Apple shock short-lived

The doom and gloom of Apple’s profit warning didn’t last long, with stock markets back in the green on Thursday and Wall Street eyeing a bounce of its own.

Source – Thomson Reuters Eikon

Investors still appear encouraged by the apparent deceleration in the number of new coronavirus cases, despite the death toll in China having surpassed 2,000. The problem is that they may be able to see the light at the end of the tunnel but it’s still not clear how long the tunnel is or what the world outside will look like.

I guess the damage is less important than the knowledge that the central banks stand ready to throw money at the problem. In such an environment, it’s no wonder everything is a dip buying opportunity.

UK inflation bounces back in January

The case for a rate cut in the UK weakened further in January, as inflation bounced back stronger than expected. Fuel and airfare prices were apparently behind the larger jump in prices, which rose 1.8%, up from 1.3% in December. The MPC can now reflect positively on their decision to not jump the gun in January, on the back of some poor end of 2019 readings. There were too many one-off factors to explain the weakness and the level-headed approach appears to have paid off. Markets are still pricing in a decent chance of a cut later this year but I imagine those odds will shrink if we see a decent post-election bounce in the economy.

CBRT takes foot off the gas

The CBRT took a more conservative approach at the meeting today, cutting rates by only 0.5%, in line with expectations. Under the leadership of Murat Uysal, the CBRT has been on an aggressive cutting cycle, surpassing market expectations at each meeting to bring interest rates back down to a level to support economic growth, appeasing President Erdogan in the process. This has not come at the cost of inflation so far but with the lira having been on a downtrend since the summer, including a more than 4% drop over the last month, the central bank may be looking to take their foot off the gas a little.

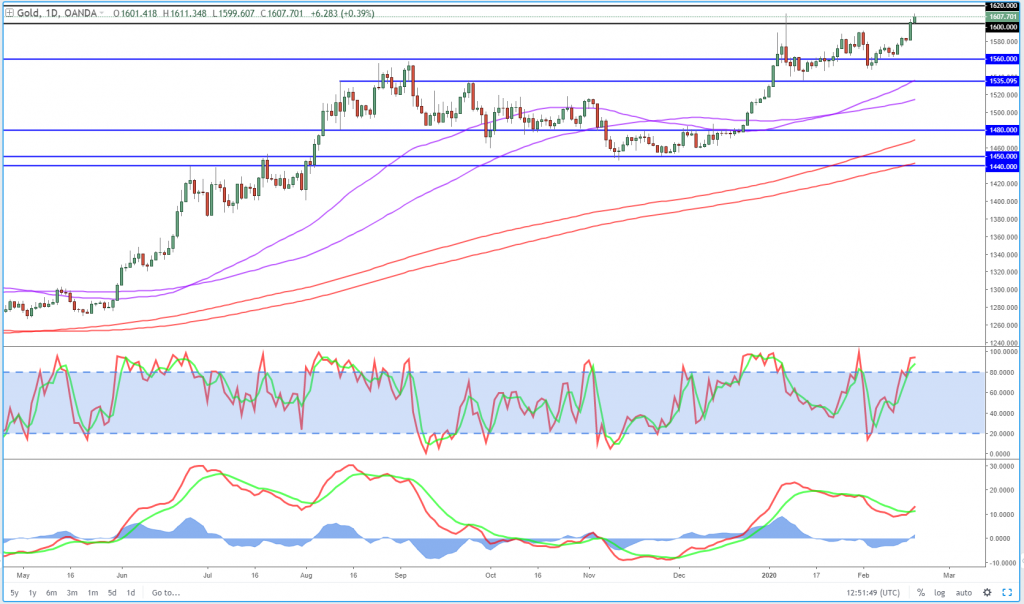

Gold storms through $1,600

Gold has stormed through $1,600 and is not looking back. The yellow metal has been met with strong resistance around here throughout this year, even during periods of risk aversion in the markets. So it’s certainly curious that it’s holding above here today, registering 0.5% gains in the process, on a day when risk assets are performing well and the dollar is making small gains. It’s finding some resistance around $1,610 where it briefly peaked in early January but with its new-found momentum, that may not hold for long.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil enters seventh day of gains

We saw some profit taking in oil prices on Tuesday, following a five day winning streak as traders began looking at life beyond the coronavirus. That profit taking didn’t even last the day though and the winning streak is now into its seventh day, with Brent having its eyes set on $60 and WTI, similarly, on $54-55 region. The recovery has been far more gradual here than elsewhere, which is understandable given the direct impact on oil demand from the coronavirus.

Brent Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.