Horrific Data Can’t Derail Stimulus Trade

Stock markets are charging higher again on Friday, with Wall Street seen around 1% higher, ahead of what is expected to be a horrific US jobs report.

There are a number of reasons to be cautious in this market but none are clearly as compelling as the grand economic reopening and authorities everywhere pumping out cash like it’s going out of fashion.

The ECB almost doubled its purchases under PEPP yesterday, serving a reminder that central banks are far from out of amunition despite the onslaught of measures in the last few months. It’s also a reminder of the severity of the situation but that’s a problem for another day, I guess.

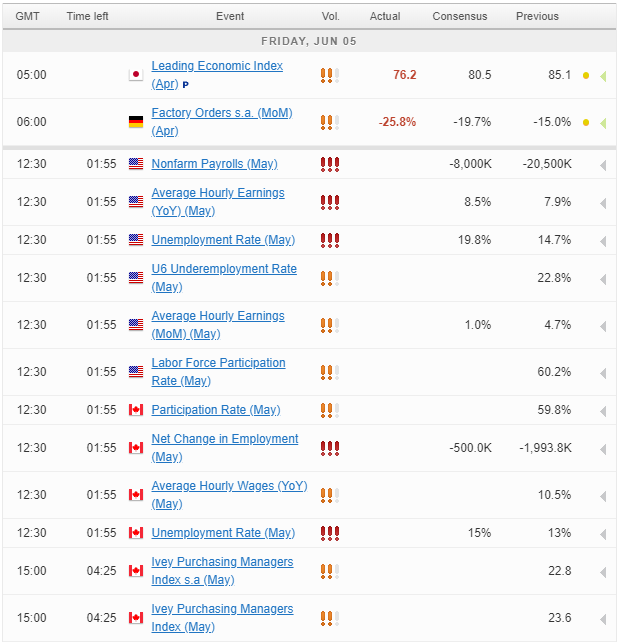

We’ll get another reminder of this shortly before the US open, as the Bureau of Labor Statistics releases the latest employment (or lack of) figures. Unemployment is expected to be close to 20% with around eight million losing employment last month. While these numbers are exaggerated by those on temporary government support, they’re none-the-less shocking and a large enough number won’t be so fortunate.

Still, we exist in a market that will be less than 10% from record highs when the opening bell rings which is incredible, given what will have come just an hour earlier. We can’t even argue that worse has been priced in anymore because those losses have been largely erased, this is purely a stimulus and momentum trade and it’s not running shy of either.

Oil marches on higher

Oil is continuing its relentless run higher. It may not quite be benefiting from the stimulus trade like we’re seeing in other markets, but the reopening push is strong in this one. Oil suffered more than anything, unless I missed other prices turning negative a couple of months ago. So its run now has been remarkable but at least this makes sense.

With people leaving their houses, returning to work – maybe even avoiding public transport in favour of the car – and borders reopening, record supply cuts won’t have to last much longer to sustain these prices, even if another month is agreed this weekend. That will take us to the end of July, at which point prices will be at far more sustainable levels, allowing for production to be raised once again.

Gold comfortable around $1,700

Gold is hanging in there around $1,700 but isn’t exactly benefiting from this period of dollar weakness. The rally this week in equity markets and continual improvement in risk appetite may be holding it back as it maybe re-establishes the relationship that was lost during the early months of the pandemic. The yellow metal looks pretty comfortable around $1,700 so further consolidation may be on the cards, although the path of least resistance – if there is one – seems to be below.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.