Powell delivers dovish gift

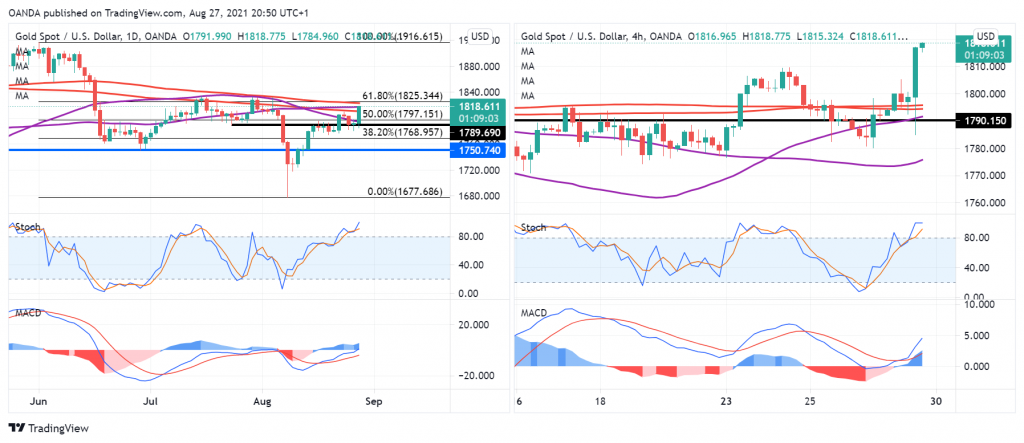

Gold appears to be eyeing its mid-summer highs after Powell’s comments during the virtual Jackson Hole event.

Powell delivered what the markets wanted to hear. No immediate taper, an awareness of the downside risks for the economy and a commitment that tapering and rate hikes remain unlinked.

The dollar softened after the speech and gold rallied back through $1,800. The question now is whether it can mount a run at $1,833, a break of which would send a very bullish signal.

We’re seeing a strong end to the week but time may just not be on gold’s side. Given what we experienced early in the Monday Asia session a few weeks ago, next week could be interesting.

A move above $1,833 will get people talking about $1,900 once more, although it may run into some resistance around $1,860 where it has previously struggled.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.