That Didn’t Last Long

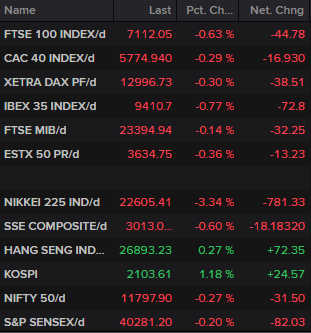

The stock market bounce was modest and short-lived in early European trade on Tuesday, as investors continue to fret about the likelihood of COVID-19 becoming a full blown pandemic.

Source – Thomson Reuters Eikon

The spikes in the number of cases in South Korea, Italy and Iran has made investors very nervous and with cases being confirmed in other countries all the time, they are right to be so. Buying the dips has proven a good strategy at times over the years, with markets recovering much quicker than they arguably should but more patience may be required this time.

Wall Street is still on course for a slightly positive open but given how quickly Europe has turned south, I’m not confident it will last. Perhaps investors in the US still feel a little sheltered from the direct effects of the spread at the moment but should it accelerate in Europe and Asia, I don’t think they will for long.

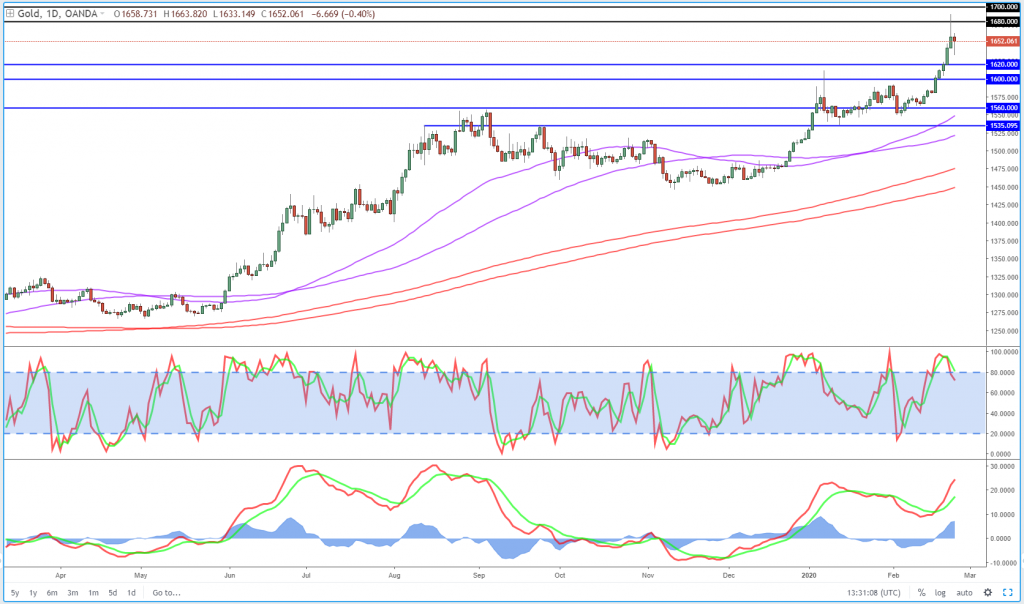

Gold seeing profit taking but safe haven status remains in tact

Gold is continuing to pare gains on Tuesday, even as we see broad risk aversion across the markets. Gold has been on a stunning run this month so perhaps we’re just seeing a little profit taking after it came close to $1,700. There could also be a knock-on effect from the severity of the declines across the globe on Monday, but it’s tough to say for sure. What I would say is that gold’s safe haven appeal remains firmly in tact which will likely support prices once the profit taking passes, assuming of course that sentiment remains bruised.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Crude prices vulnerable as cases spike

Oil prices are naturally feeling the full wrath of the coronavirus spread, with Brent now not trading too far from its February lows and momentum not its friend. There may not have been full agreement among OPEC+ behind the need for further cuts to support prices a few weeks ago but the latest developments may change things, especially if the situation deteriorates as it looks likely to. In the meantime, $54 is looking vulnerable.

Brent Daily Chart

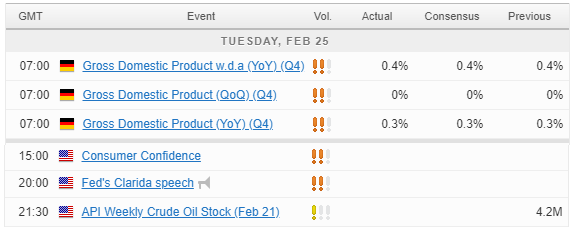

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.