- Hang Seng Index, Hang Seng TECH Index, and Hang Seng China Enterprises Index have outperformed US and Asia Pacific Ex Japan in the near term.

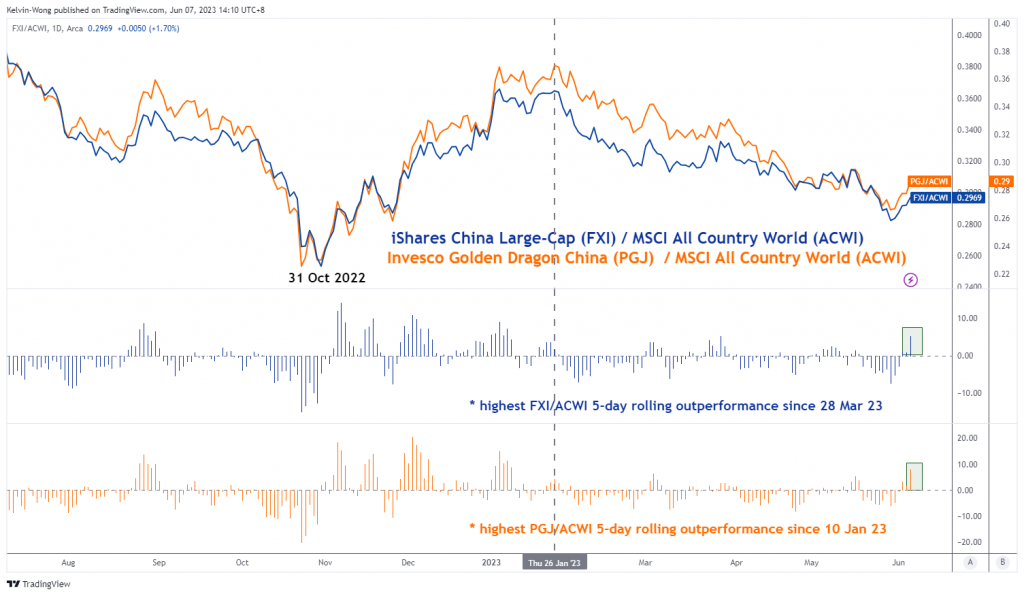

- China’s thematic exchange-traded funds listed in the US have recorded their best outperformance against the MSCI All-World Index since January/March 2023.

- An impending cut in China’s major banks’ deposit rates and a weak balance of trade data for May have increased the expectations of a cut to the one-year MLF interest rate next week.

Since last Wednesday, 31 May, there has been a minor resurgence of positive animal spirits in the China stock market and its proxies.

The Hang Seng Index, Hang Seng TECH Index, and Hang Seng China Enterprises Index have staged rallies of +5.8%, +7.6%, and +6.5% from last Wednesday’s lows to Tuesday, 6 June closing levels that outperformed the US S&P 500 (+2.8%) and MSCI Asia Pacific ex Japan (4.8%) over the same period.

Also, a similar positive performance behaviour can be seen in major China’s thematic exchange-traded funds (ETFs) listed in the US stock exchanges quoted in US dollars.

China’s thematic exchange-traded funds listed in the US have started to show signs of outperformance

Fig 1: Ratios of China Large-Cap ETF and Golden Dragon China ETF against MSCI All-World Index ETF as of 6 Jun 2023

(Source: TradingView, click to enlarge chart)

From a relative strength analysis standpoint, the ratio charts of iShares China Large-Cap ETF and Invesco Golden Dragon ETF consisting of China Big Tech ADRs over the MSCI All-Country World Index ETF have indicated significant outperformance where the 5-day rolling performances of the iShares China Large-Cap/ MSCI All-Country World Index ratio and Invesco Golden Dragon/ MSCI All-Country World Index ratio jumped to their highest levels in around two and four months respectively as of yesterday, 6 June.

Rumours of impending new stimulus measures

The reasons for such positive performances are due to impending new stimulus measures that market participants are expecting from China’s top policymakers to be introduced soon to shore up confidence and reverse the recent economic growth decline trend since February.

Last Friday, 2 June, several media reports mentioned that China’s top policymakers are working on a new basket of measures to support the faltering property market after existing policies failed to sustain a rebound and stabilize the property sector. Potential stimulative measures include a reduction in mortgage down payment in non-core neighbourhoods of major cities and further relaxation in the restrictions for residential purchases.

Yesterday, it has been reported that China’s central bank, PBoC may instruct major banks in China to cut time deposit rates as soon as this week, the second time in less than a year. A reduction of 5 basis points and 10 basis points on three-year and five-year time deposits respectively based on media reports. These measures are made to stimulate consumer confidence, and increased credit supply so that there will be lesser funds inflow into the banks’ fixed deposit products and lower the cost of funding for banks which in turn can incentivize a reduction in lending rates.

Recent key economic data have continued to flash weakening growth conditions

Also, China’s latest balance of trade data for May has continued to show a deterioration in external demand while internal consumption in China is still in a lacklustre condition. Exports growth has shrunk by -7.5% year-on-year to a three-month low, a reversal from a gain of 8.5% in April, way below consensus estimates of -0.4% while imports continued to contract for a third consecutive month to -4.5% year-on-year from -7.9% in April.

The 10-week rally in USD/CNH has reached an overbought condition

Fig 2: USD/CNH medium-term trend as of 7 Jun 2023 (Source: TradingView, click to enlarge chart)

USD/CNH (offshore yuan)’s medium-term up move from the 23 March 2023 low of 6.8103 has almost reached the lower limit of the 7.1445/7.1730 key medium-term resistance zone (printed a high of 7.1443 on 6 June) with a bearish divergence seen in the daily RSI oscillator at its overbought zone.

These observations suggest that this medium-term up move may be overstretched and the USD strength against the CNH is at risk of a pull-back or consolidation which can translate to a potential uptick in China stock indices and its proxies given their recent high indirect correlation.

Given this latest set of weak economic data and the impending major banks’ deposit rates cut, expectations of a PBoC’s rate cut next Thursday, 15 June on its one-year medium-term lending facility (MLF) interest rate have grown as PBoC has left the MLF interest rate unchanged at 2.75% since August 2022.

Hence, coupled with the positive momentum factor seen so far in China proxies stock indices and ETFs as well as the possibility of a short-term pull-back in US dollar strength, the bullish animal spirits may continue to persist for a while at least in the short-term.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.