Investors Buoyed By Reopening Talk

It’s been a strong start to the week for global stock markets, with sentiment buoyed by more encouraging signs as countries around the world fight the coronavirus pandemic.

Europe and North America have been the worst hit by the coronavirus so far but both are seeing improvements in new cases and deaths as the extreme lockdown measures bear fruit. We’re by no way out of the woods, with a second wave almost inevitable in many people’s eyes but this is encouraging and means we’re a huge step closer to the re-opening of economies around the world.

It’s going to be a very gradual process, both in terms of the loosening of restrictions and how people respond to the changes. So there’s still quite a hefty cloud of uncertainty hanging over the global economy, but the picture is far improved from a month or two ago and we now have a better idea of the where we stand and what lies ahead. From an investor standpoint, that’s a huge improvement and explains why we’re seeing such positivity.

Of course, this may all still seem premature. There are huge hurdles and uncertainties still ahead and it could be argued that investors are getting way too ahead of themselves. The counter-argument here is that a lot of the data doesn’t tell the whole story and, more importantly, there is an unprecedented amount of stimulus in the financial system now, that will have an impact.

It almost goes under the radar now when another central bank casually dramatically expands its monetary easing program. This morning it was the Bank of Japan which removed the ceiling on JGB purchases and made the program unlimited. This is a hugely significant move but when everyone is doing it or something similar, it loses its shock factor.

Oil volatility returns

Oil prices are getting crushed again this morning despite there not being any obvious trigger for the sell-off. Of course, in this environment, traders don’t really need a particular catalyst, but the volatility had been easing up towards the end of last week. Instead, the June WTI contract is now off 15%, reminiscent of what we saw last week in the May contract. Of course, this isn’t nearing expiry but with storage in the US filling up fast, that’s not particularly important. It may just be a question of how long it takes this one to turn negative now.

Gold sees profit taking again

Gold prices are off around 0.7% this morning having once again failed to break above $1,750. It fell just shy of its previous peak late last week and profit taking once again appears to have kicked in. Price action this week could now be key, with a move back towards last week’s lows potentially setting us up for a double top.

Lacklustre breakout in bitcoin

Bitcoin has edged above $7,500 in recent days but it’s still struggling to take off. The crypto was rangebound for most of the month so a breakout could have been the catalyst for a big move in either direction but the reaction has instead been a little lacklustre. It will be interesting to see how this goes in the coming days as it could have the opposite effect, casting doubt among the bulls and reinvigorating bitcoin bears.

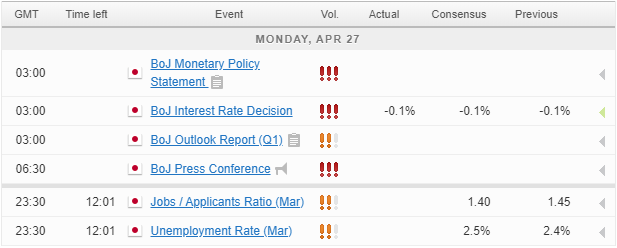

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.