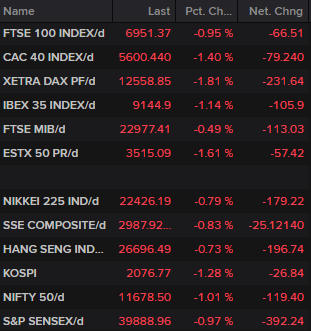

Stocks Plunge on Coronavirus Fears

Coronavirus may have been headline news for most of us for the last month but it’s taken until this week to truly infect the markets, as investors flee risk amid a growing belief that we have a full blown pandemic on our hands.

Source – Thomson Reuters Eikon

Cases are popping up right, left and centre outside of China, with the infection and fatality rate in Iran causing particular concerns for the middle east. Italy and South Korea are the other two countries that have been highlighted as being problematic but other countries are far from immune and Tuesday seemed to bring updates of new cases almost on the hour, every hour.

The sudden spike in the number of cases outside of China prompted the US Center for Disease Control and Prevention to put out quite a severe warning to American’s, suggesting it’s a case of when rather than if it will spread in the country and to assume it will be bad.

While preparing the public is arguably sensible, it didn’t do the markets much good and prompted the President to send out his team on a stock market PR offensive. Trump also tweeted “Stock Market starting to look very good to me”, not that we needed reminding how important the market is to the President.

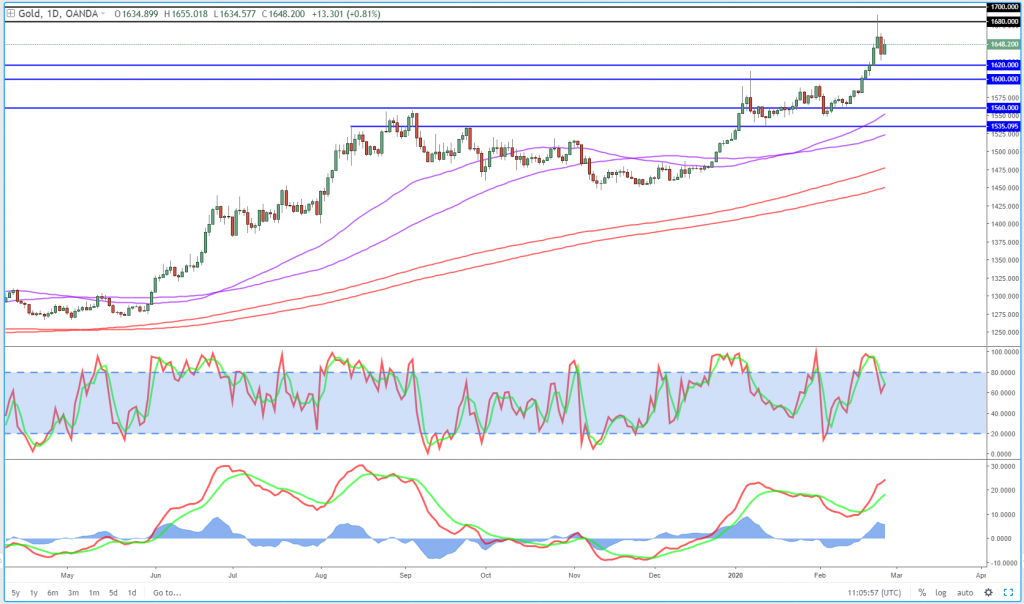

Gold finding its feet after rocky couple of days

Gold is on the mend after sliding well off its peak just as investors needed the safe haven most. The rally in the yellow metal in February saw it come within touching distance of $1,700 at which point profit taking kicked in. What followed may well have been a combination of stops being hit and even relate to the huge losses we were seeing elsewhere, but the safe haven appeal is returning. Gold has recovered from its lows yesterday and, should investors continue to flee risk in the coming days – which I suspect they will – gold could do very well again.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Crude slides on global growth fears

Oil on the other hand may be in for a rough time. Already we’ve seen it give up its hard fought gains from the last couple of weeks as coronavirus fears have spiked once again. Suddenly, we’re not talking about risks to Chinese growth, but global growth. If OPEC+ is slow to come out with measures to counter to anticipated demand hit, prices could fall quite quickly, with $50 Brent not too far away.

Brent Daily Chart

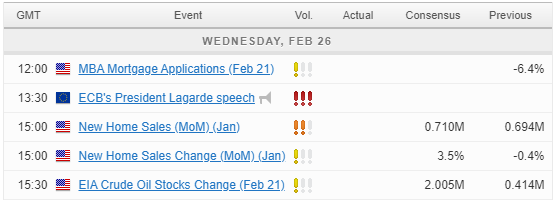

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.