Cautious optimism ahead of the decision

Stock markets are edging cautiously higher on Wednesday, as investors await the outcome of the Federal Reserve monetary policy meeting.

Fed Chairman Jerome Powell used his virtual Jackson Hole platform last month to announce changes to the central bank’s monetary policy framework, targeting average inflation of 2%; in effect allowing for inflation overshoot after a period of falling short. Given the length of time that inflation has done just that, investors were buoyed by the prospect of an even more prolonged period of zero interest rates and perhaps even more stimulus.

While we’re not anticipating more easing today, there is an expectation that the Fed will provide further colour on the changes announced last month. What exactly does this mean for monetary policy? Can we expect more asset purchases? Negative interest rates? Yield curve control? At what stage should we factor in rate increases?

I’m not naive enough to expect answers to all of these questions today but the Fed will need to display a dovish shift from the last meeting, reflecting the commitment to the new framework. And more detail may be demanded regarding what the change means in reality. I wonder whether the Fed is positioned to disappoint.

Inflationary pressures have risen more than expected in recent months and the economy is bouncing back better than expected, as evidenced by the OECD’s new economic projections. The US is now expected to contract by 3.8% this year, an improvement on the -7.3% projection in June. Against this backdrop, I can’t imagine the Fed will be keen to make overly bold promises.

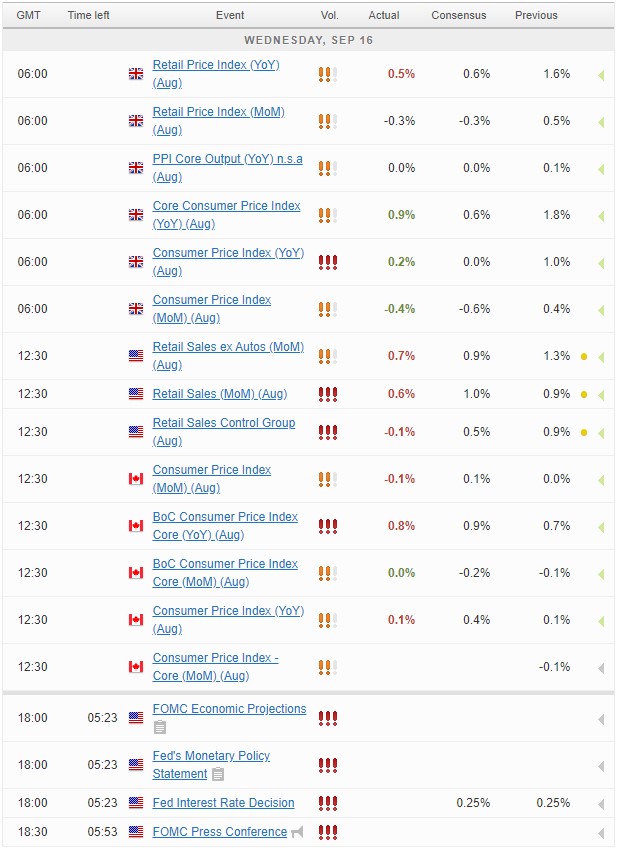

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.