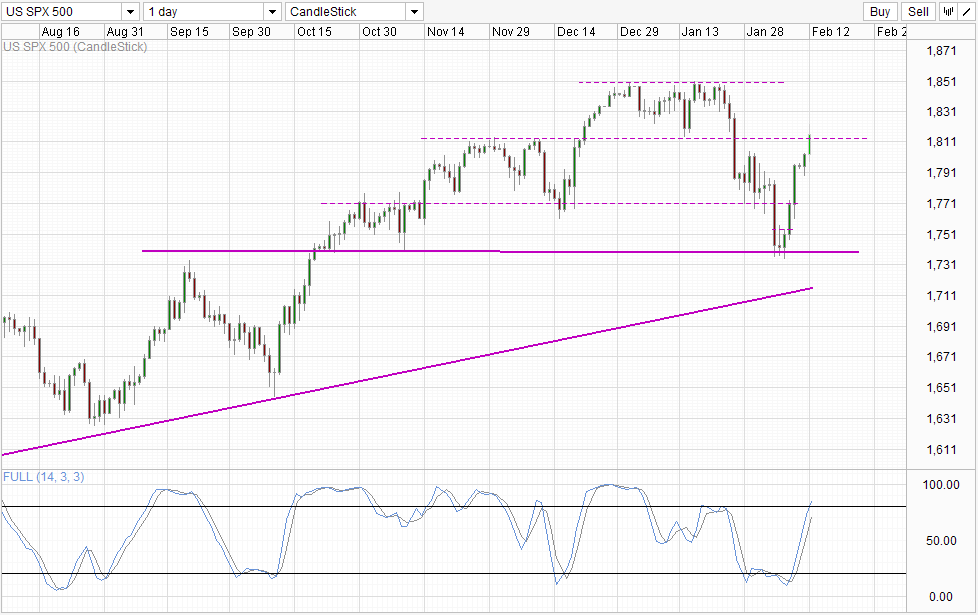

Daily Chart

Daily Chart is also bullish following the break of 1,812.5 which opens up 1,850 as the next immediate target. However, momentum is clearly overbought and even thought here is no evidence that a reversal/pullback is happening anytime soon, traders will need to be aware that the journey up north may not be as smooth as we think. Bottomline? Downsides are still possible and traders should do well not to get blindsided by surprise declines moving forward. More bullish fundamental data is still in order before we can ascertain the long-term viability of current bulltrend.

More Links:

AUD/USD – Doing Well to Stay Above Key 0.90 Level

EUR/USD – Eases Away from Resistance at 1.37

GBP/USD – Pound Rises After Positive Retail Sales

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.