West Texas Intermediate crude fall for the 2nd day on weaker that expected US ISM Manufacturing numbers. This is yet another major blow dealt following the weak Chinese official Manufacturing PMI which was released on Saturday. It should be noted though that both numbers are showing growth, but the growth rates are certainly not as high as before, resulting in less optimism about future demand for crude. Just like any other risk correlated asset, WTI also suffered from the broad risk aversion, dragging prices down to a low of 96.15.

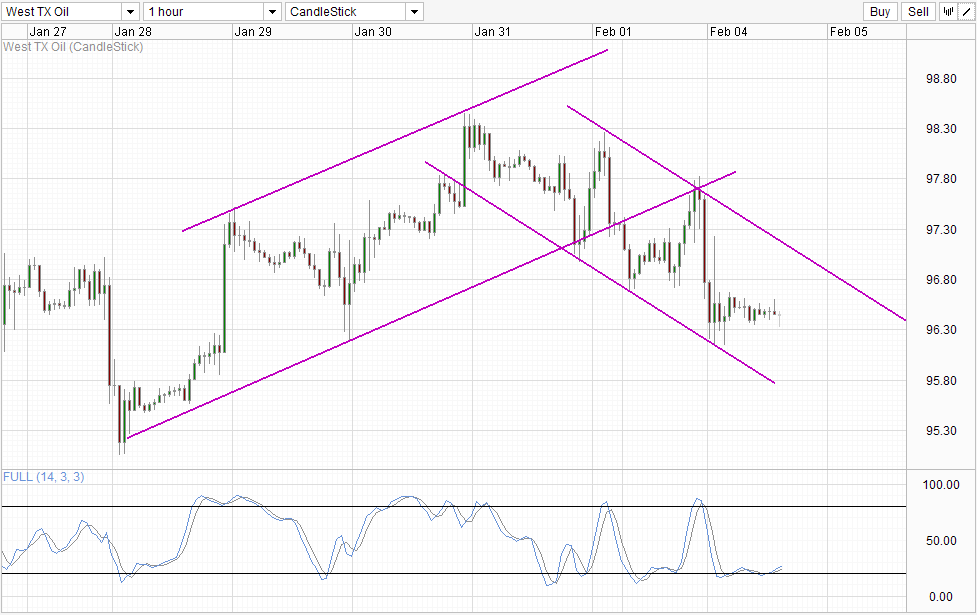

Hourly Chart

Prices have since stabilized above 96.3 soft support, but there is no evidence that prices will be able to rebound higher from Channel Bottom and tag Channel Top. Stochastic readings paint a positive picture with a bullish cycle signal, but preferably price should clear above 96.6 and ideally above 96.8 for a show of strong bullish commitment. But it is likely that Channel Top will be very near 96.8 should that happen, as such traders are forced to either wait for bullish confirmation and risk losing a huge chunk of the recovery move, or enter pre-emptively and have a higher likelihood of price going lower. Either way is not truly appealing and conservative traders will need to consider the risk/reward ratios before committing.

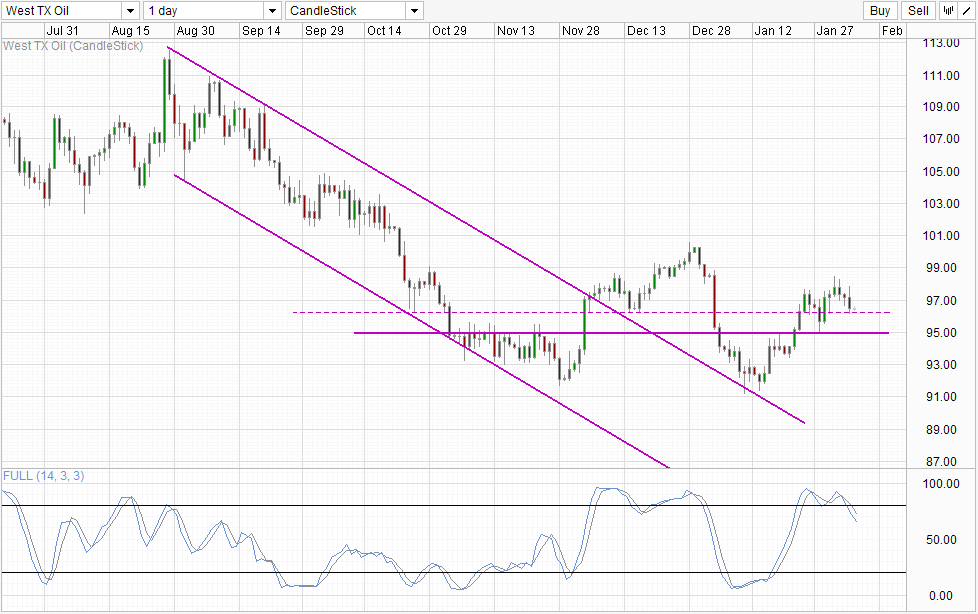

Daily Chart

Direction on the Daily Chart is mixed though, as the bullish recovery from mid Jan remains in play and will only be slightly impaired should 96.3 is broken, as the key “reversal” level would be 95.0 resistance turned support which also happens to be the 50% Fib retracement of the peak to trough in Jan. Stochastic readings is now showing a bearish signal, and reflecting a divergence between price peaks and stoch peaks, but stoch curve should push below 50.0 and preferably beyond 40.0 “support” for proof that the long-term bearish trend is back in play. Then again, by the time price breaks 95.0 or Stoch breaches 40.0, it is possible that the major move would have ended especially since 93.0 – 95.0 consolidation will add further support. As such, the risk/reward ratio may not be that great and traders will definitely need to think twice before entering.

More Links:

GBP/USD – Drops Sharply to Six Week Low Below 1.63

AUD/USD – Rejected Again at Resistance Level of 0.88

EUR/USD – Bounces Well off Support around 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.