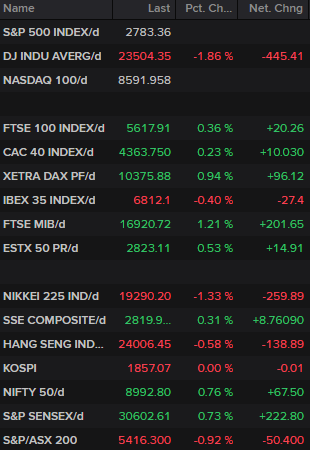

A Buy the Dip Moment?

We’re seeing a small bounce across equity markets on Thursday after two days of losses as the IMF provided grim economic forecasts and US earnings season got off to a rocky start.

Source – Thomson Reuters Eikon

This is going to be a good test of the new-found optimism, as equities bounced back strongly from one of the sharpest sell-off’s in decades. Should the dip be bought and the prior lows remain in-tact, it may well mark a bottom in these crazy markets and spur a new wave of optimism among investors.

We have to remember that not only are we seeing the trend move more favourably in many countries, particularly in new cases, but there is also an enormous amount of stimulus being pumped into the system that will naturally inflate the markets.

Earnings season has got off to a rocky start and will no doubt be sobering but investors will be looking for any signs of encouragement. It is one of many tests in the coming months but an important one that will add further colour to the wide-ranging forecasts that are out there. The sheer uncertainty of this has strongly contributed to the turmoil in the markets and slowly but surely this cloud will be lifted.

Oil rebound delayed as WTI sits below $20

Oil prices remain under considerable pressure, with WTI holding below $20 even as we see a risk bounce this morning. The output cuts announced by producers around the world we’re insufficient to offset the demand destruction caused by the coronavirus pandemic, despite being the largest ever agreed.

While it’s likely that market-driven forces will deliver further cuts in the US and elsewhere, this doesn’t provide the assurance that agreed reductions do, so oil prices may take a little longer to rebound. The data we’re seeing from the US suggests there will be large declines in production but putting a number on it is challenging. The rebound may be more gradual as a result, with the path of least resistance in the near-term potentially being below.

Gold may be seeing some profit taking

Gold prices are edging higher this morning, although gains are likely being limited by the appreciation in the dollar which typically weighs on the yellow metal. Momentum finally appears to be easing after a remarkable month in which it has rallied 20%, which may suggest some profit taking is kicking in. I remain bullish on gold but some softness in the near-term may be expected. Given the sheer amount of liquidity being pumped into the system by central banks around the world, I struggle to be anything but bullish on gold.

Is the floor crumbling below for bitcoin

It’s an interesting situation that’s been emerging in bitcoin, with the crypto battling between $6,500 and $7,500, a region that’s been a key battleground in the past. The lower end came under pressure again yesterday but the level was defended well. There seems to have been a real momentum shift here in the last couple of weeks and suddenly, the floor below looks much more vulnerable. I’m not sure it will survive another charge in the near-term, should it happen.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

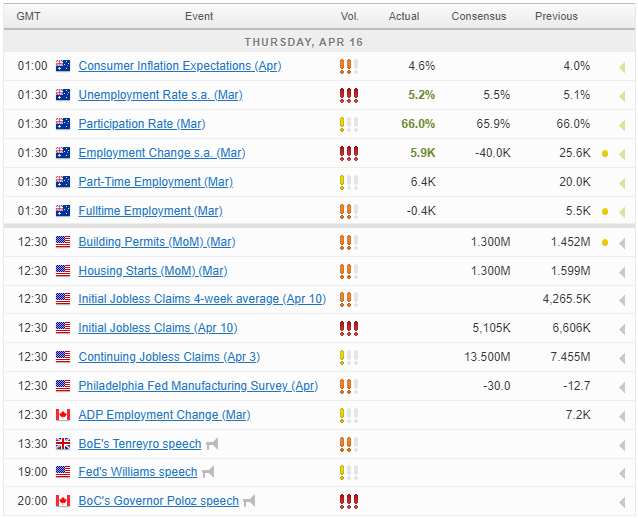

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.