Good News Trumps Bad

A mixed start to trading in Europe, with Wall Street poised for a similar open as investors mull over the reopening of various economies around the world at a time when others are seeing early signs of a second wave forming.

Nothing takes the shine off the easing of lockdown measures like previous success stories seeing fresh spikes in the number of cases. The numbers are still very small but that’s how these things start. The news may come at a good time for investors with many people questioning whether the stock market truly reflects the magnitude of the situation we’re all facing.

As we saw on Monday though, good news almost always trumps bad. Reports that parts of New York are ready to reopen with other regions not far behind triggered a late surge on Wall Street and I’d be surprised if we don’t continue to see that trend continue. Should the second wave morph into a second lockdown then investors won’t be so forgiving. That would be a disaster.

In a week like this, the COVID narrative is likely to dominate market sentiment. Central banks are broadly speaking likely to take a breather this week, while corporate America has largely now reported on the first quarter. The data is being given a free pass in the main but even this is lacking today.

Oil higher but caution may kick in ahead of June expiry next week

Oil is enjoying some relaxation, relatively speaking. It’s been a wild couple of months but we’re now seeing widespread action from producers to close the vast gap between supply and demand. This comes at a good time, with lockdown measures being eased, which has allowed prices to come well off the lows of last month, albeit back to unsustainable levels.

That said, this could just be the calm before the storm. The next contract is due to expire next week and this time las month we were also trading around these levels, oblivious to the carnage the following week had in store. Of course, a lot has changed since then but that may not settle the nerves entirely. It’s been a good run for oil but we may see some profit taking ahead of next week’s expiry.

Gold consolidation goes on and on and on and on and…

Gold continues to float around the $1,700 level. The range is closing in gradually but there’s little to suggest we’re on the verge of an explosive breakout. The dollar is also rangebound, which is likely playing a large role in the price action we’re seeing in the yellow metal. Should the dollar find its way below the April lows – less than 2% below its current levels – then gold may take off higher. It doesn’t appear in any rush though.

Bitcoin price survives halving event

The bitcoin halving has come and gone and, as expected, the publicity of the event has given the price a bump. The question is whether that can be sustained. In the run up to the halving, the price tested support around $8,000 and held. A break of that could have seen bitcoin back at early April levels before too long, wiping out the halving gains. That is promising for bitcoin bulls. The flipside is that $10,000 also held so the battleground is now set. It could be an interesting few weeks.

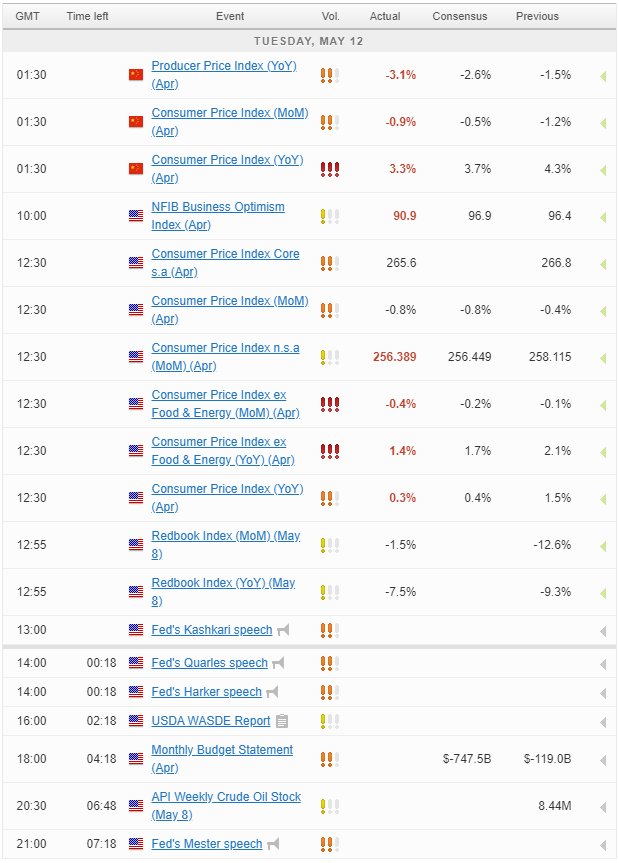

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.