Risk Correlated currency NZD/USD enjoyed the improved risk appetite in Asian markets today, climbing up from a low of 0.819 during US session to a recent high of 0.8248. However, this should not be misconstrued that sentiment in NZD/USD is bullish, as we do not have any strong evidence to support such an assertion.

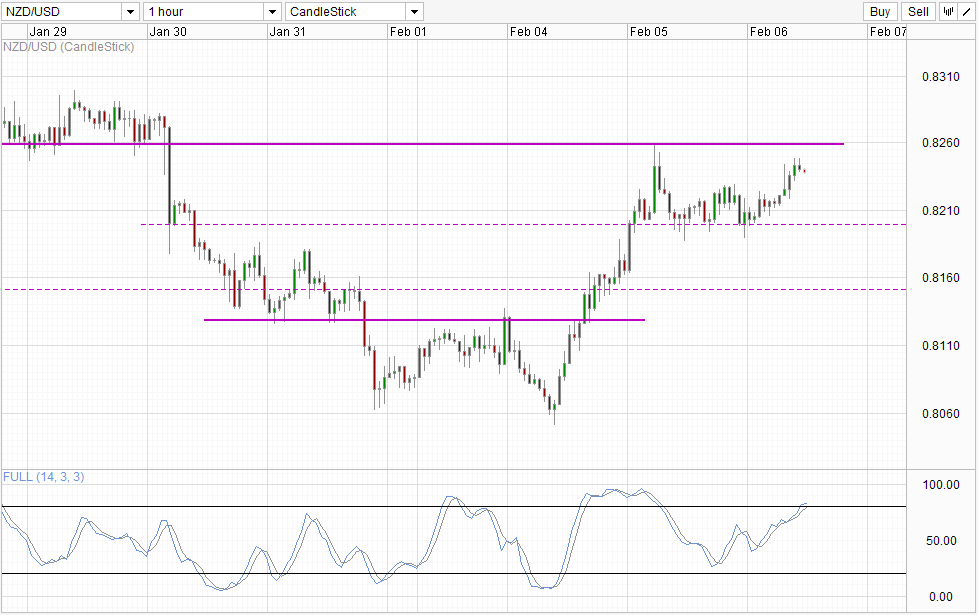

Hourly Chart

Firstly, the rally still for short of hitting the 0.826 resistance which is also the confluence with yesterday’s swing high (achieve post stronger than expected employment numbers). Secondly, price is already pulling back just as stochastic readings are within the Overbought region – favoring a move towards 0.82 round figure support.

Given all these, it may be hard for price to test 0.826 as it is, not to mention breaking the resistance and trade even higher. Hence, a bullish narrative is hard to formulate in the short-term. Nonetheless, credit should be given for staying above 0.82, which affirms the bullish recovery since Tuesday – reducing risk of any strong bearish pullback and opening the possibility of yet another bullish test of 0.826 when price rebound back once more from 0.82.

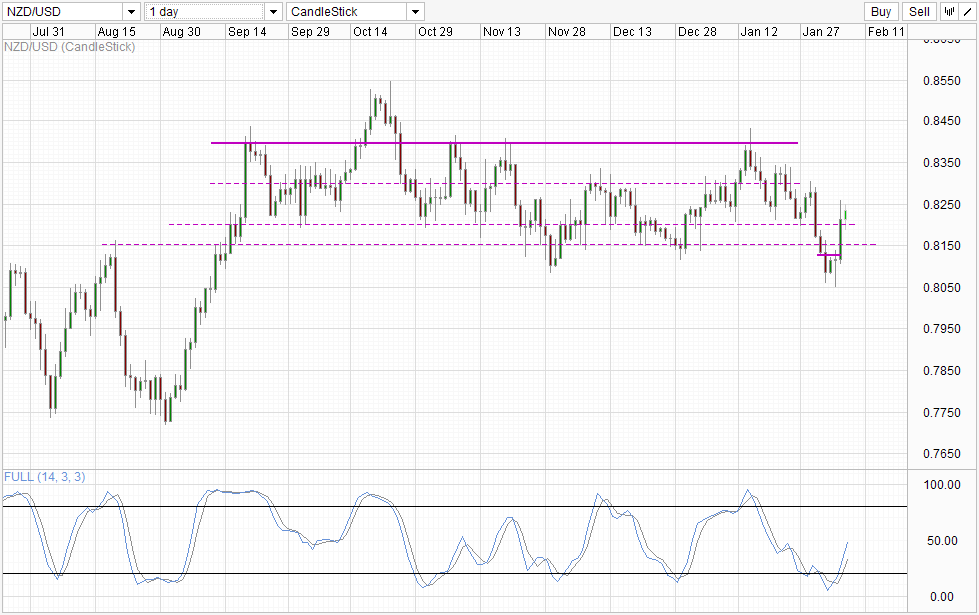

Daily Chart

By staying above 0.82, the breakout of 0.815 has been invalidated, and the move for a push towards 0.84 is now opened. Stochastic readings agree with Stoch cycle getting into full flight with Stoch level currently above the 40.0 level which were previous point of inflexions were seen. Ideally stoch curve should go beyond 50.0 but that is simply icing on the cake with the major bearish threat already banished. 0.83 may also provide some resistance but it is unlikely that current mid-term bullish cycle can be derailed unless something fundamentally shift (e.g. extremely bearish NFP print that drives risk appetite lower) in the near/mid term.

More Links:

GBP/USD – Continues to Find Support at 1.6250

AUD/USD – Maintains Breaks Through 0.89

EUR/USD – Runs into Resistance around 1.3550

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.