Markets stumble on latest COVID-19 numbers

It seems stock markets are not entirely immune to the effects of COVID-19, but they are putting up quite a fight in the face of more distressing figures on Wednesday.

Source – Thomson Reuters Eikon

Europe is trading back in the red in early trade after China reported a sharp increase in the number of cases and deaths, as the country adopted a broader definition to include those clinically diagnosed. This unexpected adjustment is a timely reminder of the scale of the disease, just as investors were starting to believe we were turning a corner.

I say that and yet, if Europe and Wall Street end the day back in the green, it would be no surprise. The ability of investors to quickly shrug these things off and get straight back in is almost admirable, if it wasn’t also concerning. It’s almost become self-fulfilling it’s happened so many times now. Everything is seemingly just a buy the dip opportunity. That can’t be healthy.

I do wonder how bad this needs to get before confidence among the buy-the-dippers starts to be tested. Perhaps that will come when the reality of the situation starts to show up in the hard data, particularly if we’re not seeing the anticipated improvement in the contagion rate. Although, at that stage the Fed and its pals will probably prop things up again.

Ramaphosa faces the nation

The South African state of the nation address will take place today, during which President Cyril Ramaphosa will lay out his government’s plans against the backdrop of a weak economy, struggling state-run businesses and high unemployment. This is a chance to get investors and businesses on board, there needs to be substance and follow-through. This is a hugely important day for the President, he needs to bring his A-game.

Gold perks up on COVID-19 numbers

Gold prices have perked up as investors have pared back their appetite for risk in response to the latest numbers from China. It continues to face the same hurdles though, with the yellow metal running into severe resistance on the approach to $1,600.

It’s currently trading around $1,575 and showing little signs of making a proper run at $1,600. The next hurdle is $1,580 and even this may prove a step too far unless something takes a significant turn for the worse and drags investors heads out of the sand.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

False start for oil

The oil rebound didn’t last long, with crude prices heading south as it became apparent that the numbers are even worse than thought. Perhaps the corner isn’t being turned after all which is bad news for oil prices that have already been pummeled as the virus has spread rapidly.

We’re not yet back to testing the lows but we’re not far away either. The good thing is that momentum has slowed, which may provide some support in the near-term and even prove to be a spring board should the news improve in the coming days.

Brent Daily Chart

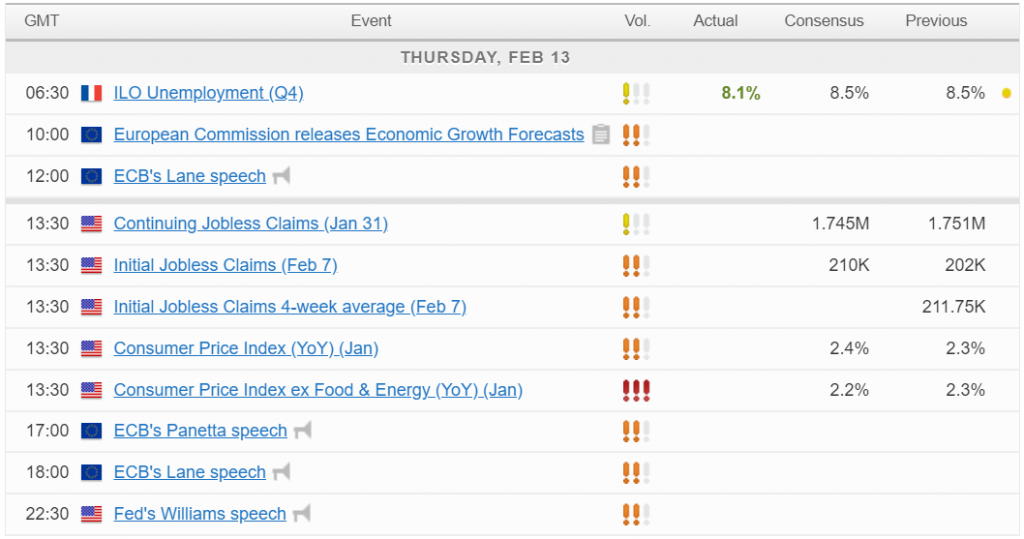

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.