Oil collapses as Saudi’s declare price war

Where do you begin on a day like today? It’s absolute carnage out there and it’s going to take a huge response from policy makers to restore order.

As if policy makers and investors weren’t struggling enough to get to grips with the rapid and unpredictable spread of the coronavirus, they’ve now been handed the additional problem of collapsing oil prices. On the face of it, falling oil prices during times of economic distress doesn’t sound like a bad thing for consumers but central bankers, oil producersand commodity countries may not exactly agree.

A deal in Vienna was always going to be difficult, with Russia already opposed to more modest cuts ahead of the meeting. Getting them on board with more than double which Saudi Arabia was proposing was always going to be tough. While no deal between the former allies was not a huge shock, what followed clearly was and has sent crude prices crashing at the start of trade this week.

Saudi Arabia has responded to the breakdown of talks on Friday by declaring a price war against other producers, hugely discounting its prices and ramping up production. It’s difficult to see what they hope to gain by lashing out in this way but perhaps the idea is to give Russia a taste of what no deal looks like in the hope of drawing them back to the negotiating table. It’s a bold move and has caused chaos in the markets this morning.

Italy takes extraordinary quarantine measures

The news out of Saudi Arabia comes as coronavirus continues to spread at a worrying rate, with Italy seeing a huge spike in the number of cases and fatalities. Italy has enacted some extraordinary measures over the weekend in a dramatic attempt to contain the virus, with a quarter of the population effectively quarantined following a more than 50% spike in the death rate in one day.

European stock markets are suffering enormous losses in the wake of the turmoil this morning. The FTSE 100 is leading the losses, down more than 8%, underperforming even the FTSE MIB.

Safe haven yen soars, Gold erases gains, commodity currencies whacked

The FTSE isn’t the only thing taking a hammering in the aftermath of Saudi Arabia’s decision, with commodity currencies like AUD and CAD getting whacked. The US dollar isn’t faring much better as US Treasuries slump to new lows on the expectation of more stimulus from the Fed. Another out-of-meeting cut may well be warranted at this rate.

Safe haven yen is soaring, despite data overnight showing the contraction in the fourth quarter was even worse than feared. In-keeping with the bizarre gold dislocation in the markets recently, the yellow metal has reversed earlier gains to trade a little lower. Given the scale of the declines in risk assets, it’s probably safe to assume some of the same factors may be driving this, such as margin calls and loss covering.

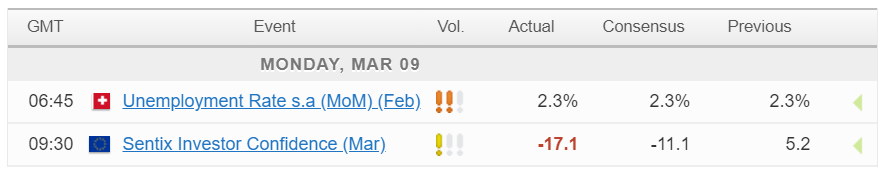

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.