Finally Some Good News!

In a week of negative economic headlines, it’s certainly encouraging to end on a more positive note and equity markets are surging this morning as a result.

The double whammy of US lockdown exit plans and, more importantly, a potential coronavirus treatment from Gilead has given investors cause for optimism heading into the weekend. It feels a long time since the weekend wasn’t treated with caution and fear but there’s certainly a feeling now that we’re moving in the right direction. The news is improving.

It’s worth noting that the clinical trial was very small, despite the seemingly very positive results and everyone is being urged to treat them with caution but let’s face it, we’ve waited a long time for some hope in the fight against this horrendous disease, people are going to get carried away. Whether that proves premature or not is kind of irrelevant.

The US exit strategy was pretty straightforward but the most encouraging thing was the claim that, per the thresholds outlined, 29 states would be able to start reopening soon. Let’s be clear, we’ve heard these overly-optimistic claims many, many times at this point, but this looks a little more encouraging and realistic. Ultimately though, it’s for the Governor’s to decide and they may act more cautiously but it’s still promising.

In keeping with these markets, they panic when faced with uncertainty and dour economic forecasts but generally take the actually grim data in their stride. Very much sell the speculation, buy the fact, kind of markets. Over the last 24 hours, another 5+ million jobless claims has taken the total to more than 20 million in just four weeks, China has recording a huge first quarter contraction and the rest of the data hasn’t been much better. But that’s old news, I guess.

May WTI contract gets pummelled

Oil prices are making small gains but continue to trade not far from their lows. The near-term WTI contract is taking a beating though as it approaches expiry, as storage facilities rapidly approach capacity and production isn’t falling fast enough. The inventory data is accelerating higher even as US output declines, now 800,000 barrels a day off its peak a month ago. The prospect of a treatment and economies reopening is obviously positive for prices but the near-term problems aren’t being resolved fast enough.

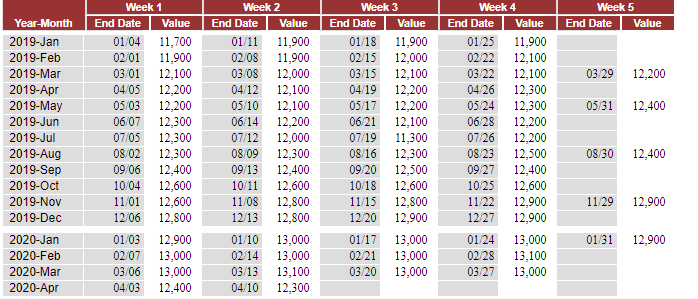

Weekly US Field Production of Crude Oil

Source – EIA

Gold in profit taking mode as dollar makes gains

Gold profit taking has properly kicked in now, with the yellow metal off 2% today and temporarily back below $1,700. The dollar has remained strong despite the bounce in risk appetite, although the prospect of the US economy reopening should be good for the currency. These relationships are never particularly straightforward. Either way, gold is under a little pressure, with $1,680 the key level below now and $1,640 notable below that.

Can Libra 2.0 spur another crypto rally?

The battle is not over yet, with bitcoin bulls taking another run at the upper end of the $6,500-7,500 range. News of Libra 2.0 overnight may have aided the rebound even if the proposal isn’t quite the digital currency that purists believe in. As we saw before though, that isn’t necessarily important and prices have been boosted just by being in the headlines and this does just that. In this sense, Libra is very much bitcoin’s friend. Whether Libra 2.0 will generate the same level of excitement, generally, despite having more realistic targets is another thing.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.