Nothing to Fear (it Seems)

Stock markets in positive territory for a second day on Tuesday, with investors growing in confidence as we head into peak earnings season.

Companies seem to be getting the economic data treatment, in that expectations are now so low that they’re basically being given a free pass. This week has the potential to be a huge banana skin for equity markets and yet investors are showing no fear. It’s amazing what a few trillion dollars (and the rest) will do.

The big tech companies, many of which report this week starting with Alphabet today, have a lot riding on their results. They can really make or break this recovery in stock markets. Amazon will be the icing on the cake if the next 72 hours goes to plan, with the company undoubtedly being one of the big winners of the lockdown. The share price will surely attest to that. And, of course, the pavement outside people’s houses on bin collection day!

Naturally the mood is helped by reports of Cities and States around the world either starting to reopen or at least planning for it. We appear to have moved beyond peak virus, for now, in the worst affected parts of Europe and North America, which is a relief, but any reopening is going to be extremely gradual so a return to normal is not going to happen any time soon. The “new normal”, that is.

USO whacks June WTI

It’s been another wild morning in the oil market, with June being the new May, as far as WTI futures contracts are concerned. It’s taken a beating this morning on reports of the largest US oil ETF, USO, reducing its holdings of it to zero in favour of longer dated contracts. They are reported to represent 20% of its $3.6 billion portfolio, so its understandable why traders may be jumping out of the way of this particular onrushing train.

The carnage may continue for another day or two yet, with the fund selling its position over a few days. This would typically be the most liquid contract but I can’t see that remaining the case for much longer which may increase the levels of volatility and see us delving back into negative territory earlier than we did on the May contract.

Update – Since the US open, the contract has gone full 180 to trade around 5% up on the day, having been 20% down in Asia overnight. It’s worth noting that this is only a $3.50 reversal but still quite a shift, none-the-less.

Gold can’t make up its mind

Gold has rebounded from its earlier lows, buoyed by a softer dollar and the rebound across risk assets, it seems. Gold appears caught in two minds at the moment. On the one hand, it looks determined to correct following an impressive rally from mid-March to Mid-April and the pause we saw in equity market and rise in the dollar appeared to allow for that.

But this week, stocks have rebounded again and the dollar dropped and gold looks unwilling to accept it. Strange times in the yellow metal. I still remain bullish longer-term though, with all of this monetary stimulus surely a bullish factor.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Bitcoin breaking out at a snails pace

Bitcoin continues to breakout at a snails pace, giving me no hope whatsoever that it will be sustained. Again this looks a market that can’t quite make its mind up about what should be happening right now. We waiting a long time for this breakout and it’s neither taken off or been faded. I can’t imagine this will carry on much longer but those backing the breakout may be a little confused right now, if not worried.

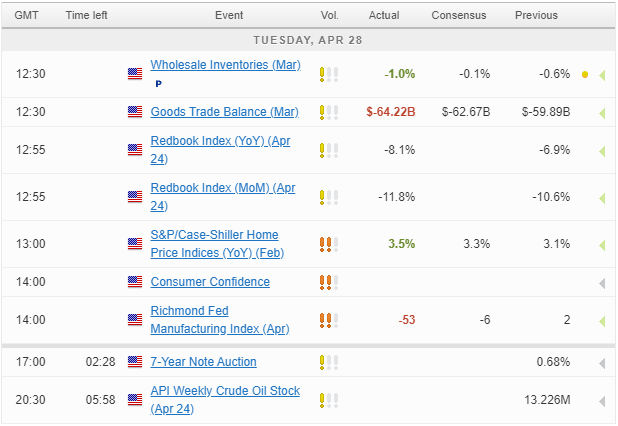

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.