G7 Committed (ish) to Supporting Global Economy

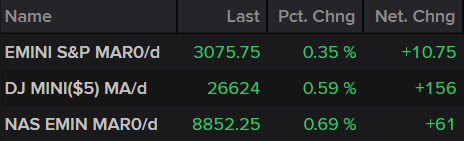

European stock markets remain comfortably in the green, up more than 1%, but are off their highs as G7 officials underwhelmed with their response following a conference call.

Source – Thomson Reuters Eikon

Investors were not particularly impressed with the loose commitments coming from the G7 conference call, with policy makers promising a monetary and fiscal response, where appropriate.

I think few doubt central banks desire to provide accommodation but it’s long been argued that governments aren’t doing enough and clearly have a different definition of what’s appropriate. It doesn’t exactly instill confidence that any fiscal response will be timely and sufficient and this is arguably the most important aspect.

It’s not been enough to derail the rally altogether but we have seen a notable pullback in Europe and US futures are back in the red, and there’s still time for it to become more significant ahead of the bell on Wall Street. For something that was expected to calm the nerves, it’s been rather underwhelming.

The real test may come over the next couple of weeks though. Once again, investors have become nervous and rather than wait for major policy signals have made clear what is expected from the Fed. The central bank now has two choices, do as its told or risk the wrath of the markets (and the President). No pressure.

Gold still finding its feet

Gold is still finding its feet after having lost its head during last week’s turmoil. The traditional safe haven was anything but last week, as everything including the yellow headed south. I wouldn’t say normality has set in but the panic may have passed for now, allowing gold to find its feet.

The FOMO trade is clearly back, as highlighted by the astonishing day on Wall Street at the start of the week. That leaves markets vulnerable to more episodes like last week, especially if policy makers are going to be so patient in their approach. With the dollar softening as more and more rate cuts are priced in, the environment still looks bullish for gold, although another plunge in stock markets may once again take its toll.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil pares gains as focus shifts to OPEC+

Oil is continuing to enjoy a relief rally as markets price in a timely and aggressive response to the coronavirus. It has previously come under severe pressure as the economic consequences take their toll. The OPEC+ meeting later this week will naturally be of interest, with the outcome possibly be highly dependent on the next 48 hours.

Producers may be encouraged by the fact that Brent is back above $50 but how confident can they be that it will hold. Only a strong response will support prices at this stage, it may just be a question of how much of the burden Saudi Arabia wants to shoulder.

Brent Daily Chart

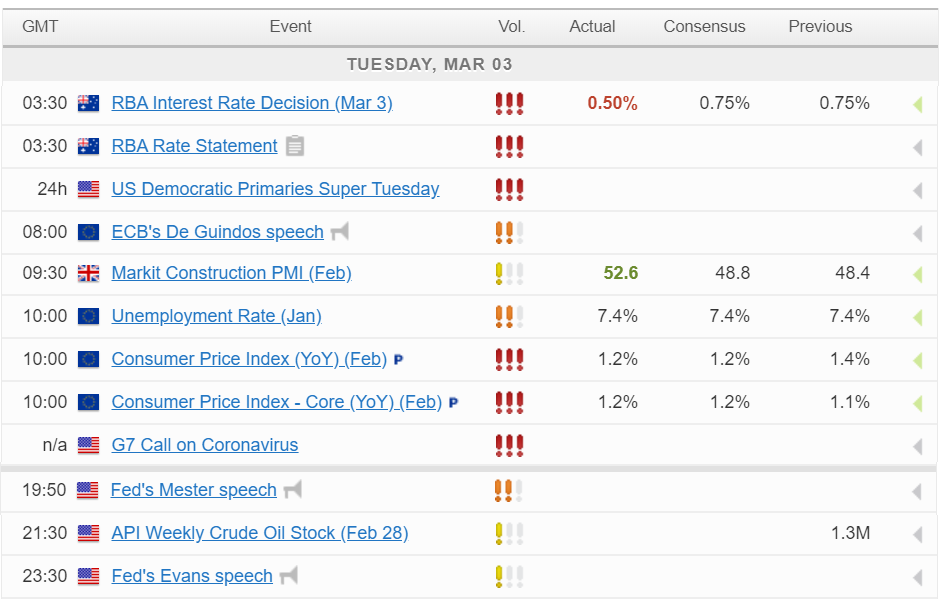

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.