Sentiment Fading Fast

Stock markets are starting the week in the red with much of Europe heavily so, as many indices trade for the first time since Thursday as a result of the Friday bank holiday.

The FTSE 100 took a hammering on Friday while many of the bourses were closed which is why it’s not coming under such heavy fire today. There’s some catch-up going on across much of the continent in the aftermath of Trump’s comments on potential Chinese tariffs. The last thing we need right now is a resumption of the trade war.

Earnings ended last week on a sour note, with Amazon and Apple adding a bit of gloom to a season that has, to that point, been given a bit of a free pass. Perhaps this is more of a timing issue than an earnings one but it appears to have contributed to the sea of red we’re now seeing. More earnings to come this week but we are past the peak.

Thankfully, the same appears to be true of the coronavirus itself. Boris Johnson emphasized this last week, even as the UK is on course to overtake Italy with the second highest number of reported fatalities, behind the US. We should learn a lot more about the lockdown easing process over the coming weeks, although I imagine it’s going to be very flexible as we see what impact it has on the data and healthcare system.

Oil slips as risk appetite dwindles

Oil prices appear to be mirroring sentiment in the markets today, with WTI down 7% on the June contract. A little over two weeks until expiry, we’ll soon see just how at ease traders have become with storage capacity. US production is now around one million barrels a day off its peak but falling very gradually in the last month, only 100,000 barrels per week.

The same isn’t true of rig numbers, which have been plunging so I imagine this will catch up with the production figures and alleviate the storage pressures in time. Whether that will come in time for the June expiry I’m not sure. Should be a fascinating couple of weeks.

Is gold a safe haven again?

Gold has enjoyed a nice bump these last couple of trading sessions. It technically remains range-bound but the move has come alongside stock market declines. I’m not going to speculate just yet about whether its normal relationship with risk has restored, I’ve done that enough over the last couple of months only for it to revert. Whatever is giving it a boost today, only a break of $1,750 will be meaningful, although $1,740 – the most recent peak – will be interesting a could create some excitement.

Bitcoin needs hype to sustain move above $10,000

Bitcoin is holding above $8,500 after peaking around $9,500 last week. It’s often difficult to attribute the moves in bitcoin to anything in particular but the proximity to the halving event seems logical, from the perspective that it gives it exposure rather than anything more fundamental. You would think that anything significant would be priced in by now.

Whether the exposure can see it through $10,000 is one thing, whether it can sustain it is another. We’ve seen it before, the mere act of it rising fast creates the stories which generates the exposure. If that doesn’t happen, any rally may quickly fizzle out and we could find ourselves back at the early April levels.

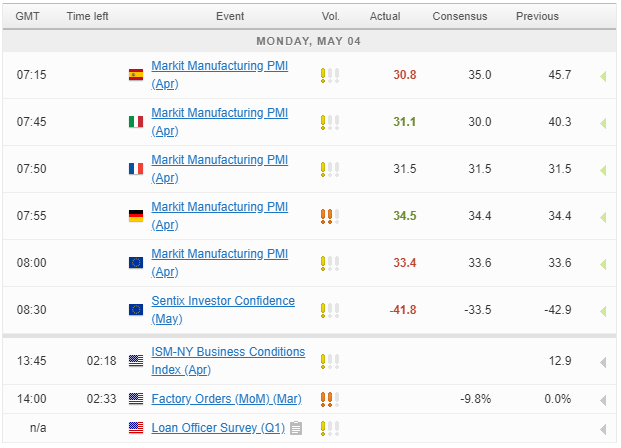

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.