Facing major resistance

Gold has come a long way over the last couple of weeks when it suffered a flash crash at the start of the week.

Since then, not only has it rebounded strongly, it’s crossed back above the support level that was the catalyst for the plunge and headed back towards recent highs.

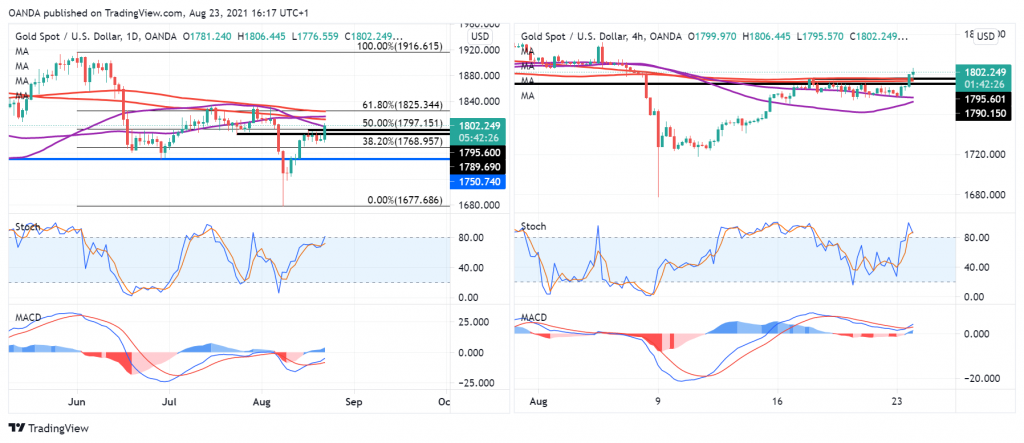

It’s broken through major resistance levels along the way, the latest being $1,800 which sees it overcome the 50% retracement level from the June highs to August lows.

The bigger test is still to come though. The 61.8% retracement level falls around those July and August highs around $1,833.

The cluster of moving averages may provide further resistance to the yellow metals ascent. But a break above here would be very bullish indeed. The question is what it will take.

The Fed looked destined to announce tapering in September but recent data along with rising Covid cases may derail their plans. That could be enough to see gold come back into favour, something that appeared highly unlikely a few weeks ago after the release of the July jobs report.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.